Reward programs are a powerful tool for businesses, but they come with a complex web of regulations. At Reward the World, we understand the challenges companies face in navigating this regulatory landscape.

Regulatory compliance is essential for protecting both businesses and consumers. This blog post will guide you through the key aspects of reward program regulations, helping you stay compliant and avoid costly mistakes.

Key Regulations for Reward Programs

Regulatory Bodies Overseeing Reward Programs

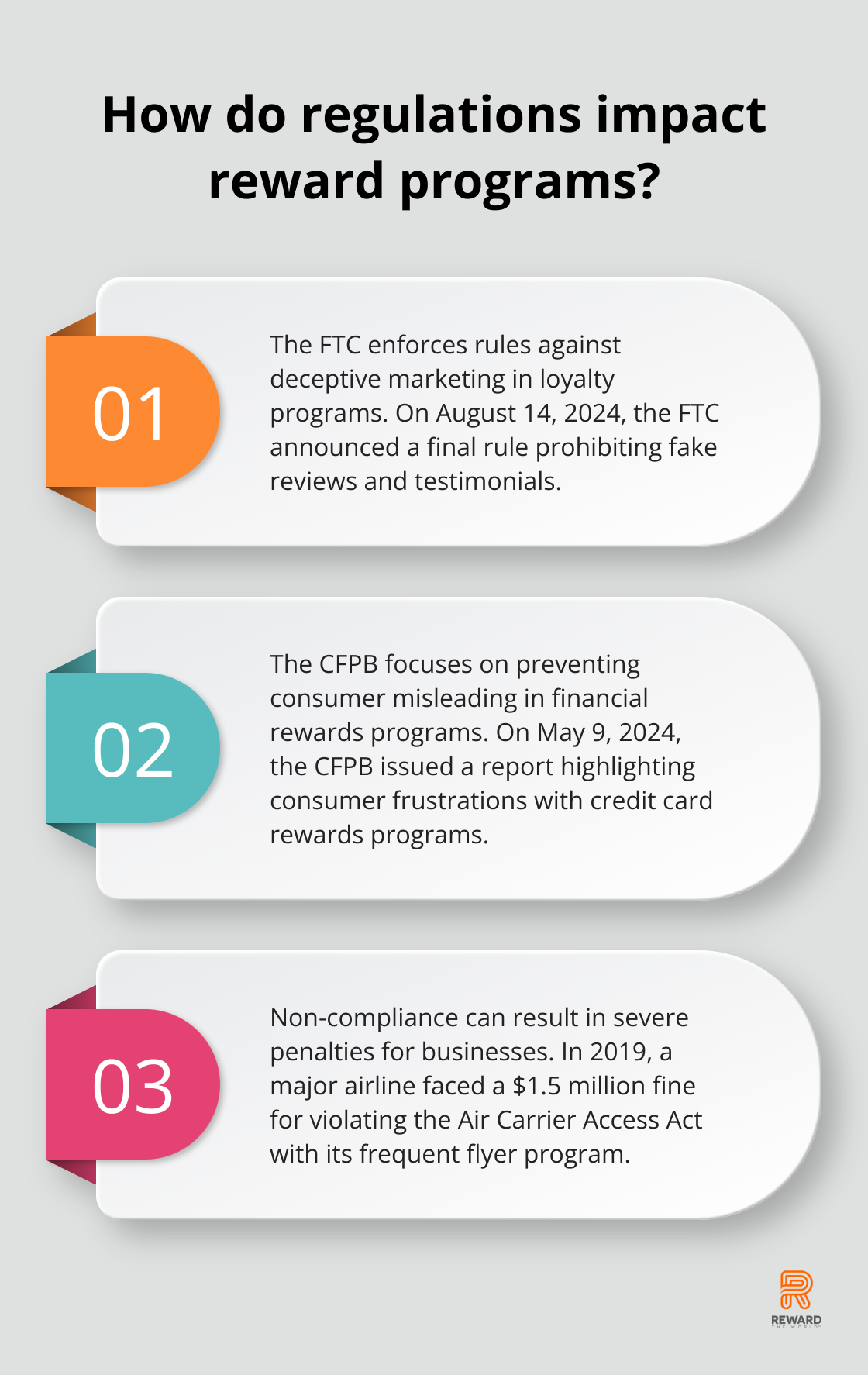

Several key regulatory bodies oversee reward programs. In the United States, the Federal Trade Commission (FTC) takes the lead in consumer protection and fair business practices. The FTC enforces rules against deceptive marketing and ensures loyalty programs maintain transparency about their terms and conditions. On August 14, 2024, the FTC announced a final rule prohibiting the sale or purchase of fake reviews and testimonials.

The Consumer Financial Protection Bureau (CFPB) also plays a significant role, especially for financial rewards and cashback programs. Their focus lies on preventing consumer misleading and violations of financial regulations. On May 9, 2024, the CFPB issued a report highlighting consumer frustrations with credit card rewards programs.

For international businesses, awareness of local regulatory bodies is essential. The UK’s Competition and Markets Authority (CMA), for instance, monitors loyalty schemes to prevent anti-competitive practices.

The Importance of Compliance in Reward Programs

Compliance builds trust with customers. A Deloitte study revealed that 81% of consumers show increased loyalty to brands that practice transparency in their data handling (a clear nod to the importance of adhering to data protection regulations like GDPR).

Non-compliance can result in severe penalties. In 2019, a major airline faced a $1.5 million fine for violating the Air Carrier Access Act with its frequent flyer program. Such incidents not only hurt financially but can also irreparably damage a brand’s reputation.

Common Regulatory Challenges for Businesses

