Loyalty program fraud is a growing concern that can significantly impact businesses and their valued customers. We at Reward the World understand the importance of protecting these programs from fraudulent activities. This post: Loyalty Program Fraud Prevention: Best Practices, outlines effective strategies for detecting, preventing, and mitigating fraud within loyalty programs. By adopting these best practices, companies can safeguard their interests and foster a secure environment for their users.

Preventing Loyalty Fraud

Loyalty program fraud is a complex issue that threatens both businesses and customers, leading to loss of revenue, erosion of trust, and potential brand damage. To effectively combat this growing challenge, it’s essential to recognize its forms and understand how it impacts all parties involved.

Exploring Types of Loyalty Fraud

The digital age has given rise to various types of loyalty program fraud, including account takeovers, where fraudsters gain unauthorized access to a customer’s loyalty account; points hacking, where loyalty points are stolen or manipulated; and fake account creation, which inflates participant numbers artificially, potentially skewing marketing efforts and financial projections. Each type poses its unique challenges but shares a common goal: to exploit loyalty programs for unlawful gain.

Understanding the Impact

The impact of loyalty program fraud extends beyond immediate financial loss. For businesses, it can lead to increased operational costs as resources are diverted to deal with fraud incidents. Long-term, it could damage a brand’s reputation, leading to a loss of current and potential future customers. For loyal customers, fraud can diminish the perceived value of a loyalty program, leading to decreased engagement and trust in the brand.

Spotting the Signs of Fraud

To protect your business and your loyal customers, it’s crucial to recognize indicators of potential loyalty program fraud early on. These can include unusual patterns of point redemption, spikes in new account creation without corresponding sales increases, or an unexpected surge in account recovery requests. By monitoring these indicators, businesses can take swift action to investigate and mitigate potential fraud.

