Point-based employee reward programs are becoming increasingly popular among businesses. However, these programs come with complex tax implications that both employers and employees need to understand.

At Reward the World, we’ve seen firsthand how the tax consequences of point-based employee reward programs can impact overall compensation strategies. This blog post will explore the tax treatment of these programs and provide strategies for maximizing their benefits while minimizing tax burdens.

What Are Point-Based Reward Programs?

Definition and Structure

Point-based reward programs serve as a strategic tool for companies to motivate and engage employees. These programs allow employees to earn points for various achievements or behaviors, which they can later redeem for rewards. This system creates a tangible way to recognize and incentivize employee contributions beyond their regular salary.

In a typical point-based program, employees accumulate points for actions aligned with company goals. These might include meeting sales targets, completing training modules, or participating in wellness initiatives. The earned points are tracked in a digital platform, often accessible through a mobile app or web portal.

A study by the Incentive Research Foundation reveals that companies using point-based programs report a 79% success rate in achieving their goals. This high success rate stems partly from the flexibility and customization these programs offer.

Popular Reward Options

The types of rewards offered in these programs can vary widely, catering to diverse employee preferences. Common options include:

- Merchandise (from electronics to home goods)

- Travel experiences (weekend getaways or all-inclusive vacations)

- Gift cards (offering flexibility and immediate gratification)

- Charitable donations (allowing employees to support causes they care about)

- Extra time off (a non-monetary reward many employees highly value)

Advantages for Employers and Employees

For employers, point-based programs offer several benefits. They can drive specific behaviors aligned with company objectives, boost employee engagement, and provide valuable data on what motivates their workforce. Gallup’s research has shown that companies with engaged workforces have higher earnings per share (EPS).

Employees benefit from the ability to choose rewards that are meaningful to them, creating a more personalized recognition experience. The program also provides a clear link between their efforts and rewards, fostering a sense of fairness and motivation.

Implementation Considerations

The success of point-based programs hinges on thoughtful implementation. Key factors include:

- Clear communication of program rules and point values

- Regular updates on point balances and available rewards

- Ensuring a wide range of reward options to cater to diverse preferences

- Aligning point-earning activities with company goals and values

Companies should address these elements to create a reward program that not only motivates employees but also drives business success.

As we move forward to explore the tax implications of these programs, it’s important to keep these foundational aspects in mind. The next section will unpack the complex tax treatment of point-based rewards, providing insights into how these programs interact with tax regulations.

How Are Point-Based Rewards Taxed?

General Tax Rules for Employee Benefits

The Internal Revenue Service (IRS) considers most forms of employee compensation as taxable income. This includes cash bonuses, non-cash rewards, and benefits received through point-based programs. The IRS Employer’s Tax Guide to Fringe Benefits mandates that employers report the fair market value of these rewards on employees’ W-2 forms at year-end.

Exceptions exist for de minimis benefits (small and infrequent enough to make accounting impractical). For instance, occasional snacks or small gifts valued under $100 might not incur tax liability.

Taxability of Different Reward Types

The tax treatment varies based on the nature of rewards:

- Cash and Cash Equivalents: Always taxable, including gift cards (considered cash equivalents by the IRS).

- Merchandise: The fair market value must be included in the employee’s taxable income. Many companies use the 30 percent rule, estimating fair market value at 70% of retail price (accounting for bulk purchasing discounts).

- Travel Awards: Generally taxable unless they qualify as business expenses. Fair market value typically estimates at 73-76% of total travel cost (factoring in group discounts).

- Time Off: Additional paid time off awarded through points programs incurs tax at the employee’s regular pay rate.

IRS Guidance on Point-Based Programs

While the IRS hasn’t provided specific guidance on point-based reward programs, existing regulations and rulings suggest key principles:

Timing of Taxation

The primary question revolves around whether points should incur tax when awarded or redeemed. Many companies opt to report the taxable value upon redemption, as this allows for accurate determination of the reward’s fair market value.

