Loyalty programs are a powerful tool for businesses, but they come with complex tax implications. At Reward the World, we’ve seen many companies struggle with the intricacies of incentive taxation.

Understanding the tax rules for loyalty programs is vital for financial compliance and optimizing your rewards strategy. This guide will help you navigate the tax landscape of loyalty programs, ensuring your business stays ahead of the curve.

What Are Taxable Loyalty Programs?

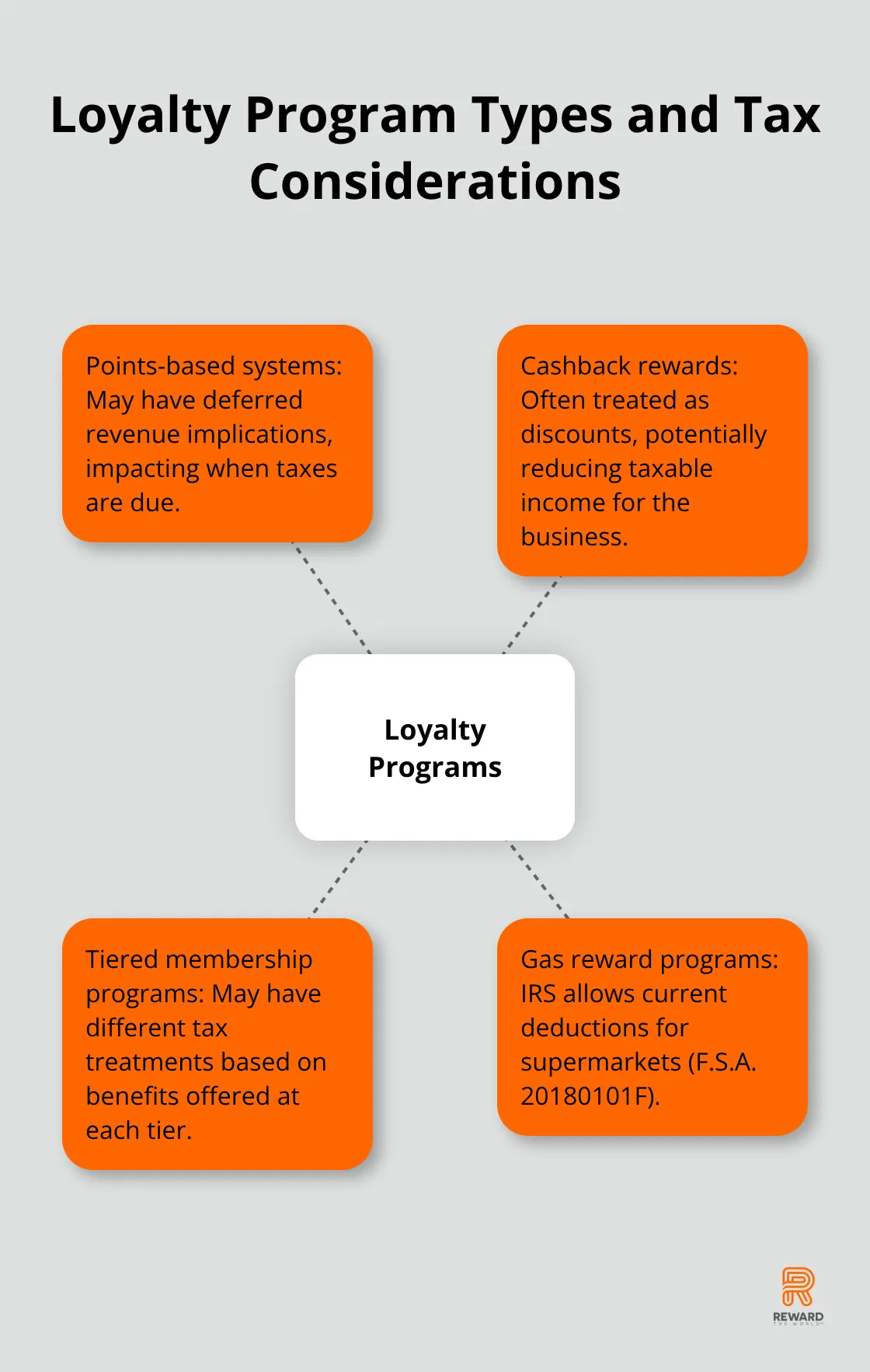

Types of Loyalty Programs and Their Tax Implications

Loyalty programs serve as marketing strategies to encourage customer retention. These programs offer rewards, discounts, or special incentives. However, their tax implications vary based on structure and implementation.