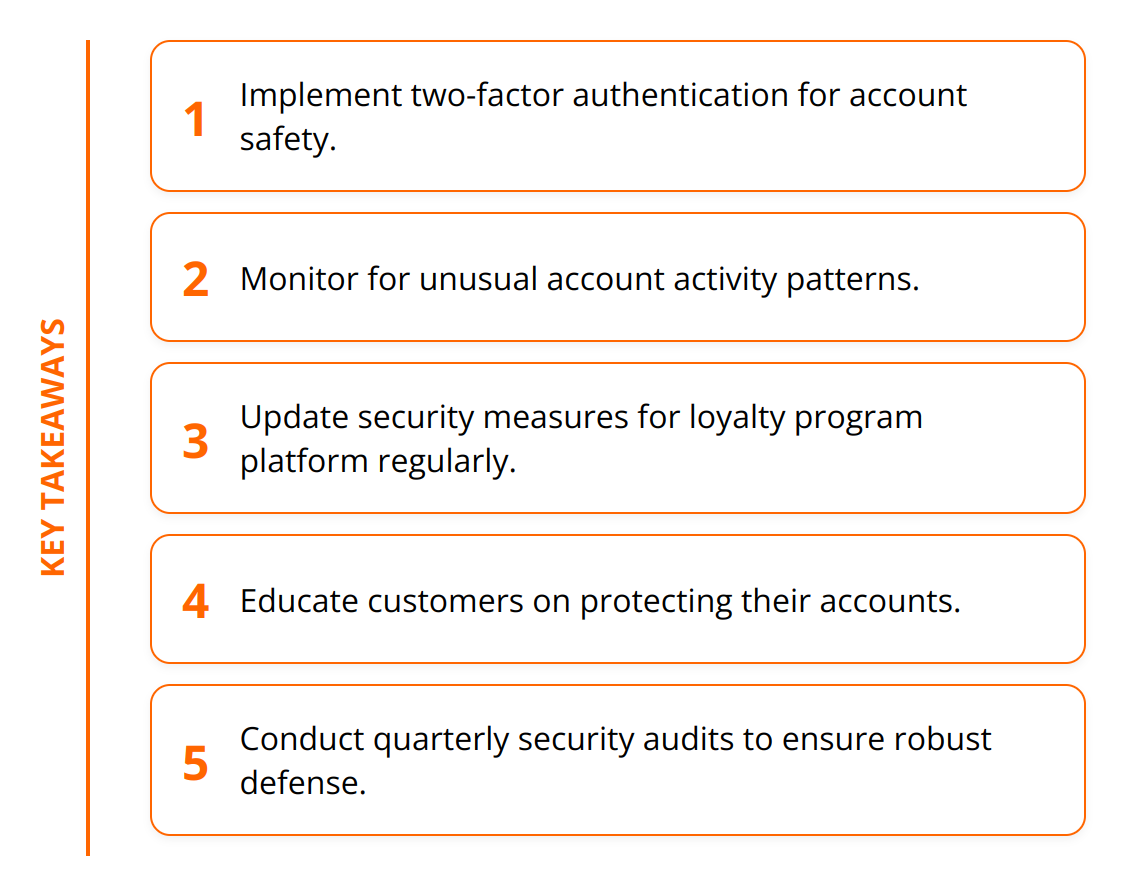

Actionable Tips:

- Implement two-factor authentication (2FA) for account access and changes.

- Monitor account activity for unusual patterns such as rapid points accumulation or redemption.

- Regularly update and review security measures for your loyalty program platform.

- Educate customers on how to protect their accounts and the importance of reporting suspicious activities.

By adopting a proactive stance on loyalty program fraud prevention, businesses can safeguard their interests and maintain the trust and satisfaction of their loyal customers. For more insights on creating secure and engaging loyalty programs, consider exploring how to enhance customer experiences or learn about the importance of loyalty point fluidity.

Strengthening Fraud Prevention

In the battle against loyalty program fraud, adopting stringent security measures is non-negotiable. From the initial account creation to the final point redemption, every step should be fortified with strong verification processes and advanced fraud detection tools. Furthermore, the security landscape is ever-evolving, making regular audits and updates to these measures indispensable.

Implementing Strong Verification Processes

Verification at every step plays a pivotal role in minimizing the risk of fraud. One of the most effective strategies is the implementation of multi-factor authentication (MFA) during account login and when redeeming points. MFA can dramatically reduce the incidence of unauthorized access by requiring a combination of something the user knows (like a password), something the user has (like a mobile phone for a one-time passcode), and something the user is (like biometric verification).

Utilizing Advanced Fraud Detection Tools

With technology’s advance, fraudsters are becoming more sophisticated. Therefore, businesses must employ advanced fraud detection tools that can analyze patterns and flag anomalies in real-time. Tools that employ machine learning can adapt to new fraud tactics over time, making them incredibly effective. These systems can detect unusual redemption patterns or account activities that deviate from the norm, enabling swift action to mitigate potential threats.

Furthermore, integrating solutions that validate email addresses and phone numbers at the signup stage can prevent the creation of fake accounts, a common fraud avenue.

Regular Audits and Updates to Security Measures

The digital landscape is in constant flux, necessitating regular security audits. These audits should assess the effectiveness of current fraud prevention strategies and identify any potential vulnerabilities. Any identified gaps should be promptly addressed by updating security measures.

Businesses should also stay informed about the latest fraud trends and adapt their strategies accordingly. This could mean updating software, revising verification processes, or even incorporating new fraud detection technologies.

Practical Tips for Implementation

- Secure signup processes: Require email and phone verification during account creation.

- Adaptive fraud detection: Utilize tools that learn and adapt to new fraudulent behaviors.

- Frequent security audits: Conduct these at least quarterly to ensure that defenses remain robust.

By placing a strong emphasis on verification, utilizing state-of-the-art fraud detection tools, and maintaining a regimen of regular audits and updates, businesses can create a formidable barrier against loyalty program fraud. This not only protects the company’s bottom line but also secures the trust and loyalty of its customers.