Keeping up with evolving regulations presents a significant challenge. The California Consumer Privacy Act (CCPA) introduced new data protection requirements affecting many loyalty programs operating in the state. Organizations should perform a review of their loyalty programs to determine appropriate compliance requirements under CCPA.

Businesses must also ensure their reward programs don’t inadvertently discriminate against certain groups. The Equal Credit Opportunity Act mandates that credit card rewards programs, for instance, offer equal terms regardless of protected characteristics (such as race or gender).

Program structure requires careful consideration to avoid conflicts with gambling laws. Sweepstakes and contests associated with loyalty programs must comply with state and federal regulations.

Best Practices for Regulatory Compliance

To stay ahead of these challenges, businesses should:

- Conduct regular compliance audits

- Seek legal counsel when introducing new program features

- Stay informed about regulatory changes in all operating jurisdictions

Reward the World built its platform with compliance in mind, helping businesses navigate these regulatory waters more smoothly. Our solution offers GDPR compliance and robust analytics, making it an ideal choice for companies looking to elevate their customer engagement while maintaining regulatory adherence.

As we move forward, let’s examine how data protection and privacy regulations specifically impact reward programs and what businesses can do to ensure compliance in this critical area.

How Can Businesses Protect Customer Data in Reward Programs?

The GDPR’s Impact on Reward Programs

The GDPR’s Impact on Reward Programs has revolutionized data privacy standards globally, profoundly affecting how companies manage customer information in loyalty initiatives. Companies can turn their data protection measures into a business advantage that builds customer trust.

For reward programs, GDPR mandates stricter data protection measures and increased transparency about data usage. The regulation’s data minimization principle requires programs to collect only essential information for stated purposes. This has prompted many businesses to streamline their data collection processes, prioritizing quality over quantity. (For instance, a coffee shop loyalty program might now limit data collection to a customer’s name and purchase history, omitting extraneous personal details.)