Points-based systems, cashback rewards, and tiered membership programs each carry unique tax considerations. For example, the IRS allows supermarkets to take current deductions for gas reward values (under F.S.A. 20180101F). This ruling provides clarity for one specific program type but underscores the need for businesses to carefully evaluate the tax implications of their particular loyalty structure.

Taxable vs. Non-Taxable Rewards

The IRS distinguishes between taxable and non-taxable rewards. Generally, rewards redeemed for products do not incur taxes for the customer. However, when customers convert rewards into cash equivalents, these become taxable income. A court ruling clarified that rewards from Visa gift cards aren’t taxable, but those from money orders are. The IRS’s unclear policy poses challenges in this area.

Reporting Requirements for Businesses

Businesses must navigate complex reporting requirements for loyalty programs. The IRS favorably concluded that credit card reward liabilities are deductible when the rewards become redeemable for cash or a statement credit. However, accrual basis taxpayers might claim deductions when customers earn rewards (as determined in Giant Eagle, Inc. v. Comr.). This discrepancy highlights the importance of understanding your business’s accounting method and its interaction with loyalty program taxation.

Deductibility and Financial Impact

The tax treatment of loyalty programs can significantly impact a company’s financial statements and cash flow. Proper structuring of these programs can minimize tax liability while maximizing customer engagement. Businesses should consider the timing of deductions, the classification of rewards as expenses or contra-revenue, and the potential for deferred tax assets or liabilities.

Technology and Compliance

Advanced tracking and reporting technologies (like those offered by Reward the World) play a crucial role in managing the tax aspects of loyalty programs. These tools help businesses accurately monitor reward accruals, redemptions, and expirations, ensuring compliance with tax regulations and providing valuable data for financial reporting.

As the tax landscape continues to evolve, businesses must stay informed about changes in regulations and rulings that affect loyalty program taxation. The next section will explore strategies for creating tax-efficient loyalty programs that balance customer engagement with financial optimization.

How Loyalty Programs Impact Your Tax Situation

Reporting Loyalty Rewards

The IRS mandates businesses to report loyalty rewards as income upon redemption or expiration. This requirement necessitates a robust system to track point accruals, redemptions, and expirations. For rewards that exceed $600 annually, businesses must issue Form 1099-MISC to the recipient. Failure to comply can result in penalties.

A recent study by the National Small Business Association reveals that 68% of small businesses find tax compliance burdensome, especially regarding reward program reporting. This statistic underscores the importance of implementing a reliable tracking system.

Deducting Program Expenses

Loyalty program expenses typically qualify as tax-deductible. However, the timing of these deductions can present challenges. Cash-basis taxpayers take deductions when rewards are redeemed. Accrual-basis taxpayers might deduct expenses when points are earned, potentially accelerating tax benefits.

The landmark case of Giant Eagle, Inc. v. Commissioner involved a gasoline discount program that entitled a customer to receive a “discount coupon” for a 10 cents per gallon reduction in price. This ruling could potentially impact how businesses deduct loyalty program expenses.

Financial Statement Implications

Loyalty programs can significantly affect your financial statements. Under GAAP, unredeemed points are treated as deferred revenue, impacting your balance sheet. Accurate estimation of breakage (points that will never be redeemed) is essential. Industry standards suggest a 30% breakage rate, but your actual rate may vary.

The SEC closely monitors compliance with ASC 606, which governs how companies recognize revenue from contracts with customers, including loyalty programs. Early recognition of breakage income can lead to scrutiny, highlighting the need for precise liability tracking.

