Big data has revolutionized how businesses operate, and loyalty programs are no exception. At Reward the World, we’ve seen first-hand how harnessing the power of data can transform customer engagement and program effectiveness.

Loyalty analytics offers unprecedented insights into customer behaviour, preferences, and trends. This blog post explores how leveraging big data can optimize your loyalty program, boost customer retention, and drive business growth.

What Is Big Data in Loyalty Programs?

The Game-Changing Power of Customer Data

Big data in loyalty programs transforms customer engagement strategies. It encompasses vast amounts of customer information collected through multiple touchpoints, analyzed to extract valuable insights. This data includes transactional information, demographic details, browsing behaviour, social media interactions, and even location data. Together, these elements create a comprehensive picture of each customer.

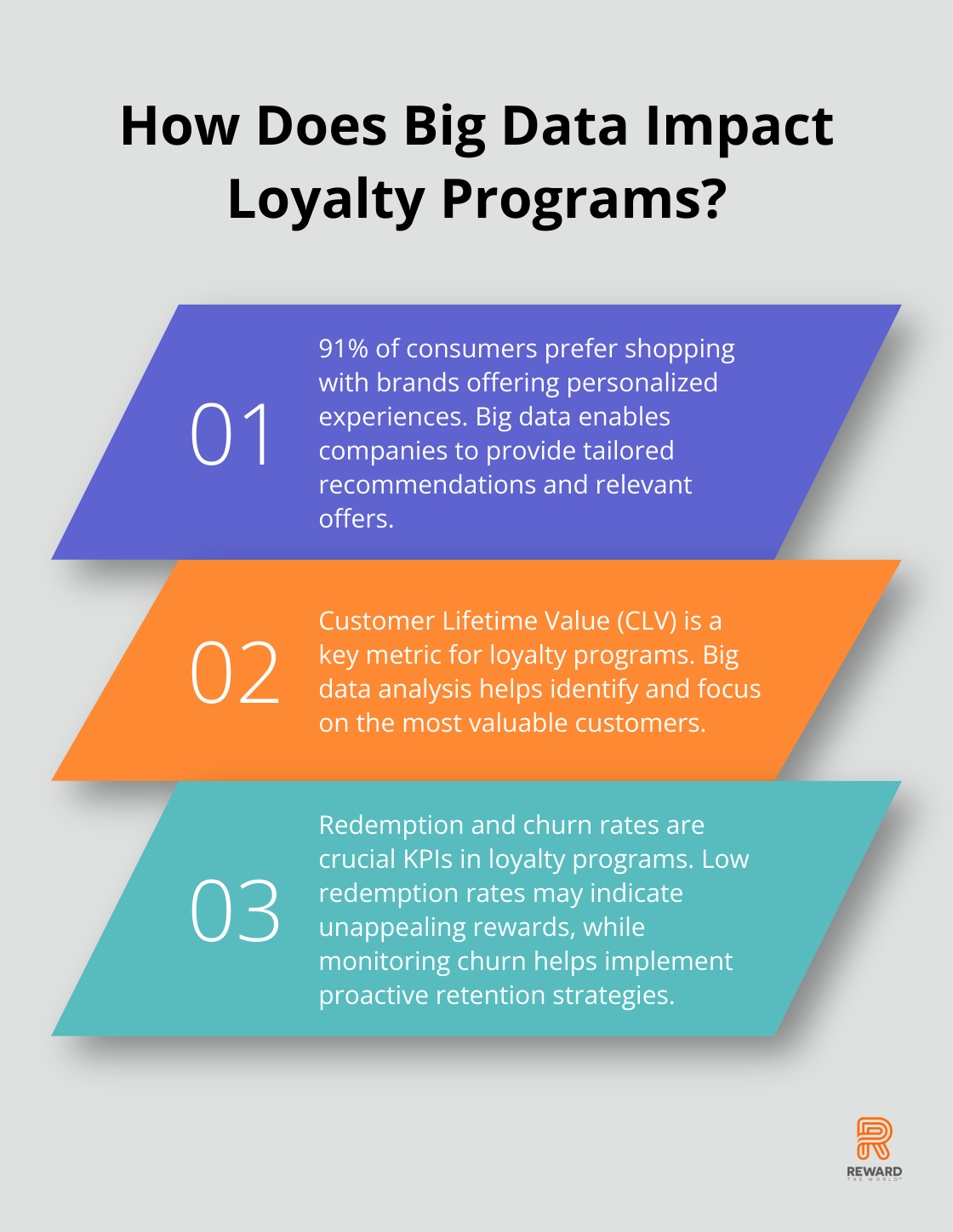

A study by Accenture highlights the importance of leveraging this data: 91% of consumers prefer to shop with brands that recognize them and provide relevant offers and recommendations. This statistic underscores the critical role of big data in creating personalized experiences that resonate with customers.

Key Metrics for Measuring Loyalty Success

To maximize the potential of big data, businesses must focus on the right metrics. Here are some essential Key Performance Indicators (KPIs) to track:

- Customer Lifetime Value (CLV): This metric identifies the most valuable customers. Loyalty programs are known to have a positive effect on improving CLV as they increase and enrich the interaction between a brand and its customers.

- Redemption Rate: This indicates customer engagement with rewards. A low rate might suggest unappealing or difficult-to-redeem rewards.

- Churn Rate: Identifying at-risk customers allows for proactive retention strategies.

Actionable Insights from Advanced Analytics