Best Practices for Data Collection and Storage

To ensure compliance and safeguard customer data, businesses should adopt these practices:

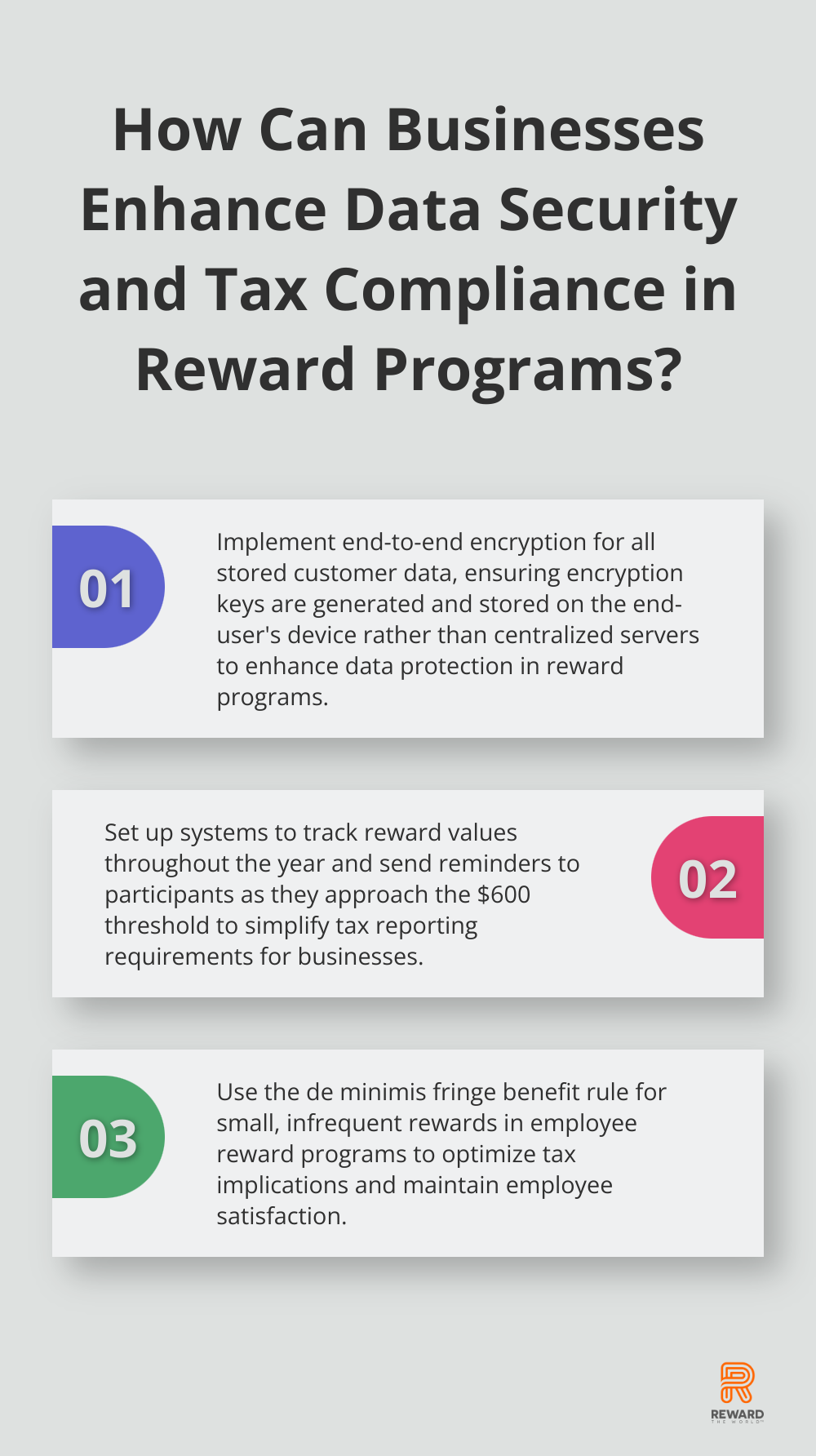

- Implement end-to-end encryption for all stored customer data, ensuring encryption keys are generated and stored on the end-user’s device, rather than centralized servers.

- Conduct regular security audits and penetration testing.

- Use pseudonymization techniques to separate personal identifiers from other data points, adding an extra layer of protection.