Technology and Compliance

Advanced tracking technologies (such as those offered by Reward the World) play a vital role in ensuring accurate financial reporting and optimizing tax positions. These tools help businesses monitor reward accruals, redemptions, and expirations with precision, facilitating compliance with tax regulations.

Strategic Considerations

To maximize the tax benefits of your loyalty program while maintaining customer engagement, consider the following strategies:

- Implement a robust tracking system to ensure accurate reporting.

- Consult with tax professionals to determine the most advantageous accounting method for your business.

- Regularly review and update your loyalty program structure to align with current tax regulations.

As we move forward, let’s explore specific strategies for creating tax-efficient loyalty programs that balance customer engagement with financial optimization.

How Can You Optimize Your Loyalty Program’s Tax Efficiency?

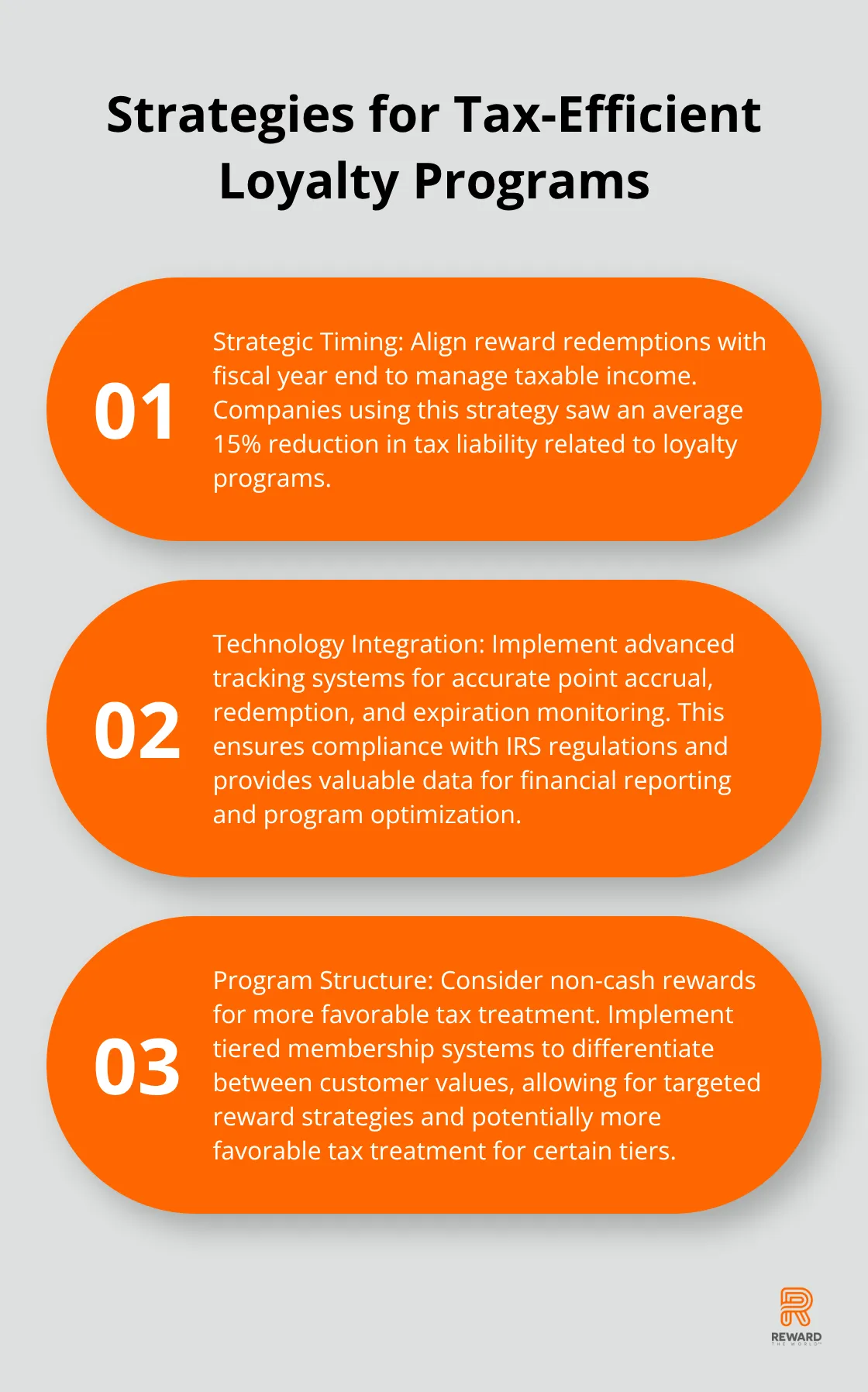

Strategic Timing of Reward Distributions

We at Reward the World understand the impact of well-structured loyalty programs on a company’s bottom line. To minimize tax liability, companies should align reward redemptions with their fiscal year. This strategy allows better management of taxable income. For example, companies approaching the end of their fiscal year with higher-than-expected profits might run a promotion encouraging customers to redeem points. This action increases deductible expenses, potentially lowering the tax burden.

A National Retail Federation study found that companies strategically timing their reward distributions saw an average 15% reduction in their overall tax liability related to loyalty programs. This significant saving highlights the importance of thoughtful program structuring.

Precision Through Technology

Accurate tracking and reporting are essential for tax compliance and optimization. Advanced loyalty program management systems automate the process of tracking point accruals, redemptions, and expirations. This precision ensures compliance with IRS regulations and provides valuable data for financial reporting and program optimization.

A mid-sized retailer implemented an automated tracking system and discovered their actual breakage rate was 22% (significantly lower than the industry standard of 30%). This insight allowed them to adjust their financial statements, resulting in a more accurate representation of their liabilities and improved tax planning.

Comprehensive Documentation

Thorough documentation serves as the best defense in case of an audit. Companies should maintain detailed records of all loyalty program transactions, including:

