At Reward the World, we’ve seen first-hand how behavioural economics can transform customer retention strategies.

This powerful field of study reveals the hidden forces that shape consumer decisions and loyalty. By understanding these principles, businesses can create more effective retention programs that resonate with customers on a deeper level.

In this guide, we’ll explore the key concepts of behavioural economics and show you how to apply them to keep your customers coming back for more.

What Drives Customer Decisions?

The Foundation of Behavioural Economics

Behavioural Economics studies the “why” of deviation from rational decision-making to build more accurate models of human behavior, which can then inform business decision-makers. This field examines how psychological, social, and emotional factors influence economic choices. Businesses must understand these principles to develop effective customer retention strategies.

The Power of Cognitive Biases

Cognitive biases significantly shape customer behavior. These mental shortcuts can lead to decisions that don’t always serve a customer’s best interest. The availability heuristic, for example, causes people to overestimate the likelihood of easily recalled events. This bias explains why customers might stick with a familiar brand even when better options exist.

A study by Kahneman and Tversky in 1974 demonstrated how the anchoring effect influences decision-making. When presented with a high initial price, customers more likely perceive subsequent lower prices as good value (even if they’re still objectively expensive). This insight applies to pricing strategies to increase perceived value and customer satisfaction.

Leveraging Loss Aversion for Retention

Loss aversion, the tendency to prefer avoiding losses over acquiring equivalent gains, is a powerful tool for customer retention. Understanding triggers, personalizing approaches, and building lasting customer relationships are effective strategies to reduce customer churn.

The Impact of Social Proof

Social proof (the idea that people look to others to guide their behavior) significantly influences customer decisions. A study by BrightLocal found that 87% of consumers read online reviews for local businesses in 2020. This highlights the importance of cultivating positive customer feedback and showcasing it prominently.

To harness social proof effectively, businesses should actively encourage satisfied customers to leave reviews and share their experiences. Displaying customer testimonials, user-generated content, and social media mentions can create a powerful retention tool by reassuring existing customers and attracting new ones.

The Role of Choice Architecture

Choice architecture defines the influence of the decision context on consumers’ behavior. This can lead to increased sales or higher-margin products. For example, the order in which options are presented can significantly impact what customers choose.

Businesses can apply this principle by strategically structuring their product offerings or subscription tiers. By carefully designing the choice environment, companies can nudge customers towards options that are mutually beneficial for both the customer and the business.

As we explore these behavioral economics principles, it becomes clear that understanding the psychology behind customer decisions is essential for creating effective retention strategies. In the next section, we’ll examine how to apply these insights to develop practical retention tactics that resonate with customers on a deeper level.

How Behavioral Economics Boosts Customer Retention

The Power of Loss Aversion

Loss aversion is a psychological principle that can enhance customer retention. People feel the pain of losing something twice as intensely as the pleasure of gaining something of equal value. Businesses can apply this insight to retention strategies by framing offers in terms of what customers might lose if they don’t stay.

For example, instead of highlighting the benefits of a loyalty program, emphasize what customers will miss out on if they don’t participate. A study by Wharton professor Maurice Schweitzer found that framing a loyalty program in terms of lost points (rather than gained points) increased participation by 20%.

Framing and Anchoring for Effective Pricing

The presentation of prices significantly influences customer perception and retention. The anchoring effect, where people rely heavily on the first piece of information offered, can make your prices seem more attractive.

A practical application involves showing the original price alongside the discounted price. This creates a reference point that makes the discount appear more valuable. Recent research has explored the definition, types, mechanisms, importance, and applications of anchoring in pricing consumer purchases and auctions.

Harnessing Social Proof

People tend to follow the actions of others, especially in uncertain situations. This phenomenon, known as social proof, can be a powerful tool for customer retention.