- Establish a clear data retention policy, keeping customer data only as long as necessary for the program’s purposes.

- Train staff on data protection practices to mitigate risks associated with human error.

Effective Customer Consent Management

Consent is a cornerstone of data protection regulations. GDPR requires consent to be freely given, specific, informed, and unambiguous. Here’s how businesses can effectively manage consent in their reward programs:

- Use clear, plain language when requesting consent, avoiding confusing legal jargon.

- Provide easy options for customers to withdraw consent.

- Regularly review and update consent as your program evolves.

- Maintain detailed records of consent, including when and how it was obtained, and for what specific purposes.

- Implement a preference center for customers to easily view and manage their consent settings.

As data protection regulations continue to evolve, businesses must remain vigilant and adaptable. Prioritizing data protection and privacy in reward programs builds customer trust and creates a solid foundation for long-term success. Implementing robust data security measures, including encryption, access controls, and regular security audits to protect customer data is crucial. This focus on data security naturally leads us to consider another critical aspect of reward programs: their tax implications.

How Do Taxes Affect Reward Programs?

Taxability of Rewards

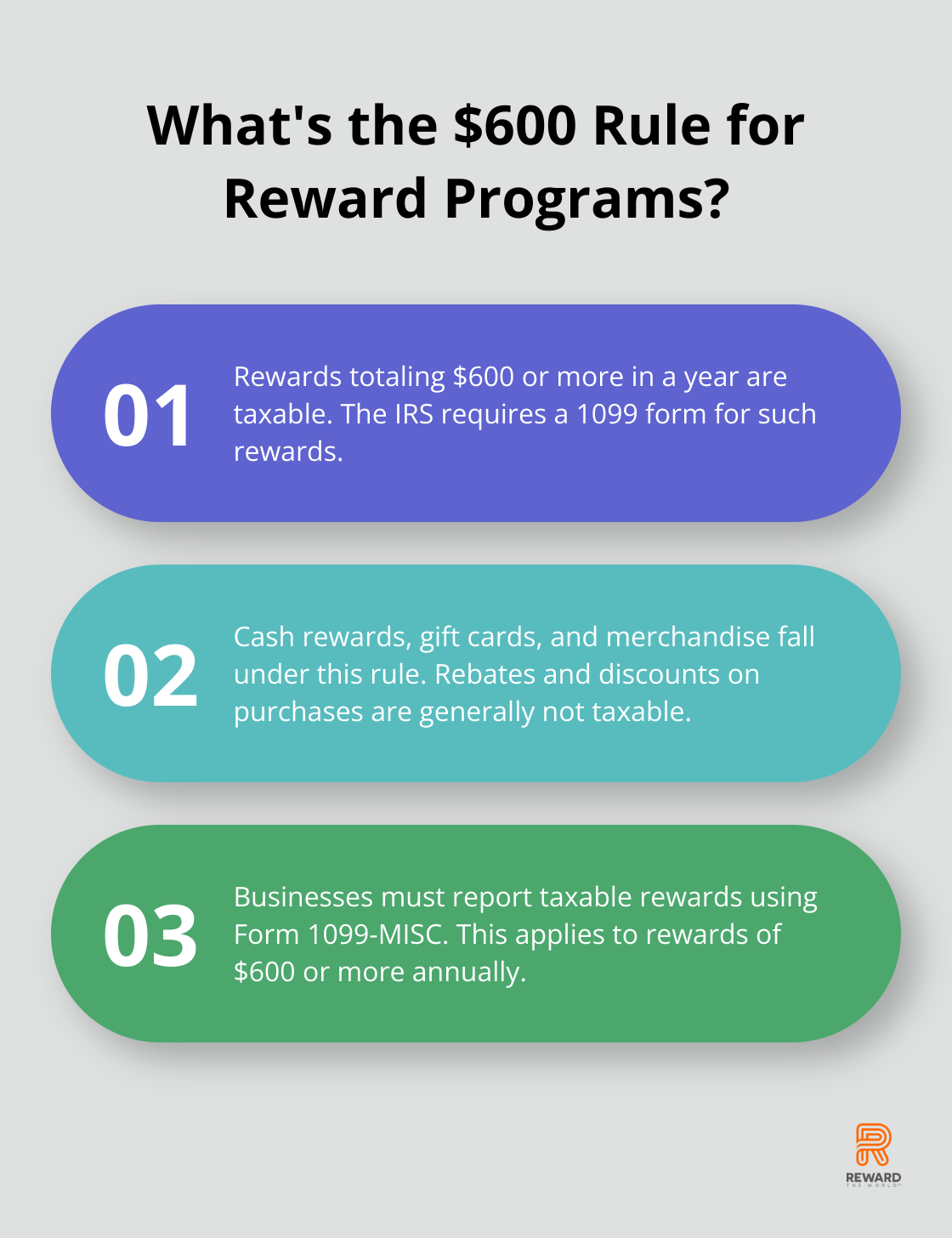

The tax implications of reward programs can make or break a loyalty initiative. The taxability of rewards depends on their value and how participants earn them. If you earn $600 or more in rewards, you will receive a 1099 form from the IRS. This rule applies to cash rewards, gift cards, and merchandise. However, rebates and discounts on purchases usually don’t count as taxable income because they represent price reductions rather than income.

For instance, if a customer earns $700 worth of gift cards through a loyalty program in a year, that amount is taxable. In contrast, a $50 rebate on a $500 purchase isn’t taxable.

Reporting Requirements for Businesses

Businesses must report taxable rewards to both the recipient and the IRS using Form 1099-MISC for amounts of $600 or more. This requirement involves collecting taxpayer identification numbers from program participants, which can present challenges.

To simplify this process, businesses should:

- Communicate tax implications clearly in program terms and conditions

- Set up systems to track reward values throughout the year

- Send reminders to participants as they approach the $600 threshold

