Mobile wallets are revolutionizing how we pay and interact with businesses. These digital payment solutions offer convenience, security, and speed for consumers and merchants alike.

At Reward the World, we’ve seen a surge in companies looking to integrate their loyalty programs with mobile wallet technology. This powerful combination creates a seamless experience for customers while providing businesses with valuable data and engagement opportunities.

Mobile Wallets Reshape Consumer Spending

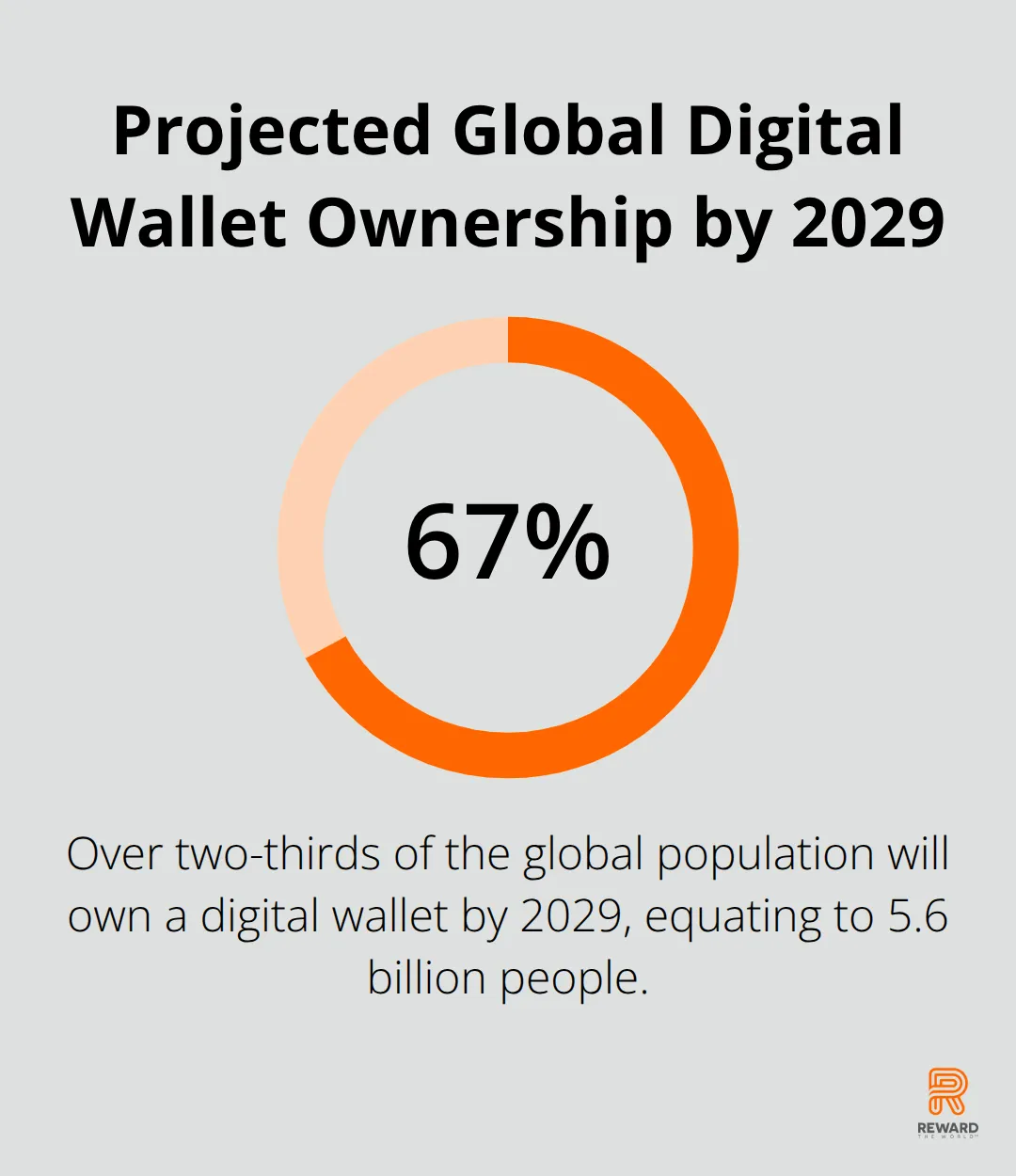

Mobile wallets are transforming consumer transactions, placing themselves at the forefront of a financial revolution. A recent Juniper Research study projects more than two-thirds of the global population will own a digital wallet by 2029, which translates to 5.6 billion people. This rapid growth redefines how consumers interact with businesses and manage their finances.

Convenience Drives Adoption

Mobile wallets offer unmatched convenience, enabling purchases with a simple tap or scan of a smartphone. This frictionless payment process increases transaction frequency. eMarketer data reveals mobile wallet users complete 23% more transactions per month compared to traditional payment methods.

