We at Reward the World understand that keeping your reward system secure is vital for the integrity of your business and the trust of your consumers. Fraud can cause significant losses and damage to reputation. This post: How to Implement Anti-Fraud Measures in Your Reward System, will guide you through essential anti-fraud measures. Implementing these strategies can protect your business and your customers from fraudulent activities.

Why Anti-Fraud is Essential

Fraud within reward systems is not just a minor hiccup; it’s a major threat that can erode the foundation of trust between businesses and their customers. It’s not only about financial losses, which can be significant, but also about the potential damage to a brand’s reputation which can take years to rebuild. Customers lose faith in compromised systems, and once loyalty is broken, it’s an uphill battle to regain it.

Key vulnerabilities in reward systems include weak authentication methods, lack of real-time fraud detection, and insufficient security measures for data protection. These gaps provide opportunities for fraudsters to exploit, leading to common schemes such as account takeover, point theft, and fake account creation for bonus harvesting. This is why How to Implement Anti-Fraud Measures in Your Reward System is a key reading.

To build a secure and trusted environment, businesses need to take a proactive stance against fraud. Implementing robust authentication processes such as two-factor authentication is a start. However, it’s also pivotal to monitor transactions in real-time for signs of unusual activity. Utilizing machine learning algorithms can help identify patterns indicative of fraud, enabling quicker response times.

Another powerful strategy is educating your customers about the importance of protecting their accounts. Inform them about common fraud schemes and encourage them to use complex passwords and to regularly check their account activities for any anomalies.

Additionally, consider these actionable tips:

- Regularly update your reward program’s terms to close any loopholes.

- Limit the number of points or rewards that can be redeemed in a single transaction.

- Use data analytics to track patterns that could indicate fraudulent activity.

- Implement capatchas for sign-ups to deter bots from creating fake accounts.

Being vigilant and adopting sophisticated anti-fraud measures is not optional; it’s imperative for the longevity and success of your reward program. Detecting and mitigating fraud effectively not only protects your bottom line but also safeguards your relationship with your customers, fostering a secure environment for genuine engagement and loyalty.

Secure Reward System Design

Building a secure reward system goes beyond just setting it up; it’s about integrating security into its very fabric from the outset. The focus should be on technical safeguards, routine checks, and fostering a culture of security among users. Here’s how to make that happen:

Layered Security with Multi-Factor Authentication (MFA)