For more insights on setting up effective loyalty programs, explore gamified loyalty solutions and understand what makes a competitive incentive program stand out.

Educating for Security

In the world of loyalty programs, where the stakes include not just revenue but customer trust and brand reputation, educating both your team and customers on fraud prevention is non-negotiable. It’s not just about having the right tools and processes in place; it’s about creating a culture of security and transparency that permeates every level of interaction with your loyalty program.

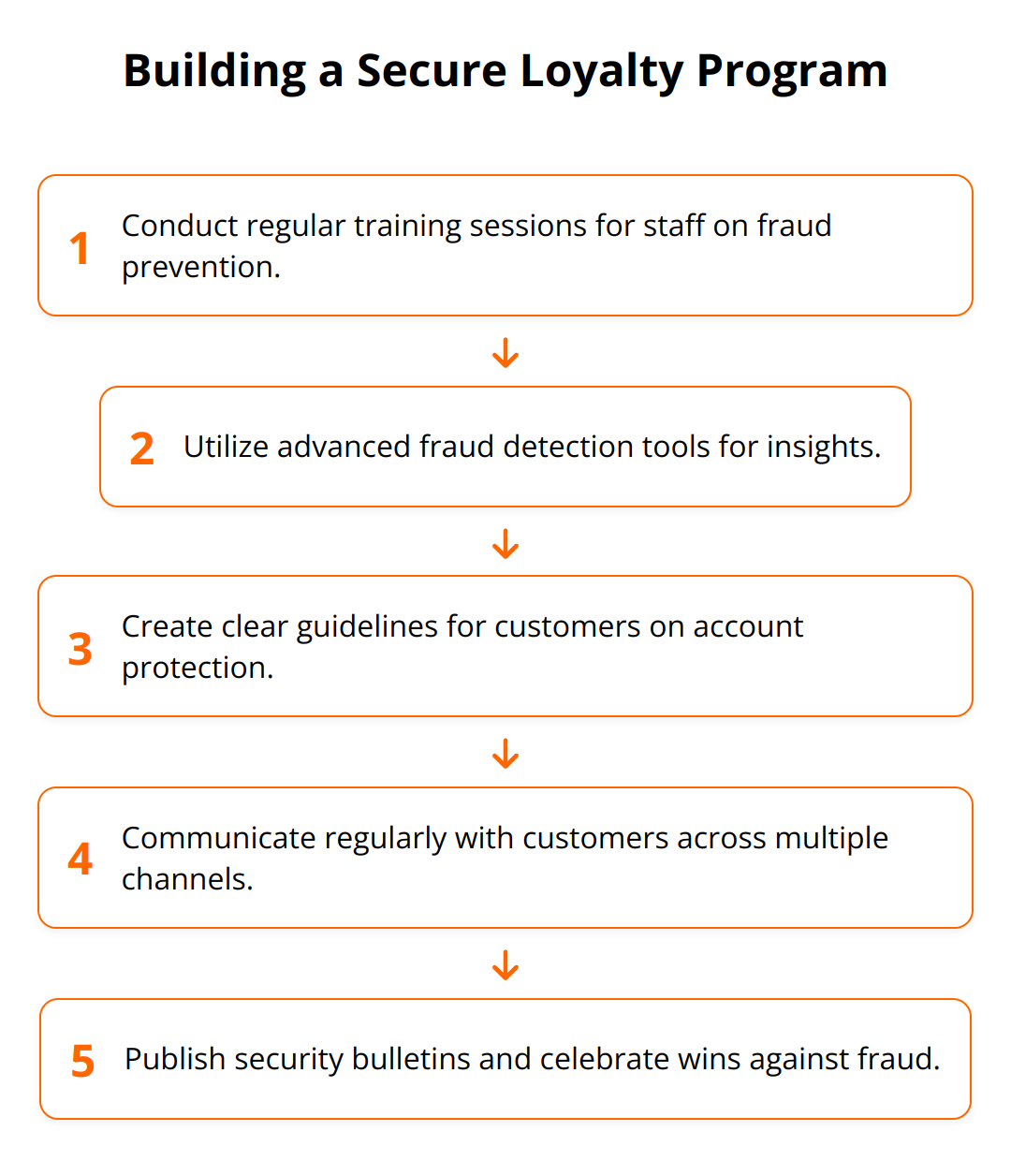

Training Staff on Fraud Detection and Prevention

The first line of defense against loyalty fraud is a well-informed team. Staff training should not be a one-off event but a continuous process that keeps pace with the evolving tactics of fraudsters. Here are some practical steps:

