Loyalty fraud is a growing threat that can devastate your rewards program and erode customer trust. At Reward the World, we’ve seen firsthand how sophisticated fraudsters exploit vulnerabilities in loyalty systems.

This blog post will explore common fraud types, advanced detection techniques, and best practices to safeguard your program. By implementing these strategies, you’ll protect your business and ensure your loyal customers continue to reap the benefits they deserve.

How Fraudsters Target Loyalty Programs

Loyalty program fraud poses a significant threat to businesses, draining resources and eroding customer trust. We’ve identified several common tactics fraudsters use to exploit these valuable programs.

Account Takeover: The Digital Heist

Account takeover stands as one of the most prevalent forms of loyalty fraud. Cybercriminals use stolen credentials (often obtained through data breaches or phishing attacks) to gain unauthorized access to customer accounts. Once inside, they drain points, change account details, or sell the account on the dark web.

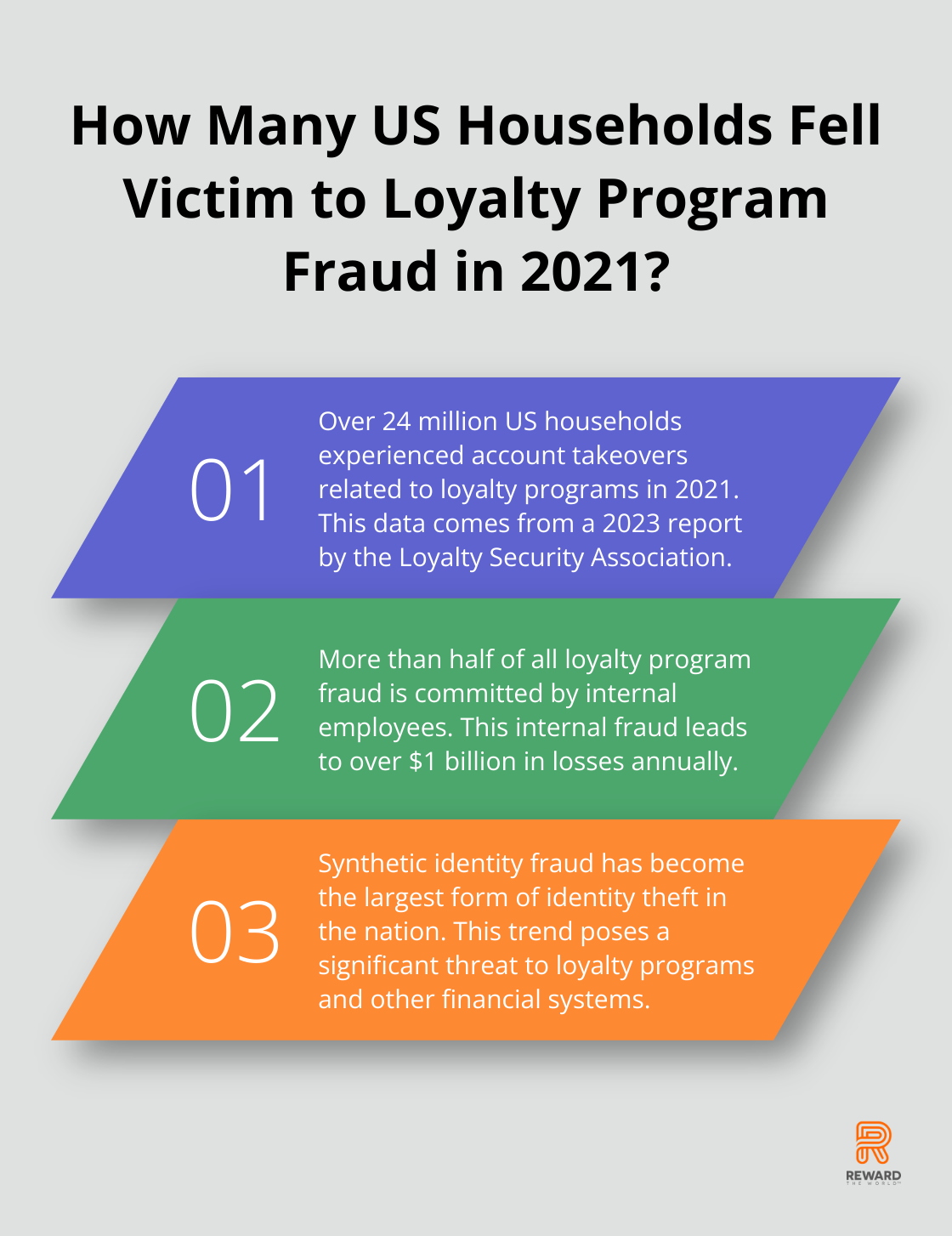

A 2023 report by the Loyalty Security Association revealed that over 24 million US households fell victim to account takeovers related to loyalty programs in 2021. This staggering number underscores the urgent need for robust security measures.