The true value of big data lies in its application. Advanced analytics tools uncover patterns and trends that inform strategic decisions. Predictive analytics, for instance, forecasts future customer behaviour, enabling businesses to tailor their offerings proactively.

The Role of Technology in Data Management

Managing and analyzing big data requires robust technological infrastructure. Cloud-based solutions (like those offered by Reward the World) provide scalable storage and processing capabilities, essential for handling large volumes of data efficiently.

Artificial Intelligence (AI) and Machine Learning (ML) algorithms play a crucial role in extracting meaningful insights from raw data. These technologies can identify complex patterns and make predictions that human analysts might miss.

Data Privacy and Ethical Considerations

As businesses collect and analyze more customer data, privacy concerns become increasingly important. Implementing strong data protection measures (such as those employed by Reward the World) and being transparent about data usage builds trust with customers.

Adhering to regulations like GDPR ensures compliance and demonstrates a commitment to protecting customer information. This approach not only safeguards against legal issues but also enhances brand reputation.

The next section will explore how businesses can leverage this wealth of data to create personalized experiences that drive loyalty and boost bottom lines.

How Big Data Personalizes Loyalty Programs

Segmentation: The Foundation of Personalization

Personalization forms the cornerstone of successful loyalty programs, with big data as the key to unlock its full potential. Effective personalization starts with smart segmentation. Analysis of purchase history, browsing behavior, and demographic data creates detailed customer profiles. When you segment your loyalty program members, you deliver personalized experiences that resonate with each group, driving higher engagement and retention rates.