- Conduct regular training sessions on the latest fraud trends and prevention techniques. Incorporate real-life scenarios to help staff grasp the practical implications of fraud.

- Utilize advanced fraud detection tools that offer insights and analytics. Staff should know how to interpret these analytics to spot suspicious activities.

- Encourage an environment where team members can share observations and insights regarding potential fraud. Sometimes, patterns only become apparent when information is pooled together.

Informing Customers About Secure Participation

Customers are partners in fraud prevention. Their awareness and cooperation can significantly reduce the risk of fraud.

- Create simple, clear guidelines on how customers can protect their accounts, such as choosing strong passwords and avoiding sharing sensitive information.

- Use multiple channels—emails, app notifications, and your website—to communicate these guidelines. Remind customers about the importance of security regularly.

- Provide a straightforward way for customers to report suspicious activities. Knowing they have support builds their confidence in your brand’s commitment to security.

Building a Culture of Security and Transparency

Transparent communication about the risks and what you’re doing to mitigate them reinforces trust. Customers value transparency and are more likely to remain loyal when they believe their interests are protected.

- Publish a regular security bulletin on your website highlighting any new threats and how customers can avoid them.

- Celebrate wins against fraud publicly. If a new measure has dramatically reduced fraudulent activities, share that success with your customers.

- Foster a culture where questions about security are welcomed. Whether it’s a customer questioning a process or a staff member proposing an improvement, every question is an opportunity to strengthen your program.

In essence, combating loyalty program fraud is as much about technology and processes as it is about education and culture. By ensuring that both your team and customers are informed, vigilant, and empowered, you create a formidable defense against fraud that also strengthens the bonds of trust and loyalty with your customers.

Explore more on creating secure loyalty programs through our guide on incentive program compliance and dive into the strategies that boost engagement while maintaining security with our insights on personalized rewards strategies.

Wrapping Up

In our journey through the complexities of loyalty program fraud prevention, we’ve highlighted the critical steps businesses need to take to protect themselves and their customers. It’s clear that staying ahead in the fight against fraud is not just about implementing the right tools but also about fostering a culture of vigilance and continuous improvement.

The essence of effective fraud prevention lies in recognizing the evolving nature of threats and adapting accordingly. This means regularly auditing security measures, employing advanced fraud detection tools, and educating both staff and customers about their crucial roles in safeguarding their interests. Moreover, a proactive stance on these fronts can significantly enhance your brand’s reputation, fostering trust and loyalty among your customer base.

However, the landscape of loyalty fraud is ever-changing, necessitating businesses to not only stay informed but also to always be a step ahead. This requires a commitment to continuous learning and improvement, ensuring that your fraud prevention strategies remain effective and relevant. By doing so, you not only protect your business but also contribute to a safer and more secure digital ecosystem for everyone involved.

At Reward the World, we understand the importance of security in building and maintaining successful loyalty programs. Our platform offers a robust framework designed to minimize risks while maximizing customer engagement, making it an ideal choice for businesses looking to enhance their loyalty programs without compromising on safety.

In conclusion, the responsibility of preventing loyalty program fraud is a collaborative effort, involving businesses, customers, and solution providers like us. By embracing best practices and fostering a culture of security and transparency, we can all contribute to a more trustworthy and rewarding loyalty program experience. Stay vigilant, keep improving, and remember that the security of your loyalty program is integral to its success.