Points Farming: Gaming the System

Points farming involves the creation of multiple accounts or exploitation of loopholes to accumulate rewards illegitimately. Fraudsters often use bots to automate account creation and point-earning activities, or they exploit poorly designed promotional offers.

A victim of debit card fraud could be fully liable for fraudulent transactions depending on the time since the transactions and bank policies. This highlights the importance of vigilance in protecting personal financial information, including loyalty program accounts.

Synthetic Account Creation: The Ghost Accounts

Synthetic account fraud occurs when criminals create fake identities by combining real and fabricated personal information. These “ghost” accounts then earn and redeem points, often at scale.

Synthetic identity fraud schemes have proliferated in the past few years, becoming the largest form of identity theft in the nation, according to financial experts. This trend poses a significant threat to loyalty programs and other financial systems.

Employee Fraud: The Inside Job

While external threats loom large, internal fraud poses a substantial risk to loyalty programs. Dishonest employees with access to customer accounts or point systems may manipulate balances, create fake transactions, or siphon off rewards for personal gain.

The Association of Certified Fraud Examiners uncovered a shocking statistic: more than half of all loyalty program fraud comes from internal employees, leading to over $1 billion in losses annually.

To combat these threats, businesses must implement multi-layered security strategies. This includes advanced fraud detection techniques, employee training, and robust authentication methods. The next section will explore cutting-edge technologies and best practices that help organizations stay one step ahead of fraudsters, ensuring the integrity of their loyalty programs and the trust of their customers.