International Tax Considerations

Global reward programs face additional tax complexities. Different countries set varying thresholds for taxable rewards and have distinct reporting requirements. In the UK, for example, non-cash rewards typically incur income and national insurance contributions.

To address these international challenges, businesses should:

- Seek advice from tax professionals in each country where the program operates

- Use local partners for reward fulfillment to simplify tax compliance

- Create region-specific terms and conditions that address local tax laws

Employee Reward Programs and Taxes

Employee rewards follow different tax rules. They typically count as taxable compensation and must appear on W-2 forms. However, certain non-cash awards (such as safety achievement awards) may qualify for tax exemption up to specific dollar amounts.

To optimize employee reward programs, companies can:

- Use the de minimis fringe benefit rule for small, infrequent rewards

- Implement qualified employee achievement awards for recognition programs

- Explain the tax implications of rewards clearly to employees

Tax Management Strategies

Effective tax management in reward programs requires careful planning and execution. Businesses should implement robust tracking and reporting systems to maintain compliance and participant satisfaction. Regular consultations with tax professionals can help companies stay updated on changing regulations and optimize their reward strategies.

(It’s worth noting that while tax considerations may seem daunting, they shouldn’t deter businesses from implementing reward programs. The benefits of increased customer loyalty and employee motivation often outweigh the administrative challenges.)

Final Thoughts

Regulatory compliance shapes the future of reward programs. Businesses must adapt to stricter data privacy guidelines and increased transparency requirements. We expect new regulations to address digital currencies and blockchain technology in loyalty initiatives.

Success in this dynamic landscape requires vigilance and adaptability. Companies should review their compliance strategies regularly and adjust their programs as needed. This approach transforms regulatory challenges into opportunities for innovation and trust-building with customers.

Reward the World offers solutions to help businesses navigate these complexities. Our platform provides GDPR-compliant tools and analytics for effective reward programs. We support companies in creating compliant initiatives that drive growth and foster lasting customer relationships.