- Point accrual rates

- Redemption values

- Expiration policies

- Customer agreements

Companies should also keep thorough documentation of estimation methodologies for breakage rates and other key metrics. The IRS often scrutinizes these areas, so clear, well-supported documentation can prevent significant issues.

Tax-Efficient Program Structure

Companies should consider structuring their loyalty program to maximize tax benefits while still engaging customers. Non-cash rewards often provide more favorable tax treatment compared to cash-back incentives. While offering strong financial rewards remains critical, consumers are increasingly looking for personalized, flexible, and digital-centric loyalty programs, making this a win-win strategy for both tax efficiency and customer satisfaction.

Another approach involves implementing a tiered membership system. This structure helps differentiate between high-value and low-value customers, allowing for more targeted reward strategies and potentially more favorable tax treatment for certain tiers.

Staying Informed and Adaptable

The landscape of loyalty program taxation constantly evolves. Companies must stay informed about changes in regulations and rulings that affect loyalty program taxation. Regular consultations with tax professionals provide businesses with insights to navigate complex tax issues regarding reward programs.

Final Thoughts

Businesses must approach loyalty programs with a strategic focus on both customer engagement and incentive taxation. Companies should implement robust tracking systems to ensure accurate reporting and gain valuable insights for financial planning. Strategic timing of reward distributions can help manage taxable income, while choosing an optimal mix of cash and non-cash rewards can offer tax advantages.

Thorough documentation serves as the best defense against potential audits. Companies must maintain detailed records of all loyalty program transactions (including point accrual rates, redemption values, and expiration policies). This level of detail not only aids in compliance but also provides data for program optimization.

Reward the World offers valuable solutions to help businesses navigate the complexities of incentive taxation while fostering customer loyalty. With its global reach and instant reward delivery, Reward the World supports businesses in creating engaging loyalty programs that balance tax efficiency with customer satisfaction. Companies that leverage such tools position themselves to reap the benefits of customer loyalty while optimizing their tax position in this dynamic landscape.