Incentive programs can significantly boost employee motivation and business growth, but navigating the legal landscape is essential.

Understanding regulations, employment laws, and intellectual property rights is critical for compliance.

We at Reward the World will guide you through best practices and common pitfalls to help you design successful and legally sound incentive programs.

What Are Key Legal Considerations?

To create a successful incentive program, compliance with legal guidelines is paramount. Companies must be vigilant in understanding local and international regulations, employment laws, and intellectual property rights.

Navigating Local and International Regulations

When designing incentive programs, it’s crucial to be aware of the various regulations that apply in different jurisdictions. Different countries and regions have unique laws governing incentives. For instance, in the European Union, GDPR compliance is a significant consideration, impacting how personal data is collected and used for incentive programs. Violating GDPR can lead to fines of up to €20 million or 4% of annual global turnover, whichever is higher. Local regulations might also stipulate specific requirements for tax reporting and data privacy.

Compliance with Employment Laws

Employment laws are another crucial area for consideration. Offering an incentive to employees must align with labor laws to avoid potential legal repercussions. The Fair Labor Standards Act (FLSA) in the United States, for example, has stringent guidelines on overtime compensation, minimum wage, and recording working hours. Incentives that appear to be driving excessive overtime or undercutting minimum wage standards could be problematic. Similarly, in countries like India and Brazil, incentives must not violate local wage and hour laws.

Protecting Intellectual Property Rights

Intellectual property (IP) rights can directly impact incentive programs, especially when they involve creative or innovative rewards. Companies should ensure that any IP used in or resulting from the program is adequately protected. For example, if an incentive includes patented technology or copyrighted material, misuse or unauthorized distribution could lead to legal disputes. Moreover, if employees create work as part of the incentive program, ensuring that the company retains IP rights is vital.

Understanding these aspects can help avoid common pitfalls in designing incentive programs. Staying compliant with regulations and protecting IP are vital steps for the program’s success and organizational reputation.