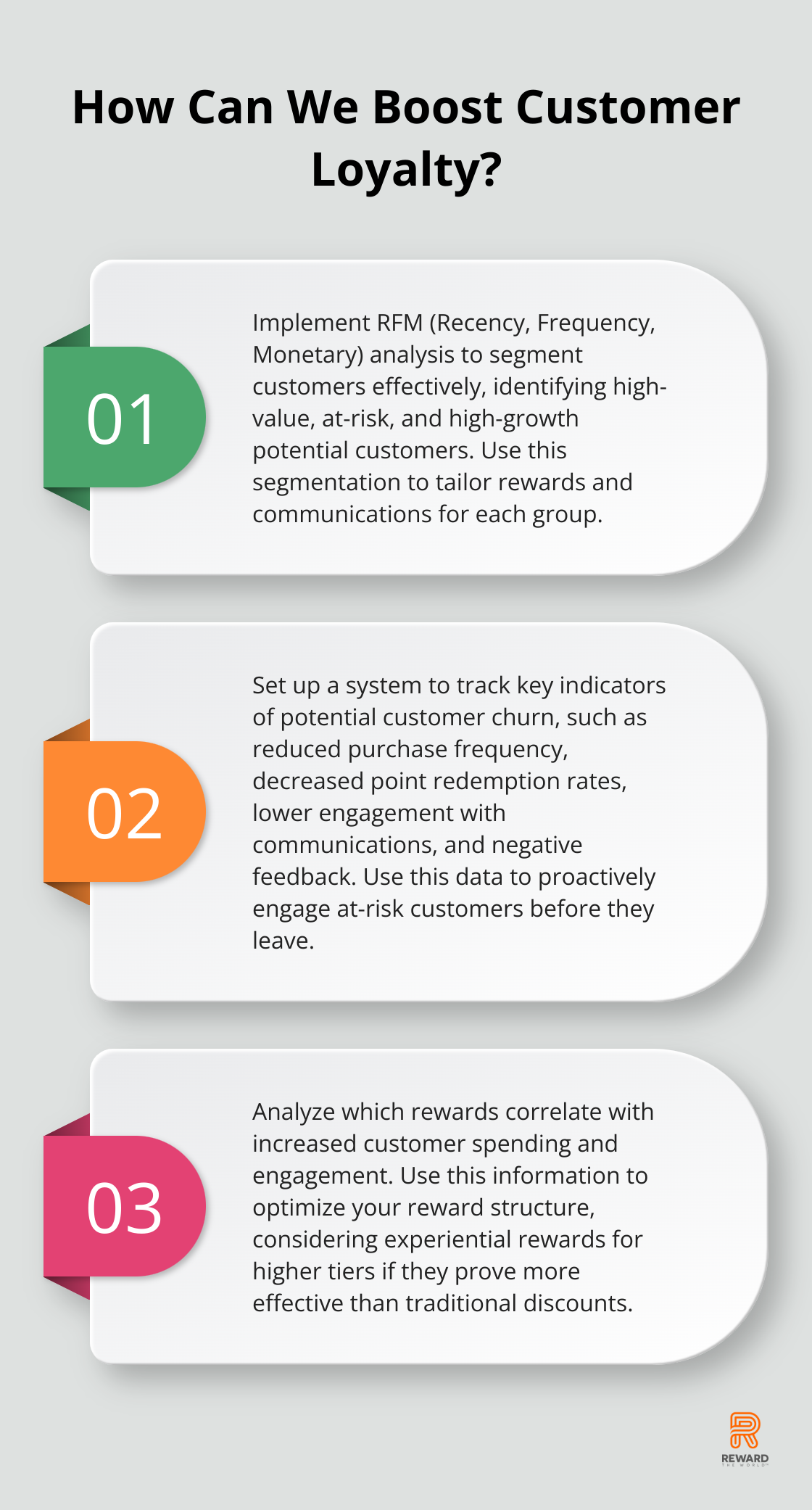

RFM (Recency, Frequency, Monetary) analysis provides an effective approach. This method segments customers based on their last purchase date, purchase frequency, and spending amount. The combination of these factors identifies high-value customers, at-risk customers, and those with high growth potential.

Tailoring Rewards to Individual Preferences

Customization of rewards follows customer segmentation. A one-size-fits-all approach no longer suffices in today’s competitive landscape. 40% of consumers say they’re likely to spend more when encountering highly personalized experiences.

Offering a choice of rewards increases program effectiveness. Some customers prefer cashback, while others value exclusive experiences. For instance, a frequent traveler might appreciate airline miles, while a parent might prefer discounts on children’s products. Customer choice in rewards increases the perceived value and engagement with the loyalty program.

Personalized Communication Strategies

Communication completes the personalization puzzle. Tailored messages delivered at the right time significantly boost engagement.

Data determines the best time and channel for each customer. Some prefer email updates, while others respond better to push notifications or SMS. The content of messages should reflect individual preferences and behaviors. For example, if a customer frequently purchases eco-friendly products, highlighting sustainable offerings in their communications proves effective.

Personalization extends beyond using a customer’s name. It creates a cohesive experience across all touchpoints. This approach enhances customer satisfaction, drives loyalty, and increases the overall lifetime value of each customer.

The Role of Advanced Analytics

Advanced analytics tools (such as those offered by Reward the World) uncover patterns and trends that inform strategic decisions. Predictive analytics forecasts future customer behavior, enabling businesses to tailor their offerings proactively. For example, predictive analytics might reveal that customers who buy eco-friendly products are also likely to be interested in organic food, enabling a grocery store to make targeted recommendations.

