Loyalty programs are under constant threat from sophisticated scammers. At Reward the World, we’ve seen firsthand how these fraudulent activities can damage both businesses and customers.

This blog post will guide you through common scams targeting loyalty programs and provide practical fraud prevention strategies. We’ll explore robust security measures and best practices to safeguard your program and maintain customer trust.

Common Loyalty Program Scams

Loyalty programs face constant threats from sophisticated fraudsters. We’ve identified four prevalent scams that pose significant risks to loyalty programs worldwide.

Account Takeover Fraud

Account takeover fraud tops the list as the most common and damaging scam. Cybercriminals use stolen credentials to access legitimate accounts, often through credential stuffing attacks. Once inside, they drain points or make unauthorized purchases. Rewards fraud has increased dramatically over the last decade with estimates ranging between $1 billion to $3 billion in global fraud losses annually.

Points Theft and Resale

Points theft involves stealing loyalty points and selling them on the black market. Fraudsters exploit weak security measures to access accounts and transfer points. They then sell these points at a discount on dark web marketplaces. For example, stolen credentials for GAP accounts were priced at $7.03, while Costco credentials were valued at $6.5. This not only results in financial losses but also erodes customer trust.

Fake Account Creation

Scammers create multiple fake accounts to exploit sign-up bonuses and promotional offers. They use synthetic identities or stolen personal information to bypass verification processes. This fraud type hits the travel sector particularly hard, contributing to the industry’s annual fraud losses.

Referral Abuse

Referral programs become vulnerable when fraudsters create fake accounts to refer themselves or collude with others. They manipulate these programs to gain unearned rewards or cash bonuses. Loyalty fraud leads to direct financial losses through fraudulent redemptions and operational costs for fraud investigation and prevention. This also skews marketing metrics, making it difficult to assess the true effectiveness of referral campaigns.