Constructive Receipt

If employees can immediately redeem points for cash or cash equivalents without substantial limitations, the IRS might consider this constructive receipt, making points taxable upon award rather than redemption.

Substantial Limitations

To avoid immediate taxation, companies often implement restrictions on point redemption (e.g., minimum thresholds or limited redemption periods). These limitations can help argue against constructive receipt.

Reporting and Withholding Requirements

Employers must report the fair market value of taxable rewards on employees’ W-2 forms and withhold applicable income and payroll taxes. For non-employee recipients (such as independent contractors), rewards valued at $600 or more in a year require reporting on Form 1099-MISC.

Effective management of these requirements necessitates detailed record-keeping of point accruals, redemptions, and the fair market value of rewards. Many companies utilize specialized software or partner with reward program providers to streamline this process.

The complex nature of point-based reward taxation underscores the importance of a well-designed program structure. In the next section, we’ll explore strategies for creating tax-efficient reward programs that maximize benefits for both employers and employees.

How to Create Tax-Efficient Reward Programs

Leverage Non-Cash Rewards

Non-cash rewards often provide more tax advantages compared to cash or cash equivalents. Performance-based awards, such as those for exceeding sales expectations, can be rewarded with hard cash. This approach rewards performance that directly translates to business results.

Offering high-quality electronics or luxury home goods as rewards can provide substantial perceived value to employees while potentially qualifying for tax exclusions. A study by the Incentive Research Foundation found that non-cash rewards can be 2-3 times more cost-effective than cash rewards when considering their motivational impact and tax implications.

