Running a multi-national loyalty program comes with a complex web of legal requirements. At Reward the World, we’ve seen first-hand how challenging it can be to navigate the maze of international regulations.

Legal compliance is not just a box to tick-it’s a critical factor in building trust with customers and protecting your business. This post will guide you through the key areas of compliance for global loyalty programs, helping you stay on the right side of the law while delivering value to your customers.

Global Compliance Challenges for Loyalty Programs

The Complex Landscape of International Regulations

Loyalty programs that operate across multiple countries face a complex web of regulations. Each jurisdiction imposes its own set of rules governing data protection, consumer rights, and financial transactions. The General Data Protection Regulation (GDPR) sets strict standards for data handling, while the California Consumer Privacy Act (CCPA) in the United States enforces different requirements. This patchwork of regulations creates a challenging environment for global loyalty initiatives.

Data Protection: The Cornerstone of Compliance

Data protection stands at the forefront of compliance concerns for loyalty programs. These programs collect vast amounts of personal information (contact details, purchase history, etc.), making proper data handling essential. The GDPR, for example, requires explicit consent for data collection and grants consumers the right to access and delete their data. Non-compliance can result in severe penalties-up to €20 million or 4% of global annual turnover, whichever is higher.

Navigating Consumer Rights and Financial Regulations

Consumer rights vary significantly across countries, adding another layer of complexity to global loyalty programs. In some regions, loyalty points may fall under financial regulations, affecting how points are issued, redeemed, and expired. Anti-money laundering (AML) and know-your-customer (KYC) requirements may also apply, especially for high-value rewards or cash-back programs.

The financial implications extend to tax considerations as well. Some countries may treat loyalty rewards as taxable income, necessitating careful accounting and reporting. Currency exchange issues further complicate matters for programs operating across multiple economies.

Adapting to Regulatory Changes

The regulatory landscape for loyalty programs is not static. Laws and regulations evolve constantly, often in response to technological advancements and changing consumer expectations. The introduction of the GDPR in 2018 forced many companies to overhaul their data practices. Similar shifts are occurring globally, with countries like Brazil and India introducing new data protection laws.

To maintain compliance, loyalty program operators must invest in ongoing legal monitoring and prepare to adapt quickly. This might involve regular audits, staff training, and updates to program terms and conditions.

The Role of Technology in Compliance

Technology plays a crucial role in managing compliance for multi-national loyalty programs. Advanced platforms (such as Reward the World) can help businesses navigate the intricacies of global regulations while delivering a seamless loyalty experience to customers worldwide. These solutions often include built-in compliance features, data protection measures, and the ability to adapt to changing regulatory requirements across different jurisdictions.

As we move forward, let’s examine how loyalty programs can specifically address data protection and privacy laws in different regions.

How to Navigate Data Protection Laws Globally

The GDPR Challenge in Europe

The General Data Protection Regulation (GDPR) sets a high bar for data protection in the European Union. To comply, loyalty programs must meet the requirements for properly handling personal data. This includes:

- Obtaining explicit consent for data collection and processing

- Providing clear, accessible privacy policies

- Implementing data minimization practices

- Ensuring the right to be forgotten and data portability

Tackling the CCPA in the United States

The California Consumer Privacy Act (CCPA) introduces strict guidelines for the handling of personal data by businesses operating in California. Key provisions include:

- Disclosure of collected personal information and its use

- Allowing consumers to opt-out of data sales

- Providing access to collected personal information

- Deletion of consumer data upon request

Small businesses, despite their size, are not exempt from these requirements.

