Loyalty programs generate massive amounts of customer data, creating complex questions around data ownership and ethical usage. Companies face mounting pressure to balance profitable data strategies with growing privacy concerns.

We at Reward the World see businesses struggling to navigate these challenges while maintaining customer trust. The stakes have never been higher for getting data ethics right.

What Data Do Loyalty Programs Actually Collect?

Personal Information Categories

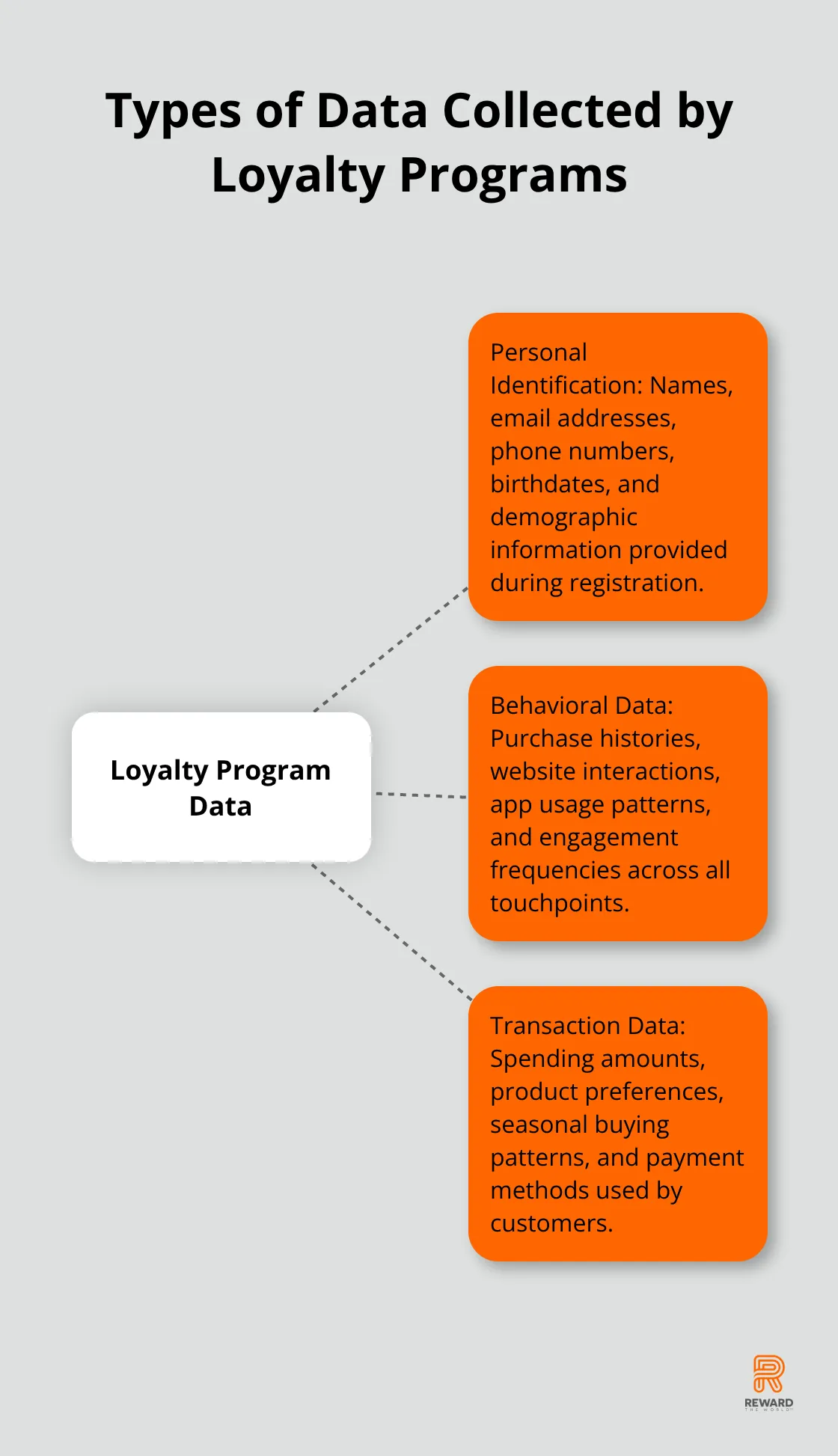

Loyalty programs collect three primary data categories that create detailed customer portraits. Personal identification data includes names, email addresses, phone numbers, birthdates, and demographic information that customers provide during registration. Behavioral data tracks purchase histories, website interactions, app usage patterns, and engagement frequencies across all touchpoints. Transaction data captures spending amounts, product preferences, seasonal buying patterns, and payment methods customers use.

