Customer loyalty data is a goldmine of insights for businesses. At Reward the World, we’ve seen firsthand how analyzing this information can transform customer relationships and boost retention rates.

In this post, we’ll explore how to effectively collect and analyze customer loyalty datasets. We’ll also show you how to turn these findings into actionable strategies that drive growth and enhance customer satisfaction.

How to Collect Valuable Customer Loyalty Data

Identify Key Data Points

Start by pinpointing the most relevant data for your business. This typically includes purchase history, frequency of visits, average transaction value, and customer feedback. A 2023 Forrester Research study reveals that companies investing in improving their CX quality experience higher customer loyalty, retention, and devotion.

Leverage Multiple Collection Methods

Don’t rely on a single data collection method. Use a combination of approaches:

- Point-of-sale systems: Capture transaction data in real-time.

- Online surveys: Gather direct feedback on customer experiences.

- Social media monitoring: Track brand mentions and sentiment.

- Website analytics: Understand online behavior and preferences.

A McKinsey report highlights that companies using at least three data collection methods are 23% more likely to exceed their customer loyalty goals.

Ensure Data Quality and Accuracy

Data quality is paramount. Implement these strategies to maintain high standards:

- Regular data audits: Schedule monthly checks to identify and correct errors.

- Data validation rules: Set up automated systems to flag inconsistencies.

- Staff training: Educate your team on the importance of accurate data entry.

Companies implementing these practices often see a 15% improvement in data accuracy within the first three months.

Prioritize Data Privacy and Consent

With increasing privacy concerns, it’s crucial to be transparent about data collection. Always obtain explicit consent from customers and clearly communicate how their data will be used. This not only ensures compliance with regulations (like GDPR) but also builds trust. A recent Deloitte survey found that 81% of consumers are more likely to remain loyal to brands that are transparent about data usage.

Integrate Data Across Channels

Create a unified view of your customers by integrating data from various touchpoints. This includes in-store purchases, online interactions, and customer service encounters. A holistic approach allows for more accurate insights and personalized experiences. Try to use a customer data platform (CDP) to collect and unify customer data, linking it from many sources to build unified customer profiles.

As we move forward, let’s explore how to analyze these valuable datasets and extract meaningful insights that can drive your loyalty strategies to new heights.

How to Measure Customer Loyalty Effectively

Customer loyalty measurement forms the backbone of successful retention strategies. Let’s explore the most impactful metrics and analysis techniques to gauge and improve customer loyalty.

Net Promoter Score (NPS)

The Net Promoter Score stands as a powerful indicator of customer loyalty. It measures the likelihood of customers recommending your business to others. To calculate NPS, ask customers: “On a scale of 0-10, how likely are you to recommend our company to a friend or colleague?”

Categorize responses as:

- Promoters (9-10): Loyal enthusiasts

- Passives (7-8): Satisfied but unenthusiastic

- Detractors (0-6): Unhappy customers

Subtract the percentage of Detractors from the percentage of Promoters to get your NPS. A positive score indicates good performance, but try to achieve 50 or higher for excellent customer loyalty.

Customer Lifetime Value (CLV)

CLV predicts the total revenue a business can expect from a single customer account throughout their relationship. It’s a vital metric for understanding the long-term value of your loyalty efforts.

To calculate CLV, use this formula:

CLV = (Average Purchase Value × Average Purchase Frequency × Average Customer Lifespan)

For example, if a customer spends $100 per visit, visits 4 times a year, and remains a customer for 3 years:

CLV = $100 × 4 × 3 = $1,200

Increasing CLV should top the priority list for your loyalty program. A new report claims that, for the first time ever, marketing to existing customers is exceeding that to new ones.

Churn Rate Analysis

Churn rate measures the percentage of customers who stop doing business with you over a specific period. It’s a critical metric for understanding customer loyalty and retention.

Calculate churn rate using this formula:

Churn Rate = (Lost Customers ÷ Total Customers at the Start of Time Period) × 100

For instance, if you started the quarter with 1,000 customers and lost 50:

Churn Rate = (50 ÷ 1,000) × 100 = 5%

Industry benchmarks vary, but generally, a churn rate below 5% indicates good performance. However, always work to reduce your churn rate over time.

To predict churn, watch for warning signs such as:

- Decreased engagement with your product or service

- Reduced purchase frequency

- Increased support tickets or complaints

Predictive analytics tools can help identify at-risk customers before they churn, allowing you to intervene with targeted retention strategies.

Repeat Purchase Rate (RPR)

The Repeat Purchase Rate measures the percentage of customers who make more than one purchase. It’s a direct indicator of customer loyalty and satisfaction with your products or services.

Calculate RPR using this formula:

RPR = (Number of Customers Who Purchased More Than Once ÷ Total Number of Customers) × 100

For example, if you have 1,000 customers and 300 made repeat purchases:

RPR = (300 ÷ 1,000) × 100 = 30%

A higher RPR indicates stronger customer loyalty. Try to improve this metric by offering personalized recommendations, loyalty rewards, and excellent customer service.

These metrics work best when used in combination, providing a comprehensive view of customer loyalty. This multifaceted approach allows for data-driven decisions to improve retention and boost your bottom line. In the next section, we’ll explore how to turn these valuable insights into actionable strategies for enhancing customer loyalty.

How to Transform Loyalty Data into Actionable Strategies

Identify Significant Trends

Start your analysis by pinpointing patterns in your data. A study by Google and Bain & Company revealed that multi-channel shoppers have a 30% higher lifetime value compared to single-channel shoppers. This insight should prompt you to develop an omnichannel loyalty strategy.