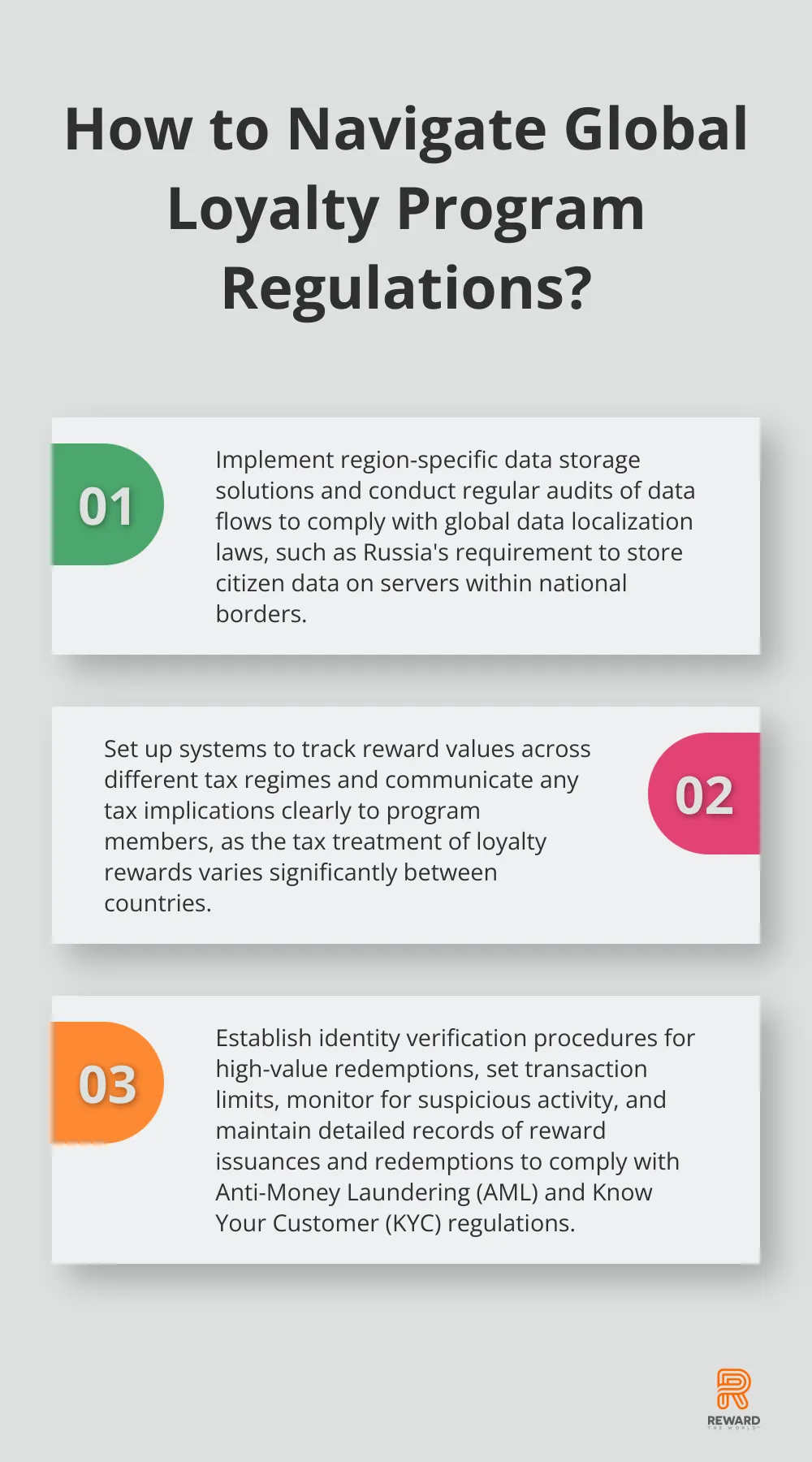

Addressing Global Data Localization Requirements

Many countries now implement data localization laws, which require companies to store citizen data within national borders. Russia’s data localization law mandates that personal data of Russian citizens be stored on servers physically located in Russia.

China’s Cybersecurity Law imposes similar requirements. These laws can significantly impact the infrastructure and operations of global loyalty programs.