How AI Revolutionizes Loyalty Fraud Detection

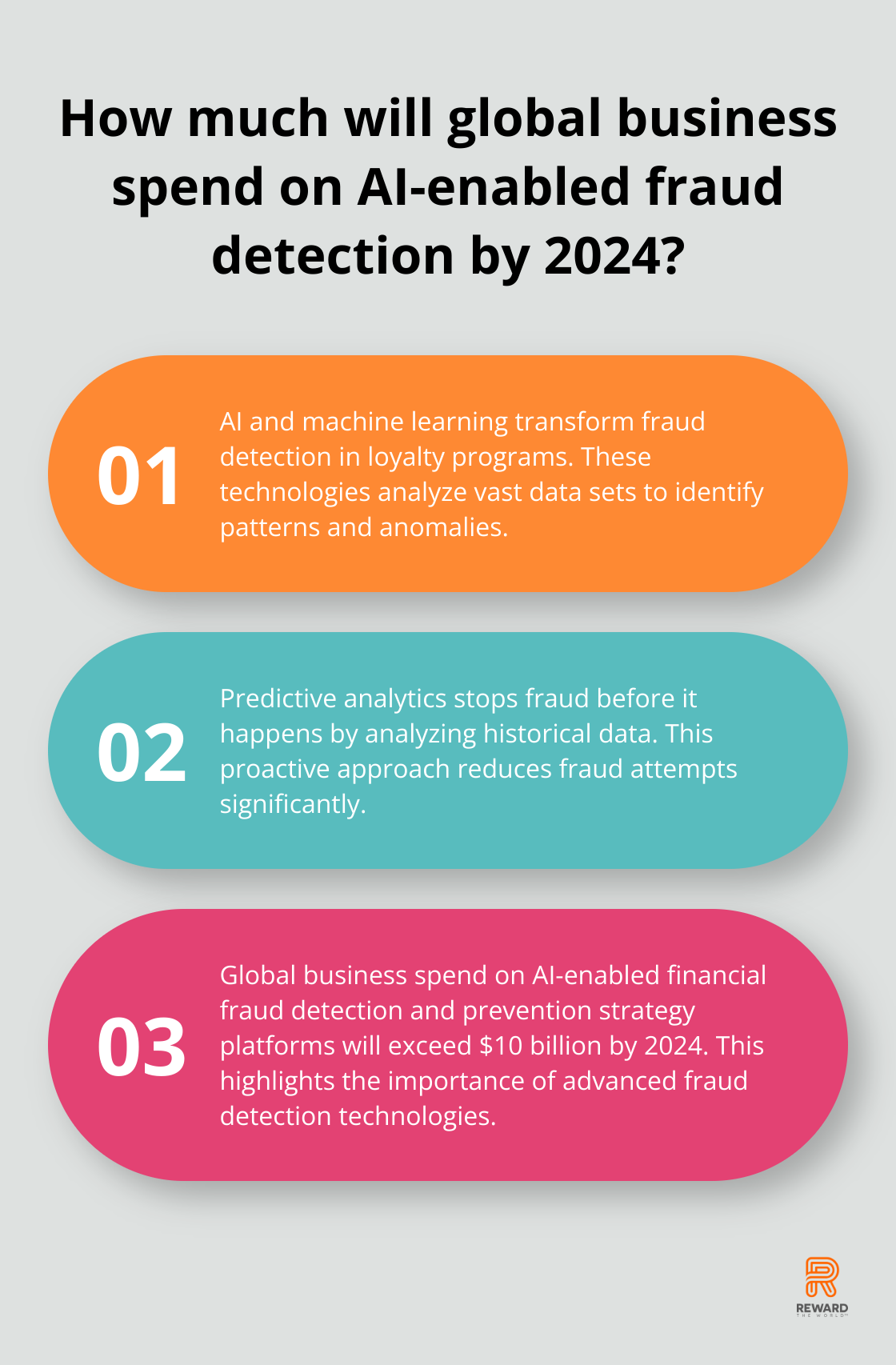

Artificial intelligence (AI) and machine learning transform fraud detection in loyalty programs. These technologies analyze vast data sets to identify patterns and anomalies that human analysts often overlook.

Predictive Analytics: Stopping Fraud Before It Happens

AI-powered systems predict fraudulent behavior by analyzing historical data to create models of normal user behavior. When a user’s actions deviate from this model, the system flags it for review. This proactive approach reduces fraud attempts significantly.

A study by Juniper Research projects that the global business spend on AI-enabled financial fraud detection and prevention strategy platforms will exceed $10 billion by 2024. This potential for investment highlights the importance of advanced fraud detection technologies.

Behavioral Biometrics: The Unique User Fingerprint

Behavioral biometrics analyzes how users interact with their devices. This includes factors like typing speed, mouse movements, and smartphone handling. These unique behavioral patterns prove much harder for fraudsters to replicate than traditional security measures.

Device Fingerprinting: Tracking Digital DNA

Device fingerprinting creates a unique profile of a user’s device based on attributes like operating system, browser version, and installed plugins. This digital fingerprint makes it easier to spot suspicious activity across multiple accounts.

Real-time Transaction Monitoring: Instant Fraud Detection

Real-time transaction monitoring allows businesses to analyze transactions as they occur. This immediate analysis stops fraudulent activities before completion, preventing losses and protecting customer accounts.

Real-time fraud detection solutions help identify fraud before funds leave financial institutions, unlike batch or next-day alerting methods.

These advanced fraud detection techniques significantly enhance loyalty program security. However, fraudsters constantly evolve their tactics. The next section will explore best practices that complement these technologies to create a robust, multi-layered defense against loyalty program fraud.