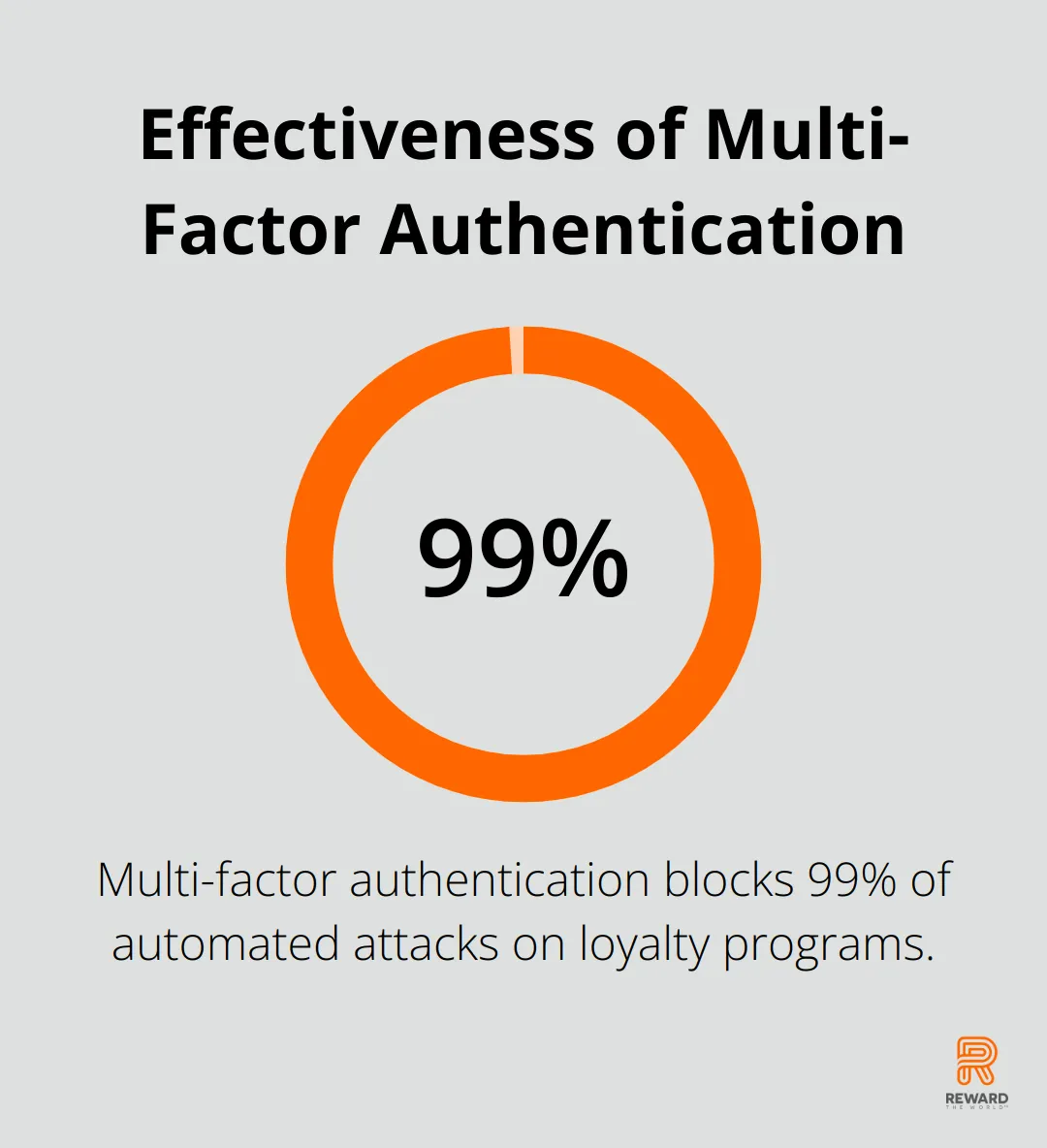

To combat these scams, businesses must implement robust security measures. Multi-factor authentication blocks 99% of automated attacks. Continuous monitoring using advanced fraud detection systems identifies suspicious activities in real-time. Regular security audits and employee training on fraud prevention round out a comprehensive defense strategy.

As we move forward, we’ll explore how to implement these robust security measures to protect your loyalty program from sophisticated scams.

How to Fortify Your Loyalty Program

Protecting your loyalty program from sophisticated scams requires a multi-faceted approach. We’ve identified key strategies that significantly reduce the risk of fraud and enhance overall security.

Implement Strong Authentication Measures

Multi-factor authentication (MFA) is a game-changer in loyalty program security. MFA requires users to provide two or more verification factors to gain access to an account. This simple yet effective measure adds an extra layer of security that’s hard for fraudsters to crack.

Try to implement biometric authentication methods like fingerprint or facial recognition. These are not only more secure but also provide a smoother user experience. Robust authentication methods can significantly reduce the risk of fraud attempts.

Leverage Advanced Fraud Detection Systems

Modern fraud detection systems use artificial intelligence and machine learning to analyze vast amounts of data in real-time, identifying suspicious patterns that human observers might miss. These systems can continuously monitor multiple endpoints to detect anomalies such as sudden spikes in reward redemptions, frequent password resets, or logins from unfamiliar IP addresses – all potential indicators of fraudulent activity.

In the travel sector, AI-driven fraud detection systems can help identify and prevent fraudulent redemptions during peak booking seasons when point redemptions are high.

Conduct Regular Security Audits

Regular security audits are essential for identifying vulnerabilities before they can be exploited. We recommend conducting these audits at least quarterly. During these audits, assess your program’s overall security posture, including data encryption methods, access controls, and patch management processes.

Pay special attention to your program’s backend systems. Tight control over backend access can significantly reduce internal fraud risks.

Prioritize Employee Training

Your employees are your first line of defense against fraud. Comprehensive training on fraud prevention should cover all staff involved in managing loyalty programs. This training should include the latest fraud trends, how to identify suspicious activities, and clear protocols for reporting and responding to potential fraud incidents.