Customer Willingness to Share Data

Research shows that customers increasingly expect personalized experiences when they share their information with companies. This reveals how customers view data sharing as a fair exchange when companies deliver tangible value. The key lies in making this value proposition clear and immediate rather than abstract or delayed.

Data Collection Methods and Storage

Companies collect this data through multiple channels including point-of-sale systems, mobile apps, website cookies, email interactions, and social media integrations. Modern loyalty platforms store data in cloud-based systems with encryption protocols and access controls that protect customer information from unauthorized access.

Legal Requirements and Compliance

GDPR mandates explicit consent for European customers, while CCPA requires California businesses to disclose data collection practices and provide opt-out mechanisms. Non-compliance with GDPR can trigger fines reaching tens or hundreds of millions of euros. The Federal Trade Commission has imposed settlement orders on major hospitality chains, which highlights how loyalty programs face intense scrutiny in enforcement actions.

Smart companies limit collection to program-essential data only, avoiding unnecessary information that increases breach risks and regulatory exposure. This approach not only reduces legal liability but also builds customer trust through responsible data practices that respect privacy boundaries.

Where Customer Rights Meet Business Reality

Consent Requirements Have Real Teeth

Customer consent has become a battleground where vague checkboxes and buried terms of service no longer pass legal scrutiny. Companies that rely on pre-checked consent boxes or confusing opt-in language face regulatory action, as the FTC demonstrated with its recent enforcement actions against major hospitality chains. Explicit consent requires customers to actively choose data sharing with clear understanding of what data gets collected, how companies use it, and who receives access. Smart businesses implement granular consent mechanisms that allow customers to choose specific data categories rather than all-or-nothing approaches. This strategy reduces legal exposure while building trust through transparency.