Data Privacy and Ethical Considerations

As businesses collect and analyze more customer data, privacy concerns become increasingly important. Implementing strong data protection measures and maintaining transparency about data usage builds trust with customers. Adherence to regulations like GDPR ensures compliance and demonstrates a commitment to protecting customer information.

The next section will explore how predictive analytics further enhances loyalty program optimization, allowing businesses to stay ahead of customer needs and market trends.

How Predictive Analytics Supercharges Your Loyalty Program

Forecasting Future Customer Behavior

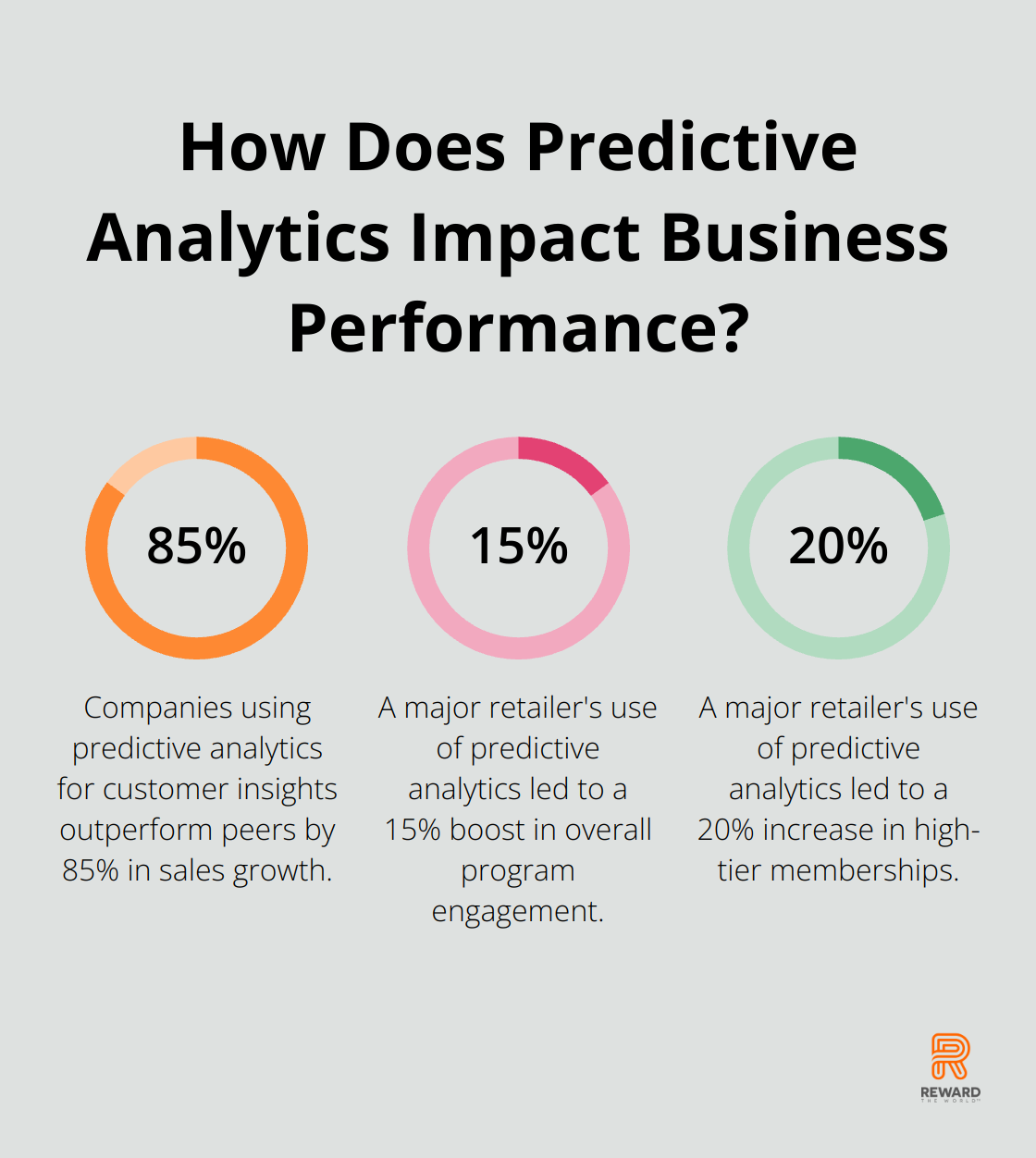

Predictive analytics transforms loyalty programs by offering businesses unprecedented insights into customer behavior and preferences. This powerful tool uses historical data to anticipate future customer actions, allowing businesses to proactively tailor their offerings and communications. A study by McKinsey found that companies using predictive analytics for customer insights outperform peers by 85% in sales growth and more than 25% in gross margin.

One practical application predicts when a customer will make their next purchase. Analysis of past buying patterns enables businesses to time promotional offers to coincide with a customer’s predicted buying cycle, significantly increasing the likelihood of a sale.

Preventing Customer Churn

Identification of at-risk customers before they leave is essential for maintaining a healthy loyalty program. Predictive models flag warning signs such as decreased engagement or changes in purchasing patterns.

A study focused on factors influencing churn in the prepaid segment and proposed a conceptual predictive model using neural networks to mitigate customer churn in the telecommunications sector.

To implement a similar strategy, focus on key indicators like:

- Reduced frequency of purchases

- Decreased point redemption rates

- Lower engagement with communications

- Negative feedback or customer service interactions

Optimizing Reward Structures

Predictive analytics plays a key role in fine-tuning reward offerings. Analysis of which rewards drive the most engagement and purchases allows businesses to optimize their loyalty program structure for maximum impact.

A major retailer used predictive analytics to revamp its reward tiers. They found that customers increased spending more when offered experiential rewards at higher tiers (rather than just increased discount percentages). This insight led to a 20% increase in high-tier memberships and a 15% boost in overall program engagement.

To optimize your reward structure:

- Analyze which rewards correlate with increased customer spending

- Identify the reward types that drive the most frequent engagement

- Determine the optimal point thresholds for different reward tiers