Educate customer service representatives about social engineering tactics that fraudsters might use to manipulate them into providing account access. Transform your employees into active participants in fraud prevention, creating a human firewall against potential threats.

Security is an ongoing process that requires constant vigilance and adaptation. The next section will explore best practices for loyalty program protection, including clear terms and conditions, monitoring unusual activity, and customer education on security.

How to Safeguard Your Loyalty Program

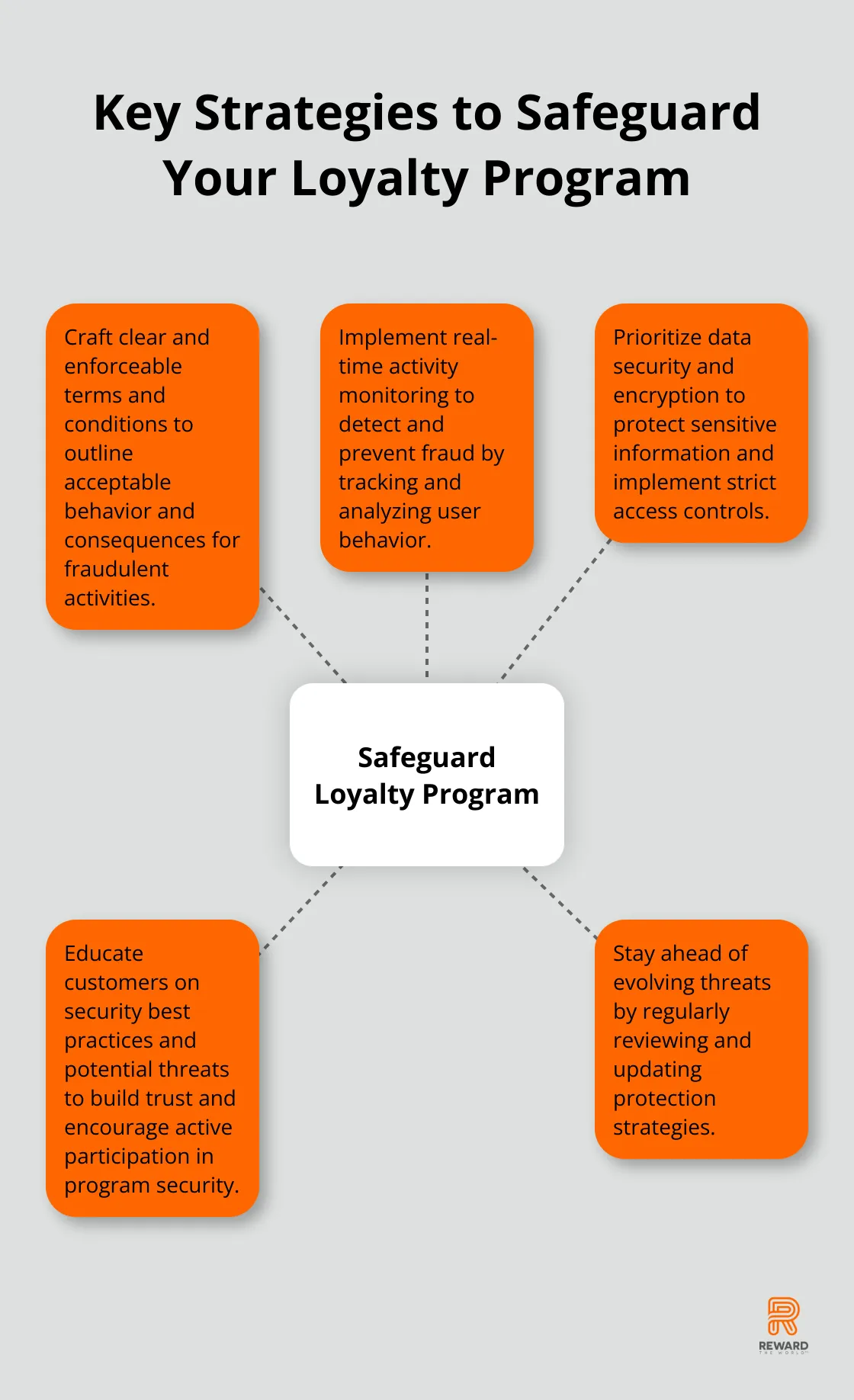

Craft Clear and Enforceable Terms

You must establish clear, concise, and enforceable terms and conditions for your loyalty program. These should outline acceptable user behavior, point accrual and redemption rules, and consequences for fraudulent activities. Make these terms easily accessible to all members and update them regularly to address emerging threats.

Include clauses that prohibit the creation of multiple accounts, the use of automated tools for point accumulation, or the resale of rewards. Specify that violating these terms may result in account suspension or point forfeiture. This clarity not only deters potential fraudsters but also provides legal protection for your business.

Implement Real-Time Activity Monitoring

You need to monitor program activity continuously to detect and prevent fraud. Implement systems that track and analyze user behavior in real-time, flagging suspicious activities for immediate review.

Loyalty fraud detection involves analyzing customer data and behavior patterns to identify, prevent, and respond to fraudulent activities within loyalty programs.

Look for unusual patterns such as:

- Sudden spikes in point accumulation or redemption

- Multiple accounts linked to the same IP address or device

- Frequent changes to account information

- Redemptions from locations far from the member’s usual activity area

Prioritize Data Security and Encryption

Secure data storage and robust encryption are non-negotiable in today’s digital landscape. Encrypt all sensitive data, both at rest and in transit, using industry-standard encryption protocols. Update your encryption methods regularly to stay ahead of evolving threats.

Implement strict access controls, ensuring that only authorized personnel can access customer data. Use tokenization for sensitive information like credit card numbers, replacing them with unique identification symbols that retain all the essential information without compromising security.

Combining encryption and tokenization in your security system can provide greater protection for your loyalty program data.