To address these challenges, loyalty program operators should consider:

- Implementation of region-specific data storage solutions

- Regular audits of data flows and storage locations

- Partnerships with local experts or legal counsel in each operating country

The Role of Technology in Compliance

Advanced platforms can help businesses navigate the intricacies of global regulations while delivering a seamless loyalty experience to customers worldwide. These solutions often include built-in compliance features, data protection measures, and the ability to adapt to changing regulatory requirements across different jurisdictions.

As we move forward, it’s important to consider how loyalty programs can address financial regulations and rewards management across borders. This includes tax implications, currency exchange considerations, and anti-money laundering requirements.

Managing Financial Complexities in Global Loyalty Programs

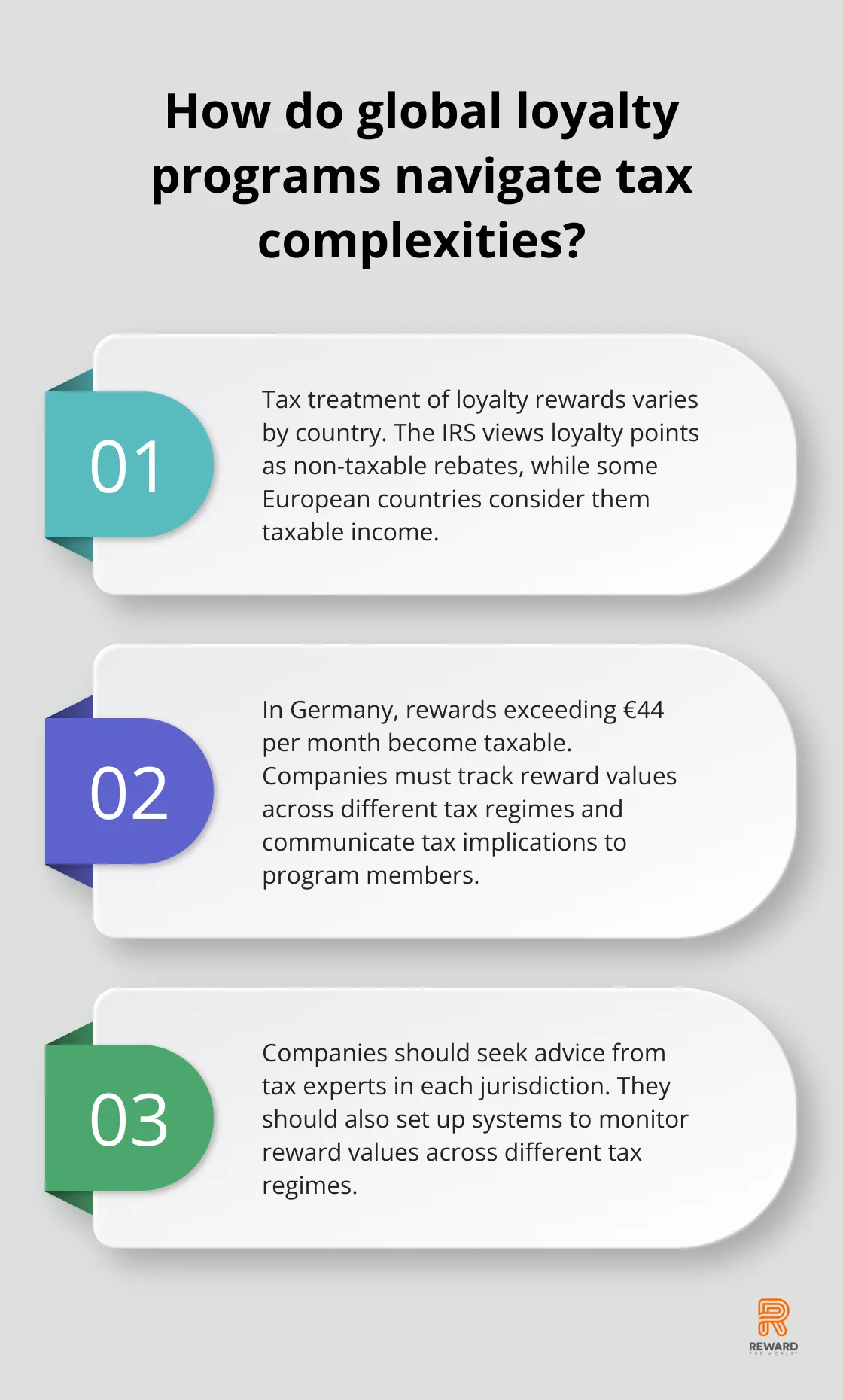

Tax Implications Across Borders

The tax treatment of loyalty rewards differs significantly between countries. The United States Internal Revenue Service (IRS) typically views loyalty points as rebates, not taxable income. This perspective, however, is not universal. Some European countries may consider loyalty rewards a form of income, subject to taxation.

In Germany, for instance, rewards exceeding €44 per month become taxable. Companies that operate loyalty programs must remain informed about these nuances to avoid unexpected tax liabilities and ensure proper reporting.

To address these complexities, companies should:

- Seek advice from tax experts in each operating jurisdiction

- Set up systems to track reward values across different tax regimes

- Communicate any tax implications clearly to program members

Currency Exchange Challenges

Currency fluctuations can significantly impact the value of rewards in multi-national programs. A points balance worth $100 today might change to $90 or $110 tomorrow due to exchange rate movements.

To mitigate these risks, companies can:

- Peg reward values to a stable currency or basket of currencies

- Implement dynamic pricing for rewards based on real-time exchange rates

- Offer local currency options for redemption where possible

AML and KYC Compliance

Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations have become increasingly relevant for loyalty programs, especially those that offer high-value rewards or cash-back options.

Financial incentives alone will have a limited impact on the quality and quantity of whistleblower reports and should only be introduced as part of wider reforms, according to the UK’s Financial Conduct Authority (FCA). This highlights the need for robust verification processes and transaction monitoring.

Key steps for AML and KYC compliance include:

