Global loyalty programs face an increasingly complex web of regulations across different markets. From GDPR requirements to regional consumer protection laws, businesses must navigate varying compliance standards.

We at Reward the World understand that effective compliance mapping becomes essential when operating across multiple jurisdictions. The stakes are high – non-compliance can result in hefty fines and damaged customer trust.

What Legal Requirements Apply to Your Global Loyalty Program?

GDPR sets the gold standard for loyalty program compliance and requires explicit consent for data collection while it limits storage duration to what businesses need for operations. The regulation imposes fines up to 4% of global annual turnover, with companies like Sephora facing $1.2 million penalties for CCPA violations in 2022. European loyalty programs must appoint Data Protection Officers and implement data protection by design, which means privacy considerations must be built into program architecture from the start rather than added later.

Regional Privacy Standards Create Complex Compliance Maps

The California Consumer Privacy Act classifies loyalty programs as financial incentives and requires businesses to disclose the exact value of rewards to customers. Colorado’s Privacy Act became effective July 1, 2023, allowing Colorado residents to gain insights into how their personal information is collected, used, and shared. Canada’s Anti-Spam Legislation restricts email marketing within loyalty programs, while 40% of loyalty marketers report difficulties when they balance privacy compliance with meaningful customer experiences. Each jurisdiction treats geolocation data differently, with many that require explicit consent for mobile app tracking.

Cross-Border Data Transfers Demand Strategic Infrastructure

International loyalty programs face strict data localization requirements, with some countries that prohibit customer data from leaving their borders. The EU-US Data Privacy Framework provides a legal pathway for transatlantic data transfers, but companies must implement standard contractual clauses and conduct transfer impact assessments. Programs that operate across multiple currencies need dynamic pricing models to maintain fair reward values, while anti-money laundering compliance requires monitoring for suspicious redemption patterns that could indicate fraudulent activity.

Consumer Protection Laws Shape Program Structure

Federal Trade Commission oversight prohibits unfair and deceptive trade practices in U.S. loyalty programs (with particular focus on hidden fees and sudden rule changes). Consumer protection laws require transparency in how points are earned and redeemed, while businesses must provide clear terms without pre-checked consent boxes or vague language. Loyalty program statistics show that the average annual activity rate across loyalty programs is 59%, meaning more than half of all loyalty program members have made a purchase in the past year.

These regulatory frameworks create the foundation for program design, but tax implications and financial compliance present additional layers of complexity that shape how rewards function across borders.

What Financial Compliance Risks Threaten Your Global Program?

Tax Classifications Vary Dramatically Across Jurisdictions

Reward points create complex tax scenarios that differ significantly between countries. In the United States, points typically remain non-taxable until redemption occurs, but gift cards require separate Form 1099-K reporting for payment card and third party network transactions. The IRS treats cash-equivalent rewards as taxable income at fair market value, while European Union member states apply different VAT rates to digital rewards (ranging from 17% to 27%). Australia requires businesses to pay Goods and Services Tax on the full retail value of redeemed rewards, not the discounted purchase price. Companies that operate across multiple markets must track redemption patterns and automatically calculate tax obligations in real-time to avoid penalties that can reach 25% of the reward value plus interest.

Anti-Money Laundering Surveillance Becomes Non-Negotiable

Digital reward systems face intense scrutiny from financial regulators who monitor for suspicious transaction patterns. The Bank Secrecy Act requires banks to identify customers, maintain records of financial transactions, and file CTRs for cash transactions. Loyalty programs must also flag unusual redemption behaviors like rapid point accumulation followed by immediate high-value redemptions. The Bank Secrecy Act requires financial institutions to establish AML/CFT programs that include transaction monitoring systems to detect attempts at structuring, where users deliberately keep redemptions below reporting thresholds. Programs must maintain detailed audit trails for at least five years and establish clear escalation procedures when suspicious activity occurs.

Consumer Rights Create Additional Compliance Layers

Consumer redemption policies must explicitly state that accounts that show irregular patterns will face immediate suspension and potential law enforcement referral. Federal regulations require businesses to provide clear notification procedures when they suspend accounts, while consumers maintain rights to appeal decisions through established dispute resolution processes. Programs must balance fraud prevention with consumer protection laws that prohibit arbitrary account closures without proper documentation and justification.

These financial compliance requirements intersect with consumer protection standards to create operational frameworks that demand both sophisticated technology and transparent member communication strategies.