Security Failures Cost More Than Money

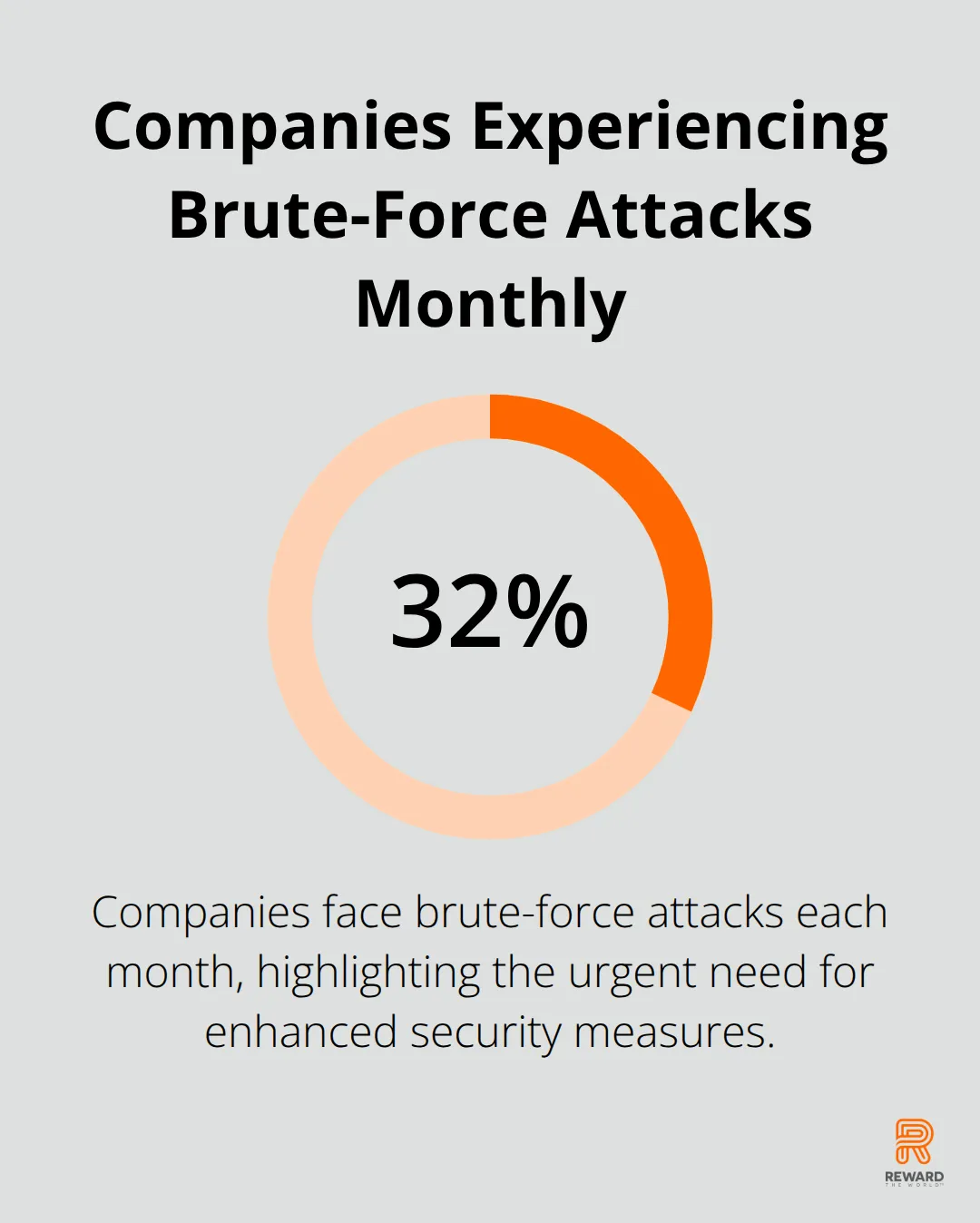

Account compromise attacks target companies regularly, with 32.5 percent of companies experiencing brute-force attacks in a single month, yet many loyalty programs still rely on basic password protection for customer accounts.

Strong encryption protocols must protect all customer data both in transit and at rest, while role-based access controls limit employee data access to job-essential functions only. Regular security audits identify vulnerabilities before criminals exploit them, and incident response plans minimize damage when breaches occur. Companies that experience data breaches face significant costs according to IBM Security, but loyalty program breaches often trigger additional regulatory fines and customer churn that multiply these costs exponentially.

Clear Communication Beats Legal Jargon

Privacy policies written in legal jargon alienate customers and create compliance risks when actual practices differ from documented procedures. Effective transparency means companies explain data practices in plain language, provide real-time visibility into data usage, and offer customers meaningful control over their information. Companies should implement preference centers where customers can modify data sharing settings, view collected information, and delete accounts entirely. This approach transforms regulatory compliance from a cost center into a competitive advantage that builds customer loyalty through trust.

These privacy foundations create the framework for ethical data management, but companies need specific strategies to turn compliance into competitive advantage.