- Identity verification procedures for high-value redemptions

- Setting of transaction limits and monitoring for suspicious activity

- Maintenance of detailed records of reward issuances and redemptions

- Staff training on AML and KYC procedures specific to loyalty programs

Regulatory Compliance Across Jurisdictions

The complexity of financial regulations across different countries requires loyalty program operators to stay vigilant and adaptable. Compliance management software automates the tracking of regulatory changes, monitors key performance indicators such as compliance rate and mean time to issue resolution.

This task can prove challenging, especially for smaller businesses or those new to international markets. Partnering with experienced providers (such as Reward the World) can simplify this process. These providers often incorporate built-in compliance features that adapt to various regulatory environments, which can ease the burden for businesses operating across multiple jurisdictions.

Risk Management Strategies

To protect against financial risks in multi-national loyalty programs, companies should develop comprehensive risk management strategies. These strategies might include:

- Regular audits of financial processes and compliance measures

- Creation of contingency plans for currency fluctuations or regulatory changes

- Use of financial instruments (e.g., hedging) to mitigate currency risks

- Implementation of robust fraud detection systems

Companies that address these financial and regulatory challenges head-on can create robust, compliant loyalty programs. These programs will deliver value to customers while protecting the company from legal and financial risks.

Final Thoughts

Legal compliance for multi-national loyalty programs requires a comprehensive understanding of diverse regulations. Businesses must protect customer data, respect consumer rights, manage tax implications, and adhere to anti-money laundering protocols. A compliant loyalty program builds trust, protects against legal risks, and enhances brand reputation.

The dynamic nature of global regulations necessitates partnerships with experienced providers who understand international compliance intricacies. Reward the World offers a solution that addresses these complex challenges with its global reach and multi-language support. Our platform simplifies the process of running a legally compliant loyalty program across borders.

Advanced technology and expertise in global regulations enable businesses to create robust loyalty programs that comply with legal requirements. These programs drive customer engagement and boost company performance. As regulations evolve, staying informed and partnering with knowledgeable providers will determine success in multi-national loyalty programs.