Implement Strategic Timing for Rewards

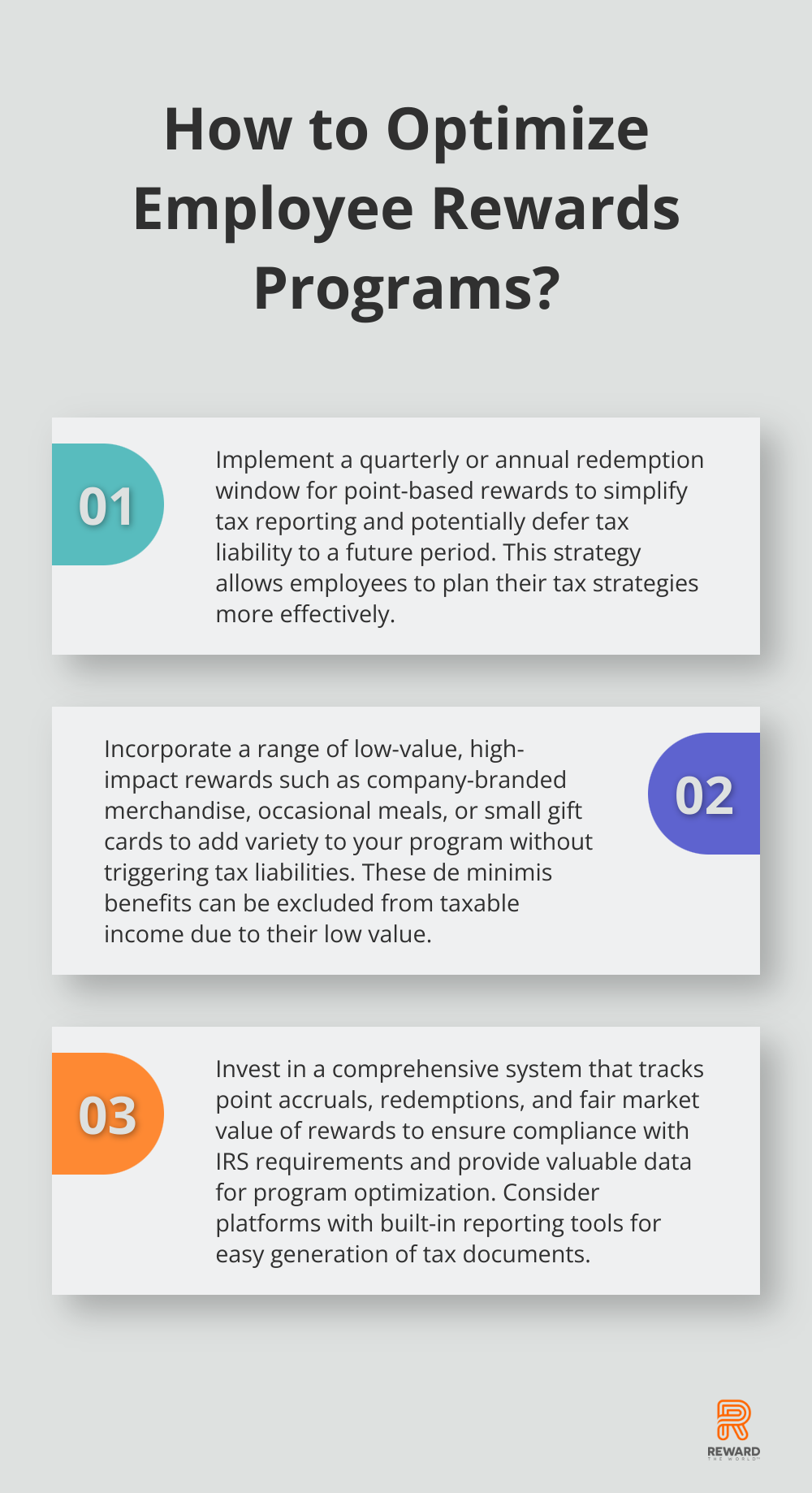

Timing plays a key role in the tax treatment of rewards. The structure of your program should delay point redemption until a specific date or milestone, which can potentially defer the tax liability to a future period. This approach can benefit year-end rewards, allowing employees to plan their tax strategies more effectively.