Educate Your Customers on Security

Customer education is a powerful tool in your fraud prevention arsenal. Communicate with your program members regularly about security best practices and potential threats. Create easy-to-understand guides on topics like:

- Creating strong, unique passwords

- Recognizing phishing attempts

- The importance of not sharing account information

- How to report suspicious activity

Try to implement a reward system for members who report potential fraud (this encourages active participation in program security). This approach not only helps prevent fraud but also builds trust and loyalty among your customer base.

Stay Ahead of Evolving Threats

Security is an ongoing process. Review and update your protection strategies regularly to stay ahead of evolving threats. You can create a robust defense against sophisticated scams by implementing these best practices, ensuring the long-term success and integrity of your loyalty program.

Implement robust data security measures, including encryption, access controls and regular security audits to protect customer data. Customer consent and transparency are also crucial aspects of managing loyalty program privacy and security.

For businesses seeking a comprehensive solution, Reward the World offers a state-of-the-art platform with built-in security features (including real-time monitoring and advanced encryption). This makes it an excellent choice for companies looking to implement a secure and efficient loyalty program.

Final Thoughts

Protecting your loyalty program from sophisticated scams requires a multi-faceted approach. Strong authentication methods, advanced detection systems, regular security audits, and comprehensive employee training form a formidable defense against common scams. Clear terms, real-time monitoring, secure data storage, and customer education on security further strengthen your fraud prevention efforts.

The ever-evolving landscape of cyber threats demands constant vigilance. Regular reviews and updates to your protection strategies help you stay ahead of sophisticated scammers. This ongoing commitment to security safeguards your program and demonstrates your dedication to protecting your customers’ interests.

Reward the World offers a state-of-the-art platform with built-in security features for businesses seeking comprehensive loyalty program management. With global reach and instant reward delivery, our solution helps implement secure and efficient loyalty programs. Investing in fraud prevention pays off through increased customer trust, reduced financial losses, and a thriving loyalty program that truly rewards your most valuable customers.