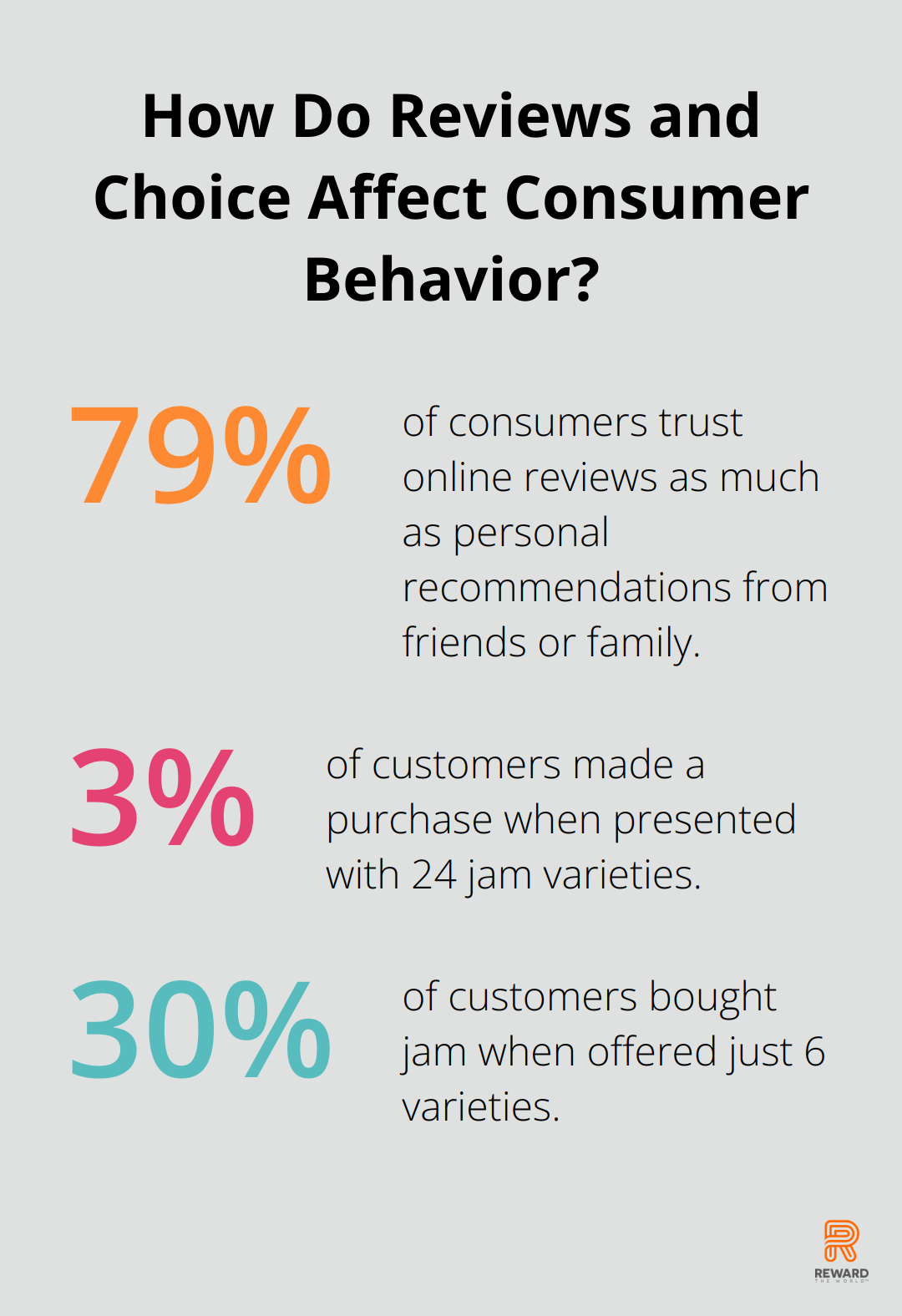

Showcase testimonials, user-generated content, and customer success stories prominently on your website and marketing materials. A study by BrightLocal found that 79% of consumers trust online reviews as much as personal recommendations from friends or family.

Encourage satisfied customers to leave reviews and share their experiences on social media. Consider implementing a referral program that rewards customers for bringing in new business. This not only leverages social proof but also turns your existing customers into brand advocates.