How Do You Turn Data Compliance Into Competitive Advantage

Data Governance That Actually Works

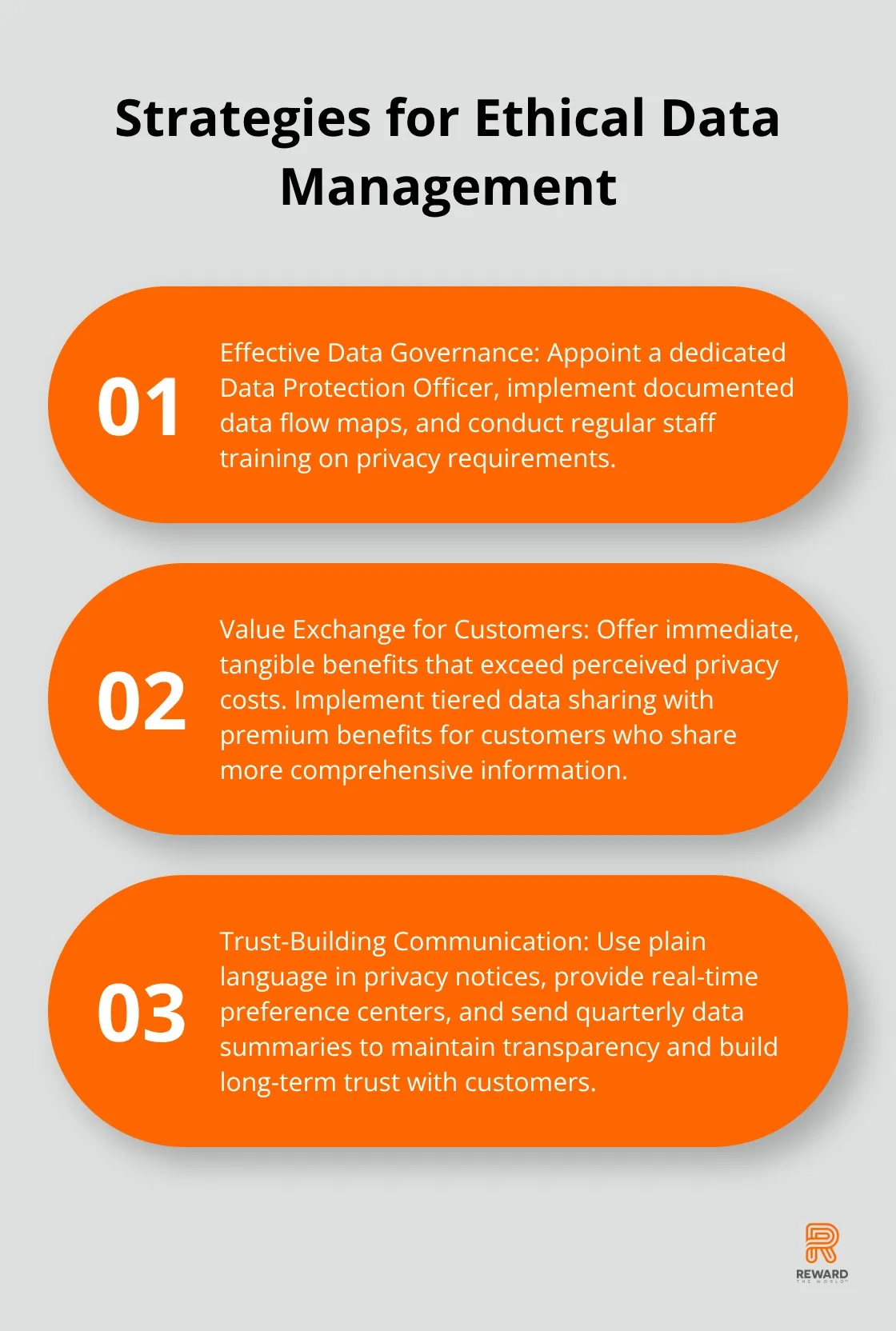

Effective data governance starts with appointing a dedicated Data Protection Officer who reports directly to executive leadership, not buried in IT departments where privacy becomes an afterthought. Companies need documented data flow maps that track every piece of customer information from collection through deletion, with clear retention schedules that automatically purge data when business purposes expire. Staff training programs must occur quarterly, not annually, because data handling mistakes happen when employees lack current knowledge about privacy requirements. Role-based access controls should limit data exposure to job-essential functions only, with audit logs that track every access attempt and modification.

Value Exchange That Customers Actually Want

Customers share data when they receive immediate, tangible benefits that exceed the perceived privacy cost. Shop Premium Outlets rewards users for taking style quizzes to gather preferences, which results in personalized shopping experiences that drive sales. Life Nutrition uses vitamin quizzes to identify health insights and suggest tailored product recommendations based on shared information. Black Box Wines incentivizes customers to upload purchase receipts to collect detailed transaction data, which enhances their customer database while providing exclusive offers. These examples demonstrate how interactive data collection creates engaging experiences rather than invasive surveillance. Smart companies implement tiered data sharing where customers choose their engagement level, with premium benefits reserved for customers who share more comprehensive information.

Communication That Builds Long-Term Trust

Privacy notices written in plain language outperform legal jargon in customer comprehension and compliance rates. Real-time preference centers allow customers to modify data sharing settings instantly rather than submit requests that take weeks to process. Proactive communication about data usage changes prevents customer surprise and regulatory scrutiny that damages brand reputation. Companies should send quarterly data summaries that show customers exactly what information was collected and how it generated personalized benefits for their accounts to maintain transparency and build trust. Modern platforms like Reward the World emphasize GDPR compliance and combine engagement tools with privacy protections to enhance customer loyalty strategies across their 250 million-user base.

Final Thoughts

The loyalty program landscape has reached a turning point where data ownership questions directly impact business sustainability. Companies that treat customer data as their property face regulatory backlash and customer exodus, while those that respect data ownership rights build lasting competitive advantages. These practices transform compliance costs into customer loyalty investments.

The future belongs to companies that view privacy as a feature, not a burden. Advanced anonymization techniques and AI-driven insights will enable personalization without compromising individual privacy (while maintaining customer trust through transparent practices). Businesses that master this balance will capture market share from competitors still treating data ethics as an afterthought.

We at Reward the World demonstrate how ethical data practices scale across global markets. Our platform serves millions of users while maintaining compliance standards and delivering instant rewards across numerous options. Companies that embrace responsible data stewardship today will dominate tomorrow’s privacy-conscious marketplace.