Personalizing the Customer Journey

Predictive analytics enables hyper-personalization of the entire customer journey. Anticipation of individual preferences and needs allows businesses to create tailored experiences that significantly boost engagement and loyalty.

Retailers can optimize their mobile shopping apps by adopting artificial intelligence to improve customer experience and boost sales.

To implement this approach:

- Collect comprehensive data on customer interactions across all touchpoints

- Use machine learning algorithms to identify patterns and preferences

- Develop a system for real-time personalization of offers and communications

Implementation of predictive analytics in your loyalty program isn’t just about having the right tools; it’s about asking the right questions and acting on the insights. Start by identifying your key business objectives, whether it’s increasing customer retention, boosting average order value, or improving customer loyalty. Then, align your predictive models to these goals.

The power of predictive analytics lies in its ability to turn data into actionable insights. It’s not enough to predict customer behavior; you must act on these predictions swiftly and effectively. This might mean restructuring your rewards, redesigning your communication strategy, or even overhauling your entire loyalty program approach.

As you start this data-driven journey, consider partnering with experts who can guide you through the process. Platforms like Reward the World offer robust analytics capabilities coupled with industry expertise, ensuring you’re not just collecting data, but leveraging it to create tangible business value.

Wrapping Up

Big data has transformed loyalty programs into powerful engines of customer engagement and business growth. Advanced analytics enable businesses to understand customers deeply, anticipate their needs, and create personalized experiences that drive long-term loyalty. The future of loyalty programs will involve real-time personalization, with offers and communications adapting instantly based on customer behavior.

Successful loyalty programs will prioritize transparency and data protection as privacy concerns grow. Customers will expect clear value exchanges for their data, making it essential for businesses to demonstrate tangible benefits of participation. The integration of loyalty programs with other business systems will become seamless, creating a holistic view of the customer across all touchpoints.

Businesses should assess their current data collection and analysis capabilities to harness the power of big data in their loyalty programs. Reward the World can help implement data-driven loyalty strategies that drive real results. Loyalty analytics will turn data into actionable insights that improve customer experiences and drive business growth.