Simplifying Choices to Prevent Decision Paralysis

While offering choices is generally good, too many options can lead to decision paralysis, potentially driving customers away. This is where choice architecture comes into play.

Streamline your product offerings and present them in a way that makes decision-making easier for customers. A famous study by Sheena Iyengar and Mark Lepper found that when presented with 24 jam varieties, only 3% of customers made a purchase. However, when offered just 6 varieties, 30% of customers bought jam.

Try creating curated collections or bundles to simplify the decision-making process for your customers. This not only makes it easier for them to choose but can also increase average order value.

These behavioral economics principles can create more effective retention strategies that resonate with customers on a deeper level. The key lies in understanding the psychological factors driving customer decisions and tailoring your approach accordingly. In the next section, we’ll explore practical applications of these concepts in real-world retention strategies.

How to Apply Behavioral Economics to Boost Retention

Leverage the Goal-Gradient Effect in Loyalty Programs

The goal-gradient hypothesis states that people accelerate their efforts as they approach a reward. You can apply this to loyalty programs by creating a sense of progress and achievement.

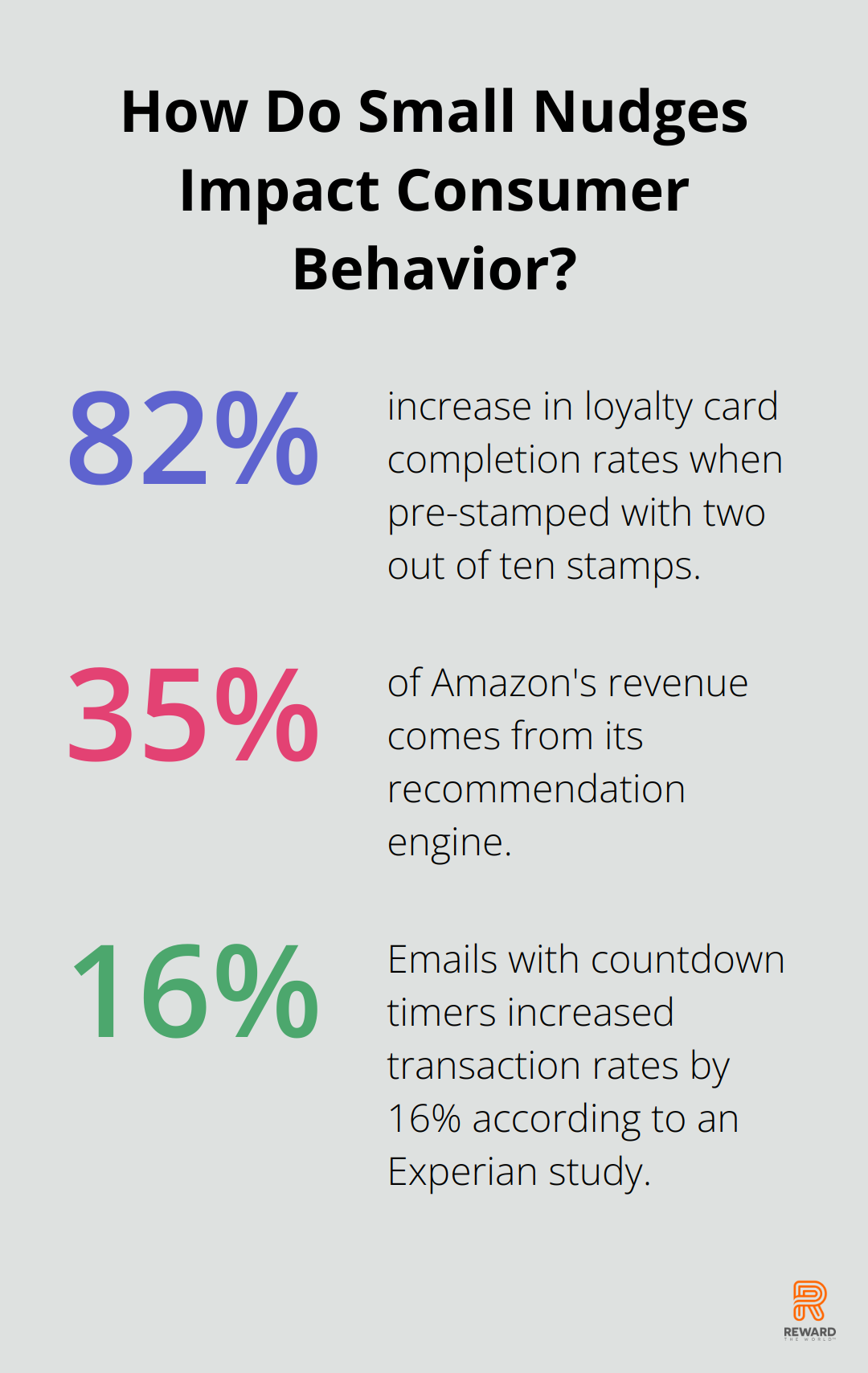

Instead of starting customers at zero points, give them a head start. A coffee shop loyalty card pre-stamped with two out of ten stamps needed for a free coffee can increase completion rates by up to 82% (according to a study by Nunes and Drèze).

Try to implement a tiered loyalty program where customers can see their progress towards the next level. This visual representation of advancement can significantly boost engagement and retention.

Personalize Using the Availability Heuristic

The availability heuristic suggests that people rely on readily available information when making decisions. Use this to your advantage by personalizing customer experiences based on their recent interactions and purchases.

Recent research has analyzed the impact of heuristic or systematic cues related to electronic word-of-mouth on consumer perceived product value.

Implement a recommendation engine that suggests products similar to those a customer has recently viewed or purchased. Amazon reports that 35% of its revenue comes from its recommendation engine, showcasing the power of this approach.

Send personalized emails highlighting products related to a customer’s browsing history. A study by Experian found that personalized emails deliver 6x higher transaction rates.

Create Scarcity and Exclusivity