Enhanced Security Measures

Security concerns have historically hindered digital payment adoption. However, mobile wallets address this issue with advanced encryption and biometric authentication. A Visa report found mobile wallets provide higher safety and security for merchants in handling payments compared to cash storage and card transactions, boosting trust and usage.

Business Benefits Beyond Transactions

Businesses gain advantages beyond streamlined payments. Mobile wallets provide rich customer data, enabling personalized marketing and improved inventory management. The Deloitte Center for Financial Services predicts that in-app payments on social media sites could grow at a compound annual growth rate (CAGR) of about 30%.

Popular Platforms Lead the Charge

Apple Pay, Google Pay, and Samsung Pay (each with hundreds of millions of users worldwide) spearhead the mobile wallet movement. These platforms have evolved beyond mere payment methods into comprehensive financial ecosystems, incorporating loyalty programs, peer-to-peer transfers, and budgeting tools.

The Integration Imperative

As mobile wallets gain traction, businesses must adapt or risk obsolescence. The integration of loyalty programs with these digital payment solutions has become a necessity for competitiveness in today’s fast-paced digital economy. This synergy creates a powerful tool for fostering customer loyalty and driving repeat business.

The next chapter will explore how loyalty programs and mobile wallets work together to create a seamless and rewarding experience for both consumers and businesses.

How Loyalty Programs and Mobile Wallets Create Powerful Synergies

The integration of loyalty programs with mobile wallets forms a potent combination that benefits both businesses and consumers. This synergy boosts customer engagement and drives sales in remarkable ways.

Frictionless Rewards Experience

Mobile wallet integration eliminates physical loyalty cards, making point earning and redemption effortless for customers. A 2023 Nielsen study showed that customers who understood how to use integrated loyalty-payment systems were 40% more likely to engage with the program. This seamless experience results in higher participation rates and increased customer satisfaction.

When a customer purchases using their mobile wallet, points automatically credit to their loyalty account. They can then view their balance and redeem rewards directly through the wallet interface. This smooth process encourages more frequent interactions with the loyalty program.

Hyper-Personalized Marketing

Rich data collected through mobile wallet transactions enables highly targeted marketing efforts. Businesses can send personalized offers based on a customer’s purchase history, location, and preferences. Personalized emails achieve an impressive open rate of 29% and an outstanding click-through rate of 41%.

Companies use this capability to great effect. For instance, a coffee shop might send a push notification with a discount on a customer’s favorite drink when they’re near the store. This level of personalization creates a more engaging and relevant experience for the customer.

Real-Time Analytics and Insights

The integration of loyalty programs with mobile wallets provides businesses with a wealth of real-time data. This information optimizes marketing strategies, improves inventory management, and enhances the overall customer experience.