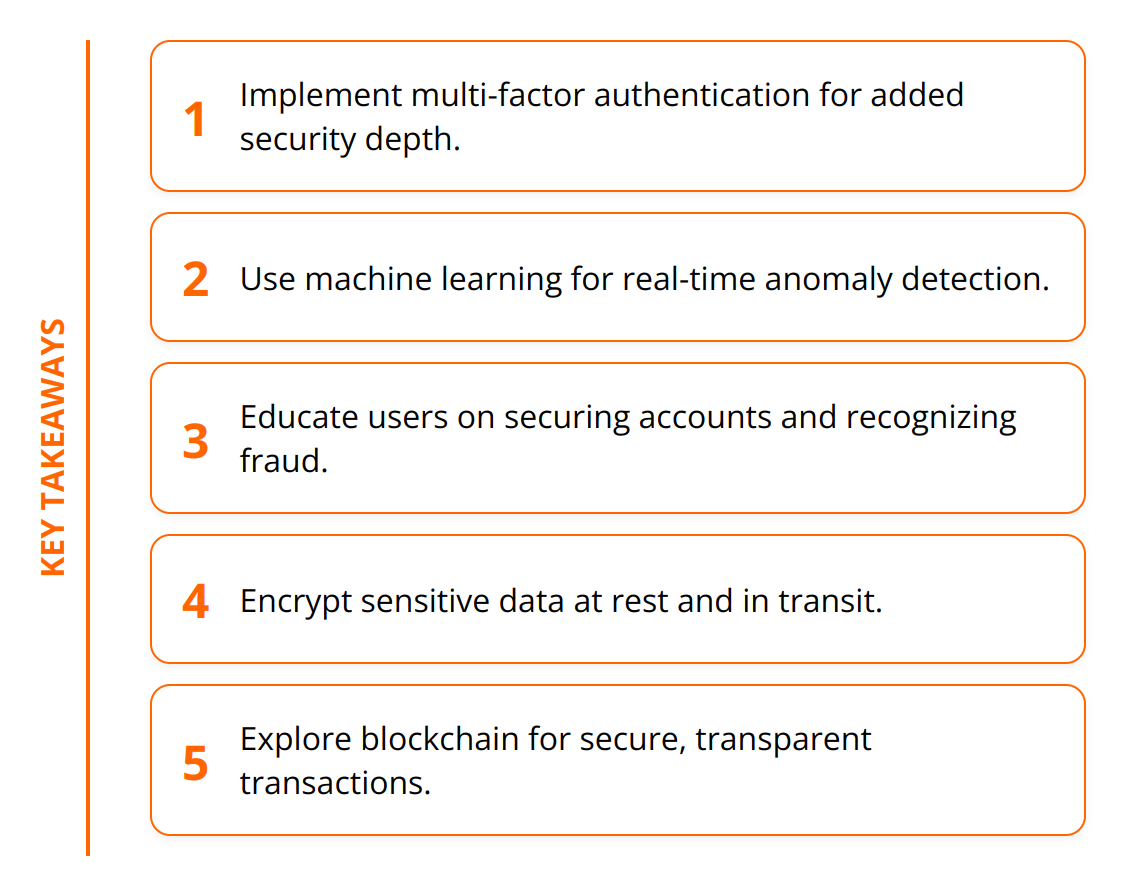

The first line of defense against unauthorized access to reward accounts is robust authentication. Implementing MFA is more than just a recommendation; it’s a must for adding depth to your security. This involves requiring users to provide two or more verification factors to gain access to their accounts, making it exponentially harder for attackers to commit fraud. MFA can include something the user knows (a password), something the user has (a phone or security token), and something the user is (biometric verification like fingerprints or facial recognition).

Automated Monitoring and Proactive Auditing

Real-time monitoring of transactions and behavior within your reward system can catch fraud before it balloons into a larger issue. Employing automated tools that leverage machine learning can scan for anomalies that deviate from normal user patterns, such as unusual redemption activity or access from strange locations. Alongside, periodic auditing of accounts and transactions helps in identifying and addressing potential security flaws before they can be exploited.

Encouraging Users Towards Secure Practices

Security is a two-way street. While on one end, the system must be ironclad, users also need to partake in securing their own accounts. Initiatives to educate users on secure practices are vital. This includes guiding them on creating strong, unique passwords, recognizing phishing attempts, and being cautious about sharing sensitive information. Rewards programs themselves can incentivize secure behavior, offering points or rewards for users who take security quizzes or set up MFA on their accounts.

For further insights on nurturing secure user behavior, check out our guide on personalized rewards strategies, and keep in mind at all time this How to Implement Anti-Fraud Measures in Your Reward System guide.

Here are a few actionable tips to reinforce the security of your reward system:

- Regularly update and patch security software to fix vulnerabilities.

- Limit login attempts to thwart brute force attacks.

- Use encryption for sensitive data, both in transit and at rest.

- Conduct security awareness training for staff and users.

Remember, a secure reward system doesn’t just protect your business; it also shields your customers, fostering a lasting relationship based on trust. Continuous improvement and adaptation to new threats are the keys to maintaining a robust security posture.

Leveraging Tech Against Fraud

The advancement of technology offers powerful tools for businesses seeking to fortify their reward systems against fraudulent activities. Two standout technologies in this field are Artificial Intelligence (AI) and Machine Learning (ML) for anomaly detection, and Blockchain for creating secure, transparent transactions. Additionally, the role of data encryption in safeguarding information cannot be overstated. By integrating these technologies, businesses can significantly elevate their fraud prevention capabilities.