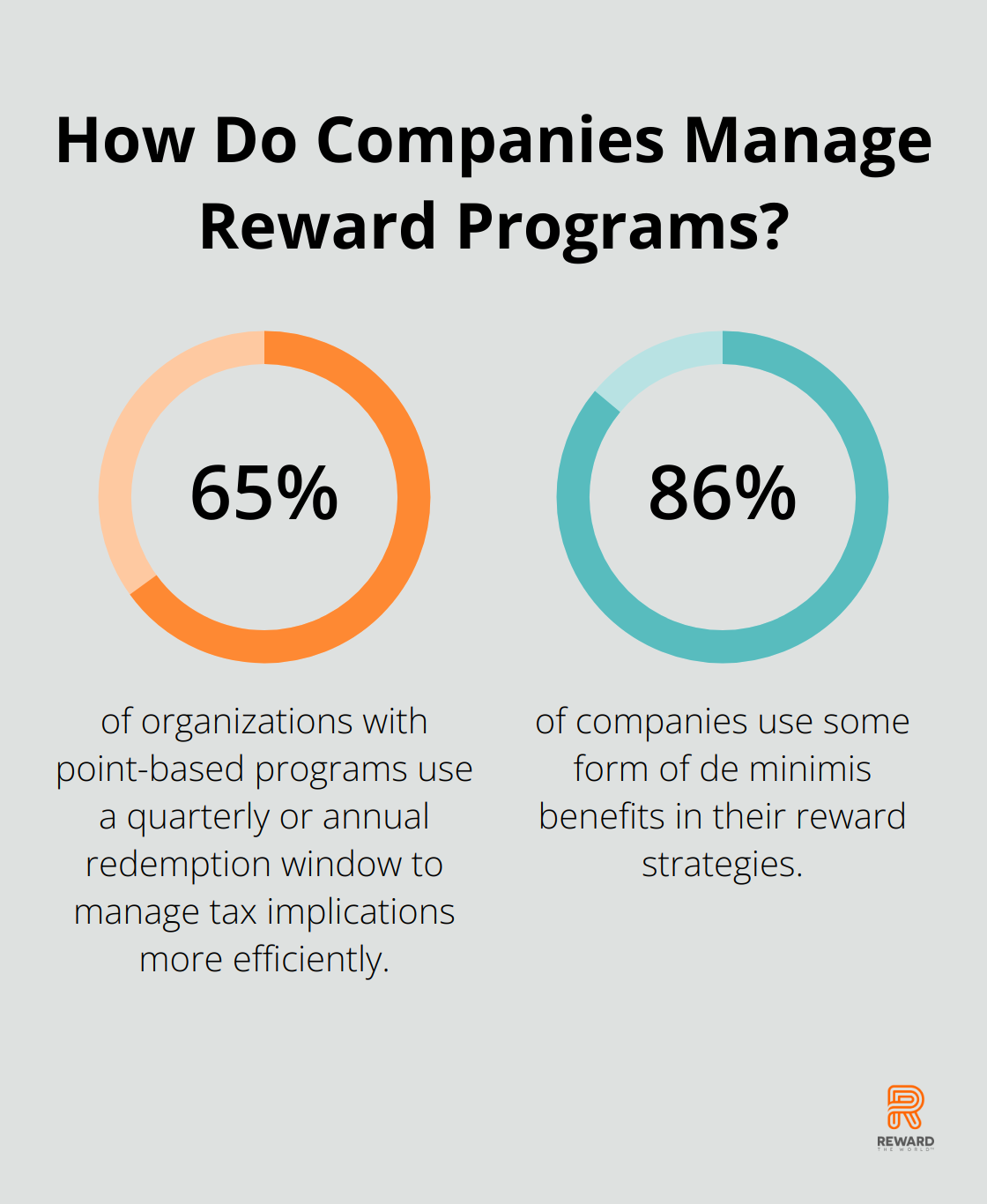

Some companies find success with a quarterly or annual redemption window, which simplifies tax reporting and creates anticipation around the reward program. A survey by WorldatWork revealed that 65% of organizations with point-based programs use this strategy to manage tax implications more efficiently.

Utilize De Minimis Benefits

The IRS allows for certain de minimis benefits to be excluded from taxable income due to their low value and administrative impracticality of accounting for them. Special rules apply to allow exclusion from employee income for achievement awards.

The incorporation of a range of low-value, high-impact rewards can add variety to your program without triggering tax liabilities. This could include company-branded merchandise, occasional meals, or small gift cards. A report from the Society for Human Resource Management indicates that 86% of companies use some form of de minimis benefits in their reward strategies.

Implement Robust Documentation and Reporting Systems

Proper documentation ensures the management of tax implications of your reward program. The investment in a comprehensive system that tracks point accruals, redemptions, and the fair market value of rewards is essential. This not only ensures compliance with IRS requirements but also provides valuable data for program optimization.

Reward the World’s platform offers built-in reporting tools that simplify this process, allowing for easy generation of necessary tax documents and real-time tracking of program metrics (a feature not consistently available across all platforms in the market).

Consider Charitable Donations as Rewards

The inclusion of charitable donations as a reward option can provide tax benefits for both employers and employees. When employees redeem points for charitable donations, the company can potentially claim a tax deduction for the donation amount. This strategy aligns with corporate social responsibility initiatives and can appeal to socially conscious employees.

Final Thoughts

Point-based employee reward programs offer powerful motivation tools, but they come with complex tax implications. The tax consequences of point-based employee reward programs impact both employers and employees significantly. Companies must understand these implications and implement strategic program designs to maximize benefits while minimizing tax burdens.

Key considerations include taxation timing, reward types, and clear documentation. Non-cash rewards often provide more tax advantages than cash equivalents, while strategic redemption timing helps manage tax liabilities. Utilizing de minimis benefits and incorporating charitable donations as reward options can enhance tax efficiency.

At Reward the World, we understand the intricacies of designing tax-efficient reward programs. Our global incentives platform offers a comprehensive solution for businesses looking to enhance employee recognition while navigating tax complexities. We help companies create reward programs that drive performance and engagement while optimizing tax efficiency.