How to Ensure Incentive Program Compliance

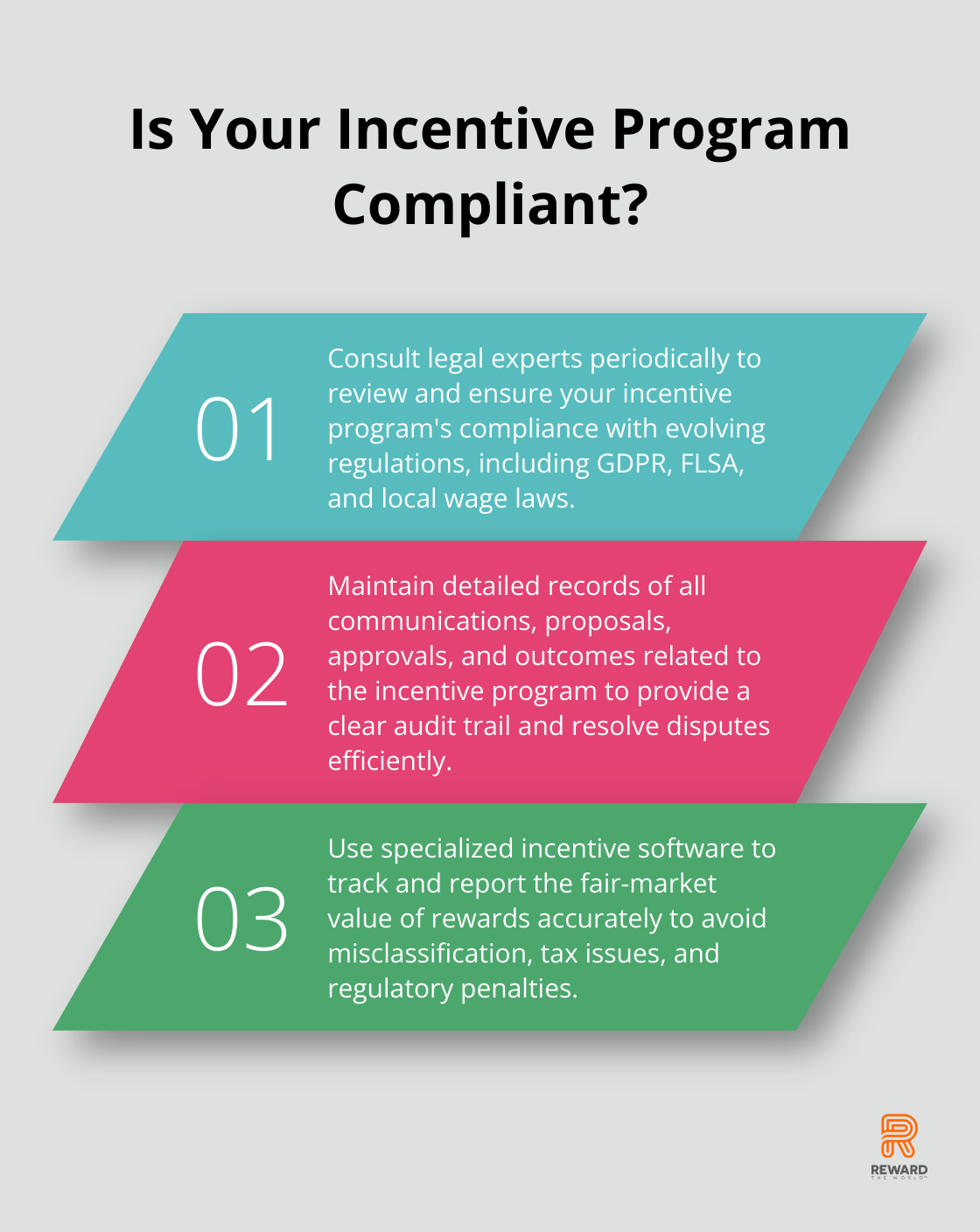

Transparent communication and diligent documentation are foundational for compliance in incentive programs. Start by clearly outlining the program’s rules, eligibility criteria, and rewards structure to all participants. Transparency reduces misunderstandings and ensures that everyone is aware of their roles and responsibilities.

Clear Documentation

Maintaining detailed records of all communications related to the incentive program is essential. Document every aspect, from initial proposals and approvals to execution and outcomes. Regularly update these records to reflect any changes or adjustments. This practice not only helps in resolving disputes but also ensures that you have a clear audit trail in case of regulatory scrutiny.

Aligning Incentives with Business Goals

Aligning incentives with business objectives is crucial for the program’s effectiveness. For example, if the company aims to boost sales in a specific quarter, the incentive structure should directly reward achieving those sales targets. Studies show that well-designed incentive programs can improve employee performance by 22 percent. Misaligned incentives, on the other hand, can result in wasted resources and unmet goals.

Regular Legal Reviews

Given the complexities of legal requirements, regular legal reviews are indispensable. Consult legal experts periodically to review the incentive program’s compliance with evolving regulations. This proactive approach mitigates the risk of non-compliance and ensures that your program remains up-to-date with legal standards. In the United States, for example, staying abreast of updates to the Fair Labor Standards Act (FLSA) can prevent inadvertent violations.

Stay Informed About Tax Implications

Knowing the tax implications is also critical. In the EU alone, failing to report taxable benefits correctly can result in substantial penalties and interest. Employee incentives are often taxable, and understanding the specific tax requirements of different types of rewards—be it cash, travel, or merchandise—can save your company from future legal troubles. Consider using specialized incentive software to assist in accurate tax reporting.

For further details on tax implications for incentive programs, you might find this guide on tax implications useful.

Staying compliant while designing and implementing incentive programs is non-negotiable. Adopting these best practices will help you build a compliant, effective, and legally sound incentive program.