AI and Machine Learning: The Watchdogs of Anomalies

AI and ML are transforming how businesses approach fraud detection. These technologies excel at analyzing vast amounts of data to identify patterns and anomalies that may indicate fraudulent behavior. For example, ML algorithms can monitor redemption behaviors and flag transactions that deviate from the norm, such as an unusually high volume of points redemption in a short period of time. This real-time detection allows businesses to respond promptly to potential threats.

Practical Tip: Implement machine learning models that continuously learn from transaction data. This ensures that your fraud detection mechanisms become more accurate over time.

Trend: The use of AI in fraud detection is on the rise, with a 35% increase in adoption noted in the last year alone. Businesses report a significant reduction in fraud instances as a result.

The Power of Blockchain for Transaction Security

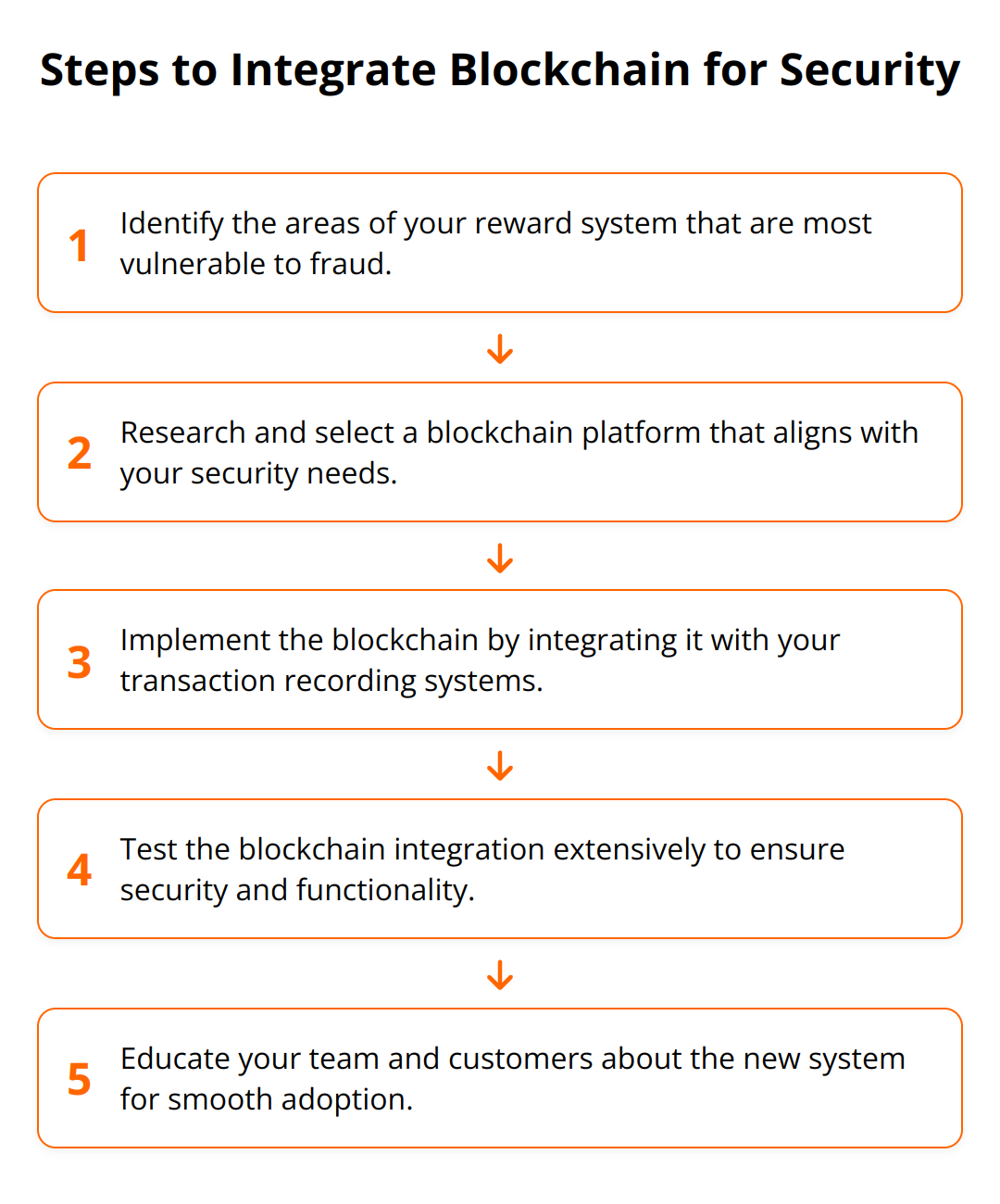

Blockchain technology offers a revolutionary way to record transactions in a tamper-proof manner. Each transaction is recorded in a “block” and linked to the previous one, creating a secure and transparent chain. This makes it virtually impossible for fraudsters to alter transaction histories or steal points without detection. Blockchain also enables secure, direct, and efficient reward redemption processes, reducing the chances of fraud.

Recommendation: Explore integrating blockchain technology into your reward system for its enhanced security features and transparency. This will not only fortify your system against fraud but also build trust with your customers.

Data Encryption: The Shield of Information

Data encryption translates data into another form or code, so that only people with access to a secret key or password can read it. Encrypting sensitive customer information and transaction data is a fundamental security practice. It ensures that even if data is intercepted, it cannot be read or misused by unauthorized parties.

Actionable: Always use strong encryption protocols for data at rest and in transit. Regularly review and update your encryption practices to battle the constantly evolving cyber threat landscape.

Statistic: Reports show that encryption can prevent roughly 90% of potential data breaches, emphasizing its critical role in protecting sensitive information.

In conclusion, leveraging technology is not just about embracing the new but about building a resilient, future-proof reward system. AI and ML offer intelligent, dynamic fraud detection, blockchain adds a layer of indisputable transaction security, and encryption protects the very core of your system – its data. Integrated wisely, these technologies can be the cornerstone of a robust anti-fraud strategy.