How Do You Build Legally Compliant Global Programs

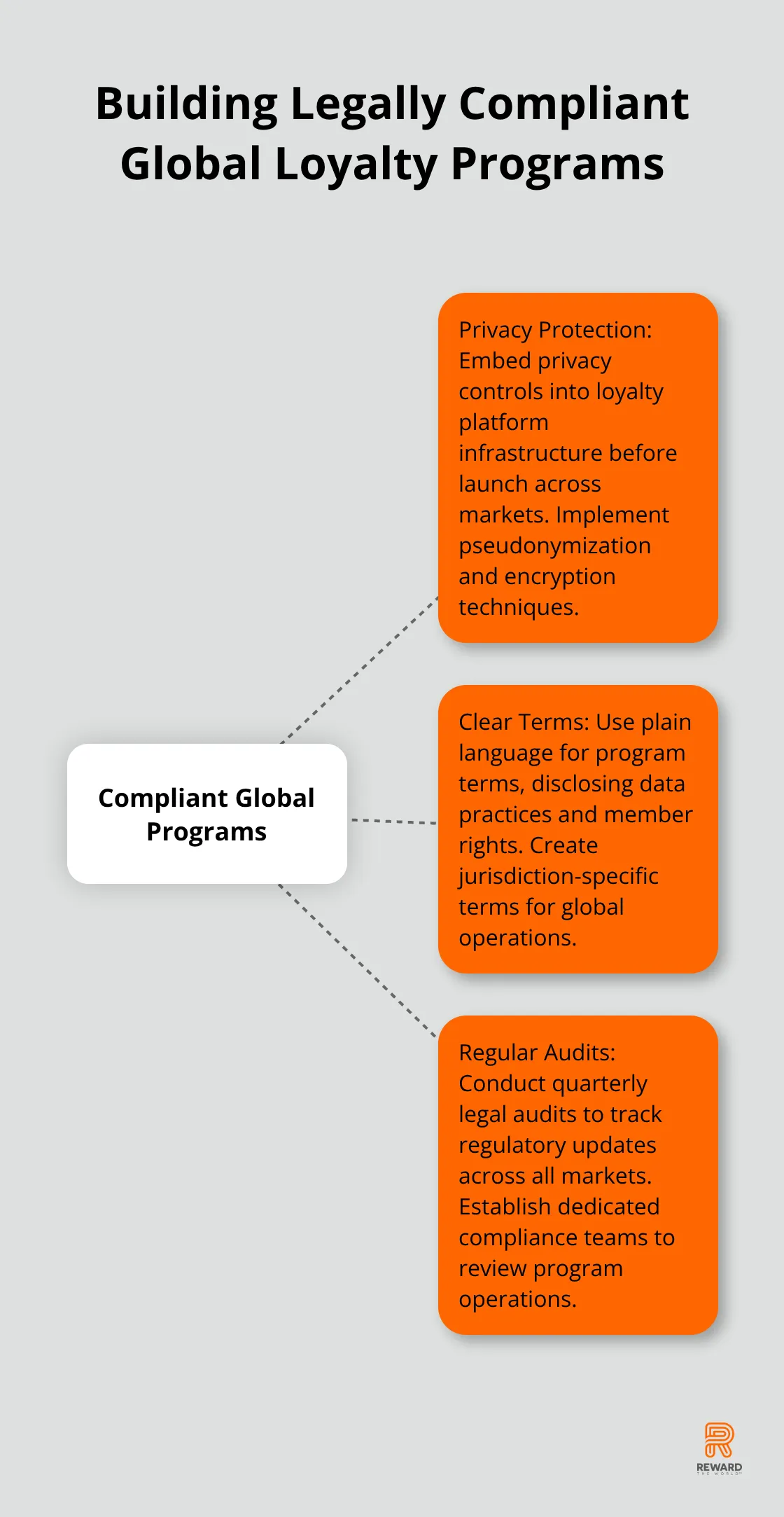

Privacy Protection Must Drive System Architecture

Data protection by design requires businesses to embed privacy controls into loyalty platform infrastructure before they launch across markets. The European Data Protection Board mandates that businesses conduct Data Protection Impact Assessments when processing creates high risks to individual rights and freedoms. Companies must implement pseudonymization techniques that separate customer identities from behavioral data, while encryption standards like AES-256 protect data both in transit and at rest.

Technical measures include automated data deletion after retention periods expire (with transparent data handling essential for trust given changing consumer spending patterns). Role-based access controls limit employee data exposure to job-essential information only, while API security protocols prevent unauthorized third-party access to customer profiles.

Terms Must Eliminate Legal Ambiguity Across Jurisdictions

Transparent program terms require plain language explanations of point earning rates, redemption procedures, and account suspension policies without legal jargon that confuses members. The Federal Trade Commission requires businesses to disclose material terms prominently, meaning reward limitations cannot hide in fine print or require multiple clicks to access.

Terms must specify exact data collection practices, third-party sharing arrangements, and member rights under local privacy laws like GDPR’s right to data portability. Companies operating globally need jurisdiction-specific terms that address local consumer protection requirements, with dynamic content management systems that display relevant legal information based on member location.

Regular Audits Prevent Compliance Gaps

Regular legal audits should occur quarterly rather than annually because regulatory changes happen frequently (with Colorado’s Privacy Act demonstrating how quickly new requirements emerge). Compliance monitoring systems must track regulatory updates across all operating markets and automatically flag potential conflicts with existing program structures.

Companies must establish dedicated compliance teams that review program operations against current regulations and identify potential violations before they occur. These teams should maintain direct relationships with legal experts in key markets to receive immediate updates on regulatory changes that could impact program operations.

Final Thoughts

Global loyalty programs demand comprehensive compliance mapping across multiple jurisdictions to avoid penalties that reach 4% of annual turnover. The regulatory landscape requires proactive management rather than reactive responses. Quarterly legal audits become standard practice as laws evolve rapidly across different markets.

Privacy regulations will tighten worldwide as more countries adopt GDPR-style frameworks that require explicit consent and data protection by design. Anti-money laundering requirements expand to cover digital rewards while consumer protection laws focus on transparency in point valuation and redemption policies. Companies must invest in automated compliance systems that track regulatory changes across all markets (with real-time updates becoming essential for global operations).

The future belongs to businesses that build legal considerations into their program architecture from day one rather than retrofit compliance measures later. We at Reward the World provide GDPR-compliant loyalty solutions that handle the complexity of global compliance while we deliver seamless customer experiences. Our platform supports businesses across multiple jurisdictions with built-in legal safeguards that adapt to local requirements.