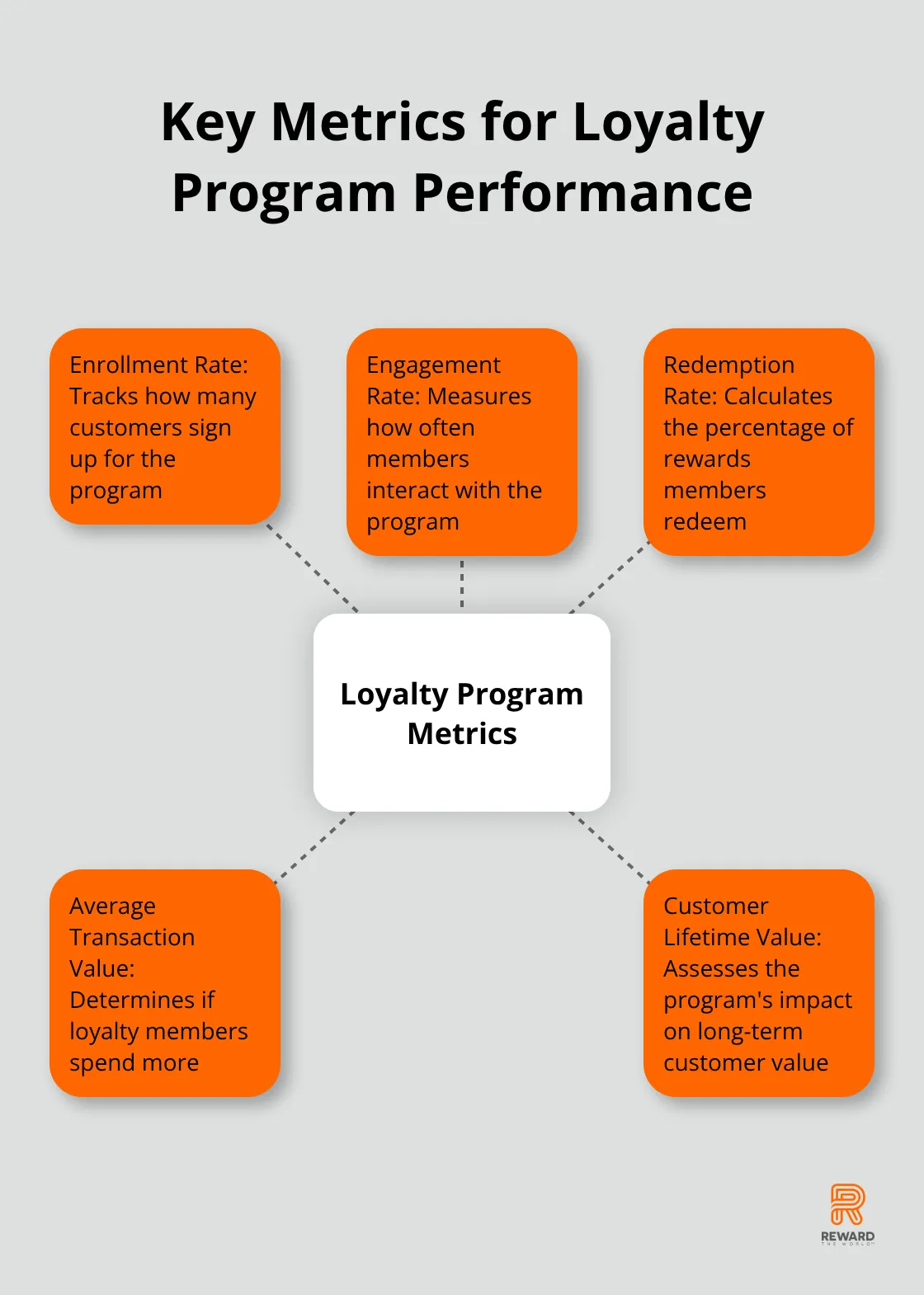

McKinsey’s annual State of the Consumer report looks at the data behind the biggest trends shaping global consumer behavior in 2025 and beyond. With mobile wallet integration, businesses can track metrics such as redemption rates, average transaction value, and customer lifetime value in real-time. These insights allow for quick adjustments to loyalty program strategies, ensuring they remain effective and relevant.

Enhanced Security and Trust

Mobile wallets offer advanced security features (such as encryption and biometric authentication) that protect both customer data and transactions. This increased security builds trust between businesses and consumers, encouraging more frequent use of the integrated loyalty program.

Streamlined Operations

The combination of loyalty programs and mobile wallets streamlines operations for businesses. It reduces the need for physical cards, paper receipts, and manual data entry. This efficiency not only cuts costs but also minimizes errors and improves the overall customer experience.

As we move forward, let’s explore how businesses can effectively implement these integrated solutions to maximize their benefits and stay ahead in the competitive digital landscape.

How to Successfully Implement Mobile Wallet Loyalty Programs

Integrating loyalty programs with mobile wallets transforms businesses. This integration boosts customer engagement and sales significantly. Here’s how to implement it effectively for your business.

Select the Right Mobile Wallet Partner

The choice of mobile wallet integration is paramount. Look for providers that offer smooth integration with major platforms (Apple Pay, Google Pay, and Samsung Pay). These platforms have the largest user bases and are most likely to be used by your customers.

Evaluate the technical capabilities of potential partners. Can they handle high transaction volumes? What about security measures? Ensure your chosen partner meets the highest security standards.

Consider scalability. As your loyalty program expands, you’ll need a solution that can grow with you. Some platforms can handle millions of transactions daily, making them suitable for businesses of all sizes.

Prepare Your Team and Educate Customers

Implementation of a new system is only half the battle. You must ensure your staff and customers know how to use it effectively. Start with comprehensive training for your employees. They should understand not only how the system works but also its benefits for customers.

For customer education, create clear, concise guides on how to use the integrated loyalty program. Use multiple channels to spread the word (email, social media, in-store signage, and your website). Consider creating short video tutorials for visual learners.

Invest time in this step – it pays off.

Measure and Optimize Performance

Once your integrated loyalty program is operational, track its performance. Key metrics to monitor include:

Use these metrics to refine your program continuously. If enrollment is low, you might need to improve your marketing efforts. If redemption rates are low, consider making rewards more attractive or easier to claim.

Optimization is an ongoing process. The mobile wallet landscape evolves constantly, and your loyalty program should evolve with it. Stay informed about new features and technologies that could enhance your program.

Research has shown that a higher reward frequency can increase customer satisfaction and retention. Regular rewards create a positive reinforcement loop.

Final Thoughts

The integration of loyalty programs with mobile wallets transforms customer engagement. This powerful combination streamlines transactions, enhances personalization, and provides valuable insights for companies. As mobile wallet usage continues to grow, businesses that embrace this technology will gain a competitive edge in customer retention and acquisition.

We expect to see more innovative features in mobile wallet loyalty integration. Artificial intelligence will predict customer behavior and tailor rewards. Augmented reality might create immersive experiences, while blockchain technology could revolutionize reward point management (making it more secure and transparent).

The future of customer engagement lies in seamless, personalized experiences. Reward the World offers a comprehensive solution that helps businesses leverage the power of mobile wallet integration. Don’t let your business fall behind – embrace the mobile wallet revolution and transform your loyalty program today.