How to Fortify Your Loyalty Program

Strengthen Your Authentication Process

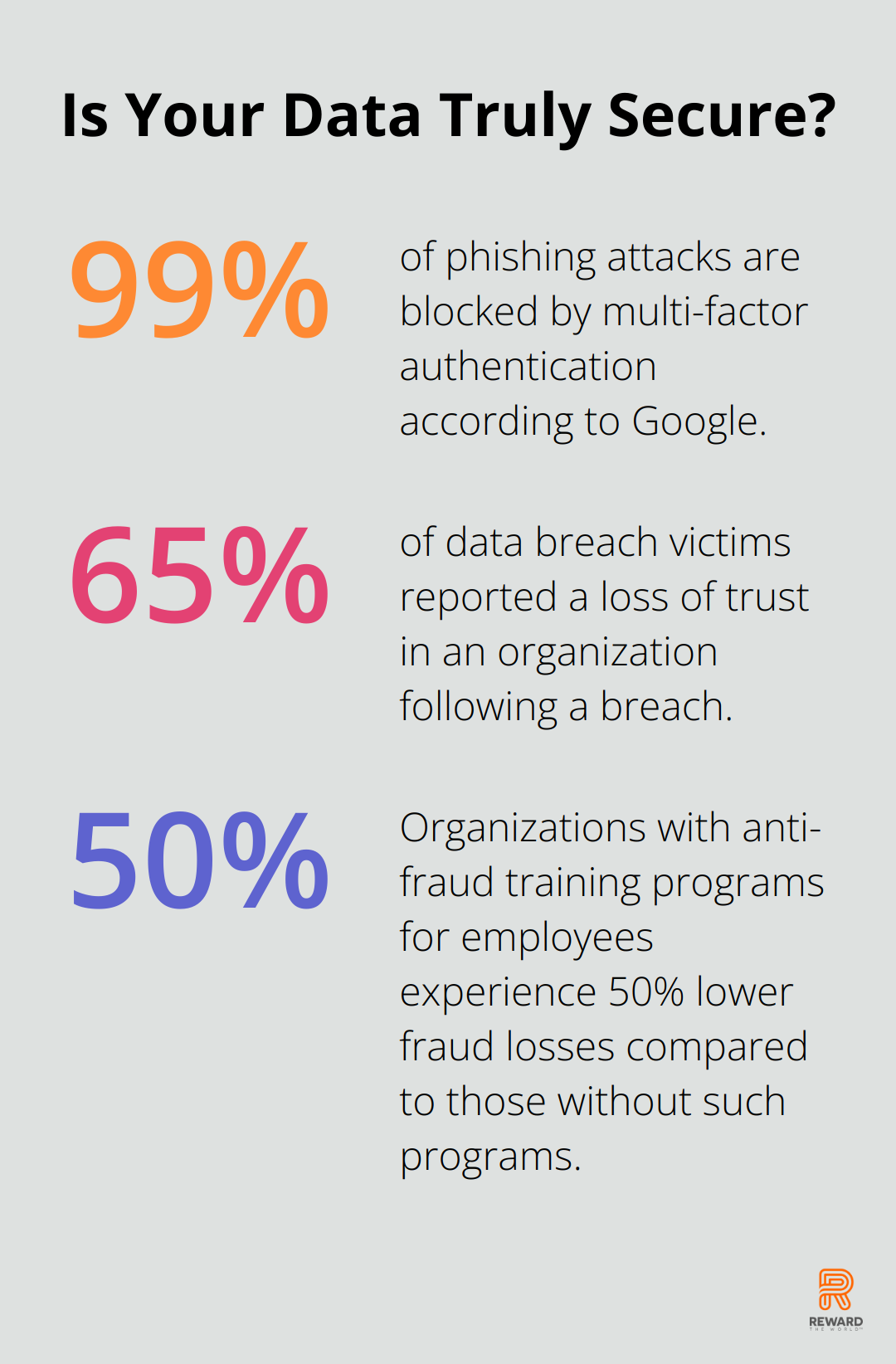

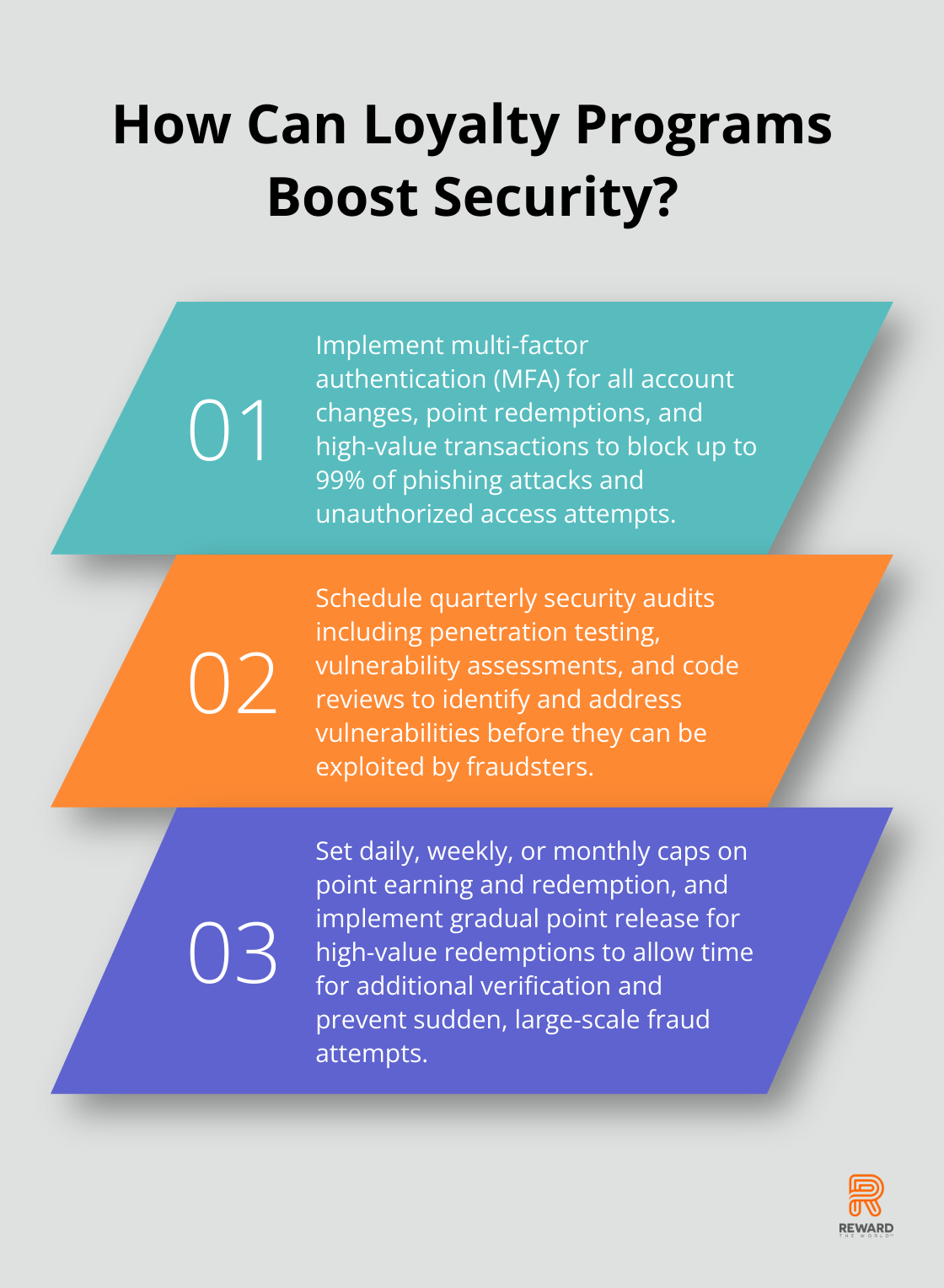

Multi-factor authentication (MFA) acts as a game-changer in fraud prevention. It requires users to provide two or more verification factors, creating a formidable barrier against unauthorized access. According to Google, MFA blocks up to 99% of phishing attacks. You should implement MFA for all account changes, point redemptions, and high-value transactions.

Biometric authentication methods (like fingerprint or facial recognition) offer enhanced security and a smoother user experience. A comprehensive new market analysis from Goode Intelligence predicts that over 3.5 billion people worldwide will use biometric technology to secure payments by 2030.

Conduct Regular Security Audits

Proactive security audits are essential. Schedule quarterly reviews of your loyalty program’s security infrastructure. These audits should include penetration testing, vulnerability assessments, and code reviews.

65% of data breach victims reported a loss of trust in an organization following a breach, which can have enduring consequences on customer loyalty. Regular audits help identify and address vulnerabilities before exploitation, potentially saving millions in damages and lost customer trust.

Invest in Comprehensive Employee Training

Your staff can become your strongest defense or your weakest link. Implement a robust training program that covers:

- Recognition of social engineering tactics

- Proper handling of customer data

- Identification and reporting of suspicious activities

The Association of Certified Fraud Examiners found that organizations with anti-fraud training programs for employees experience 50% lower fraud losses compared to those without such programs.

Establish Clear Program Terms and Enforce Them