For insights on integrating technology into your rewards program, read about market research rewards.

Final Thoughts

As we’ve explored throughout this post, creating a secure and trusted reward system is essential for protecting your business and maintaining customer confidence. The strategies of implementing robust authentication, proactive monitoring, and customer education are vital components of a comprehensive anti-fraud approach. These measures, alongside technical safeguards and continuous auditing, form a solid foundation for fraud prevention.

The landscape of anti-fraud technologies is continually evolving, with advancements in AI, machine learning, and blockchain technology leading the way in detecting and preventing fraudulent activities. These tools not only provide real-time anomaly detection but also offer a level of transaction security and data protection previously unattainable. Businesses must stay on the forefront of these technological advances to effectively combat fraud.

However, technology alone is not enough. A culture of security awareness and proactive fraud prevention is critical. It’s imperative for businesses to remain vigilant, adapting to new threats and incorporating the latest security practices into their reward systems. Encouraging both customers and employees to stay informed about potential fraud risks and how to counteract them is key to maintaining a secure environment.

At Reward the World, we understand the importance of integrating these advanced anti-fraud measures into your reward system. Our platform is designed to provide a secure, global incentives solution, equipped with the latest in technology and compliance standards to protect your business and your customers. With our extensive experience and robust analytics, we’re here to help you navigate the complexities of fraud prevention, ensuring your reward program contributes to lasting customer loyalty and business success.

In conclusion, protecting your reward system from fraud is an ongoing process, requiring constant vigilance and adaptation to the latest in security practices and technologies. As fraudsters become more sophisticated, so too must our efforts to thwart them. By staying informed and proactive in your anti-fraud efforts, you can safeguard your business, build trust with your customers, and ensure the integrity of your reward system for years to come. We hope this article: How to Implement Anti-Fraud Measures in Your Reward System, was useful in your journey to earn trust from your customers.