Common Legal Pitfalls

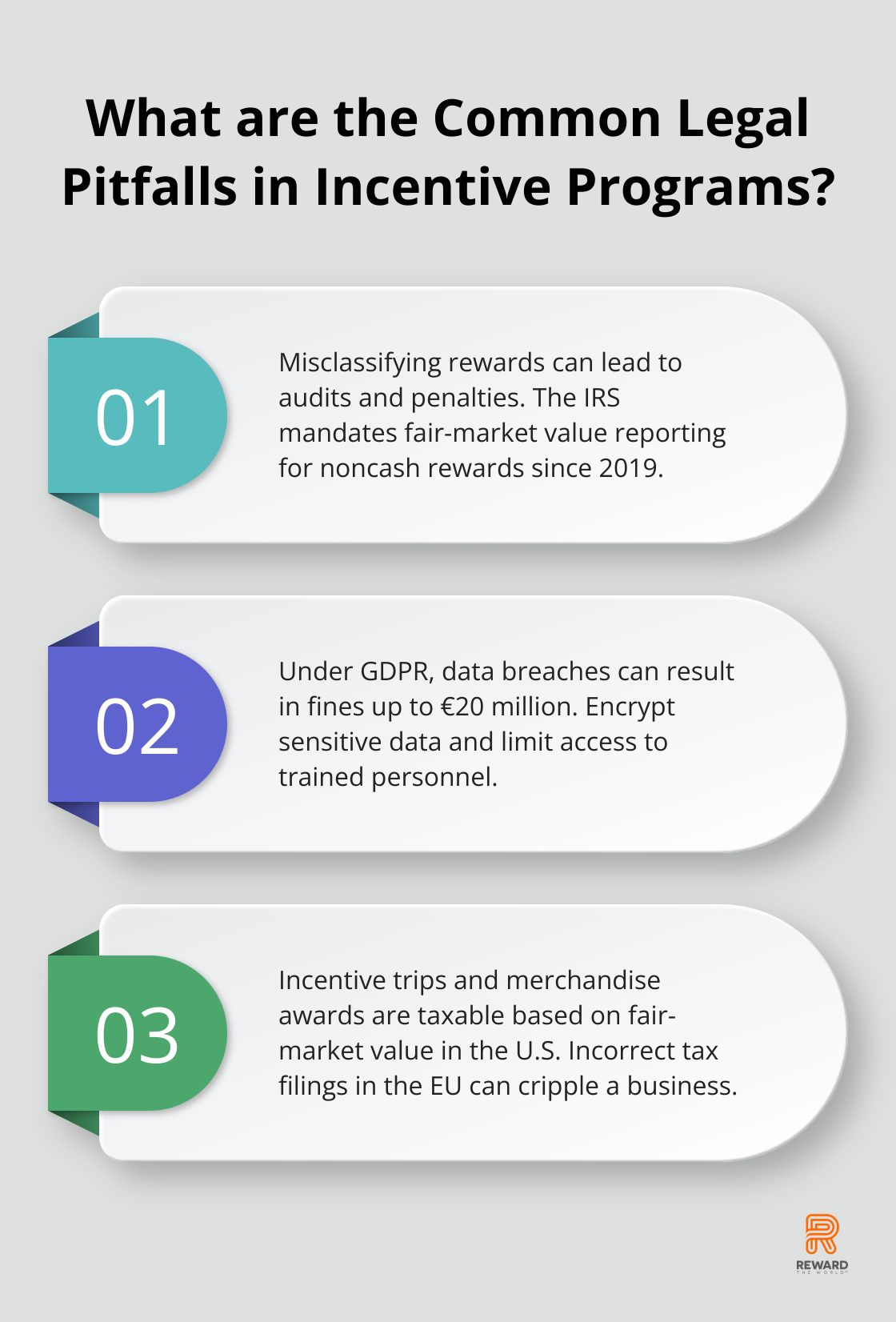

Misclassifying Rewards as Earnings

One common mistake is misclassifying rewards, which can lead to significant legal and financial issues. Any monetary or material incentive handed to employees could be deemed taxable income. In 2019, the IRS updated guidelines that mandate the fair-market value of noncash rewards must be reported as income. Misclassification can result in audits, back taxes, and penalties. Use specialized incentive software to track these effectively.

Failing to Protect Participant Data

Data protection isn’t just a compliance issue—it’s a trust issue. Under the GDPR, companies can face fines of up to €20 million for data breaches. Always encrypt sensitive information and limit access to essential personnel. Regular training on data protection laws and using secured portals for data exchange can mitigate risks. Detailed data encryption practices can also help ensure compliance and maintain user trust.

Ignoring Tax Implications

Rewards come with tax implications that vary widely by jurisdiction. For instance, in the U.S., incentive trips and merchandise awards are taxable based on their fair-market value. In the EU, penalties for incorrect tax filings can cripple a business. Regular consultations with tax advisors are essential. Also, consider implementing tax calculation tools that align with local laws. This can save you from legal troubles while keeping the program attractive to participants. For additional tips, refer to this guide on tax implications.

Conclusion

Incentive programs can drive remarkable outcomes, but they must be carefully designed with legal considerations in mind. Compliance with varied regulations, employment laws, and intellectual property rights is indispensable. Proper navigation of local and international regulations, especially GDPR in the EU, is critical to avoid hefty fines. Employment laws ensure fair treatment and avoid potential disputes. Safeguarding intellectual property rights protects both company and participant contributions.

Best practices such as clear documentation, aligning incentives with business goals, conducting regular legal reviews, and understanding tax implications help maintain compliance. Transparent communication fosters a positive environment and keeps everyone informed of their roles and responsibilities.

Staying compliant is an ongoing commitment, not a one-time task. Implementing robust measures to protect participant data and avoid misclassifying rewards is fundamental. Regularly consulting legal experts and utilizing advanced software tools can mitigate risks and ensure that your incentive program is both effective and legally sound.

Consider integrating Reward the World into your incentive strategy. With its global reach, instant reward delivery, and comprehensive analytics, it offers a seamless solution for enhancing customer engagement and employee recognition while staying compliant with GDPR. Explore more about how Reward the World can elevate your incentive program at Reward the World.

For additional insights on legal compliance in incentive programs, you can read more about incentive programs compliance. Safeguarding your program against common legal pitfalls helps ensure its long-term success and alignment with evolving regulations.