Clearly defined terms and conditions are vital. They should outline acceptable user behavior, point expiration policies, and consequences for fraudulent activities. Make these terms easily accessible and require users to actively agree to them.

Enforce your policies consistently. If users violate the terms, take swift action. This might include account suspension, point forfeiture, or even legal action in severe cases.

Implement Smart Restrictions

Velocity checks and spending limits act as powerful tools against fraud. Set daily, weekly, or monthly caps on point earning and redemption. This prevents sudden, large-scale fraud attempts.

For example, if a typical user earns 100 points per week, flag accounts that suddenly accrue 1,000 points in a day for review. Similarly, implement gradual point release for high-value redemptions to allow time for additional verification.

Final Thoughts

Loyalty fraud threatens businesses, erodes customer trust, and drains resources. We explored common fraud types and cutting-edge detection techniques powered by AI and machine learning. These systems analyze data in real-time, identify suspicious patterns, and flag potential fraud before it occurs.

Technology alone cannot solve the problem. Multi-factor authentication, security audits, employee training, clear program terms, and smart restrictions form a robust defense against loyalty program fraud. Fraudsters constantly evolve their tactics, which requires businesses to stay vigilant and adaptable.

At Reward the World, we offer a platform to engage customers, drive sales, and recognize employees while maintaining high security standards. Our solution provides instant reward delivery, seamless integration, and comprehensive analytics to help businesses protect their loyalty programs and maximize their potential (while balancing security and user experience).