Scarcity and exclusivity tap into our fear of missing out (FOMO) and can be powerful motivators for customer retention. Limited-time offers, exclusive access, and members-only perks can all drive engagement.

Recent studies have shown that using the scarcity principle correctly can motivate buyers and increase revenue.

Try to create a VIP program for your most loyal customers. Sephora’s Beauty Insider program offers exclusive events and early access to new products for its top-tier members, contributing to its high customer retention rates.

Use countdown timers for limited-time offers to create a sense of urgency. A study by Experian found that emails with countdown timers increased transaction rates by 16%.

Optimize Default Options and Opt-Out Strategies

The power of defaults is well-documented in behavioral economics. People tend to stick with pre-selected options, even when alternatives are available.

Set the default option for your subscription service to auto-renew. Netflix uses this strategy effectively, contributing to its high retention rates.

When customers consider cancellation, offer an opt-out strategy that defaults to a lower-tier service instead of complete cancellation. This can help retain customers who might otherwise leave entirely.

Time Rewards for Maximum Impact

The peak-end rule suggests that people judge an experience based on its most intense point and its end. Apply this to your retention strategies by timing rewards and positive experiences strategically.

Surprise long-term customers with unexpected rewards or recognition. This creates a peak positive experience that can significantly boost loyalty.

End customer interactions on a high note. Train your customer service team to resolve issues and then offer an additional, unexpected benefit or gesture of goodwill.

Final Thoughts

Behavioral economics revolutionizes customer retention strategies. Companies now understand psychological factors driving decisions, creating more effective approaches that resonate deeply with customers. These principles offer powerful tools for building lasting relationships, from loss aversion to choice architecture optimization.

Ethical application of these insights remains paramount. Businesses must prioritize transparency and genuine value creation in their retention strategies. The future promises even more sophisticated applications of behavioral economics in loyalty programs, with AI-powered insights enabling hyper-personalized experiences.

Reward the World stands at the forefront of this evolution. Our global incentives platform helps businesses boost customer loyalty and increase sales conversions. We leverage behavioral economics principles to create meaningful connections between companies and their customers.