Use cohort analysis to track changes in customer behavior over time. You might discover that customers acquired through referrals have a 37% higher retention rate after six months compared to those from paid ads. This finding could lead you to prioritize referral programs.

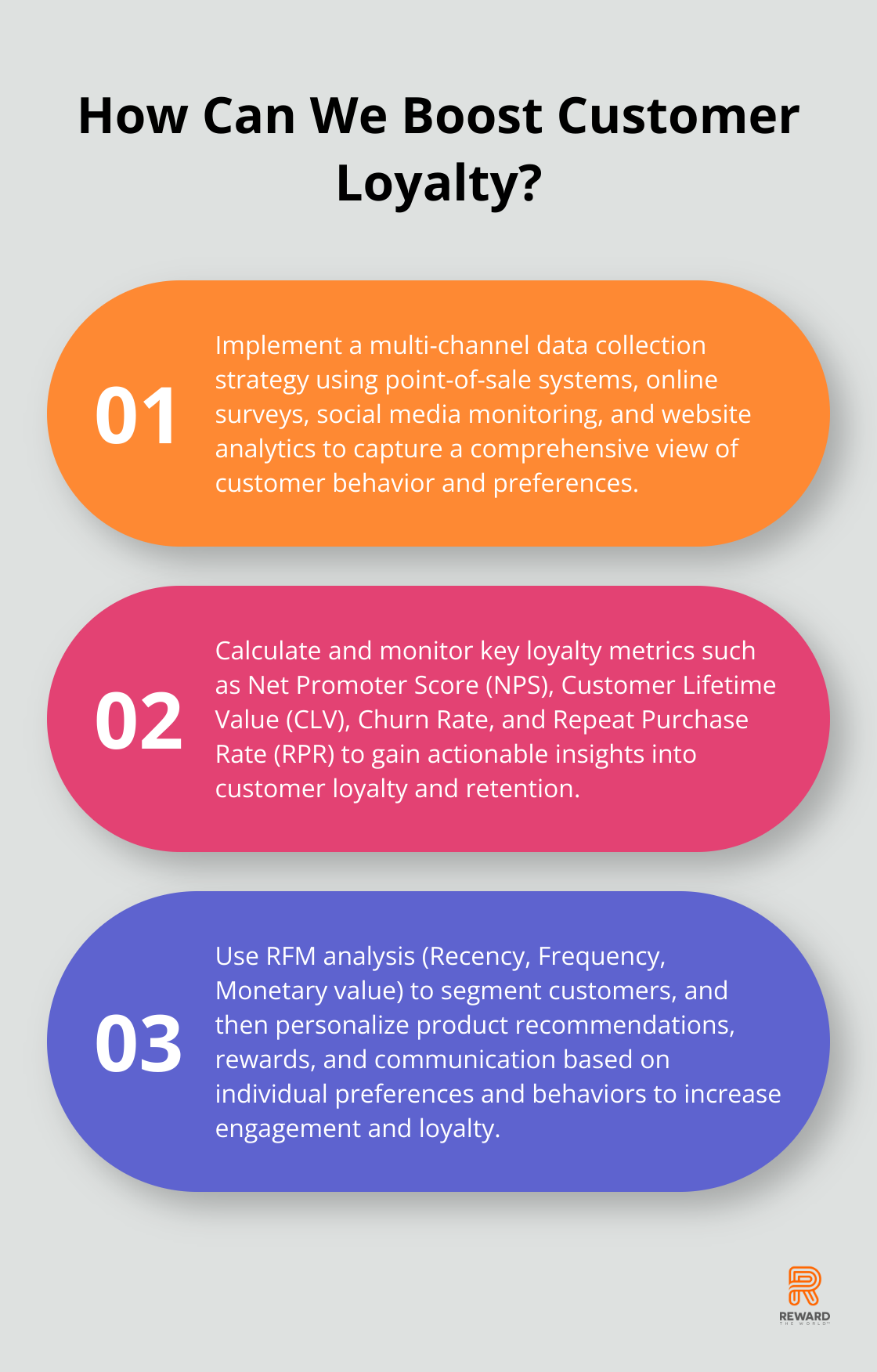

Implement Smart Segmentation

Effective segmentation is essential for targeted marketing. An Epsilon report found that 80% of consumers are more likely to purchase when brands offer personalized experiences. Here’s how to segment effectively:

- RFM Analysis: Group customers based on Recency, Frequency, and Monetary value of their purchases. This method helps identify your most valuable customers and those at risk of churning.

- Behavioral Segmentation: Analyze how customers interact with your brand. Segment based on preferred communication channels or product categories.

- Lifecycle Stage: Tailor your approach based on where customers are in their journey (from first-time buyers to loyal advocates).

Prioritize Personalization

Personalization is now essential for customer loyalty. According to Accenture, 91% of consumers are more likely to shop with brands that recognize, remember, and provide them with relevant offers and recommendations. Here’s how to leverage your data for personalization:

- Product Recommendations: Use purchase history and browsing behavior to suggest relevant products. Amazon attributes up to 35% of its revenue to its recommendation engine.

- Tailored Rewards: Offer incentives based on individual preferences. A frequent flyer might value extra miles more than a cash-back reward.

- Customized Communication: Adjust your messaging and channel based on customer preferences. A Campaign Monitor study found that emails with personalized subject lines are 26% more likely to be opened.

Leverage Predictive Analytics

Predictive analytics can help you anticipate customer needs and behaviors. Use machine learning algorithms to forecast future trends and identify potential churn risks. This proactive approach allows you to intervene with targeted retention strategies before customers leave.

Continuously Refine Your Strategy

The loyalty landscape is always evolving. Regularly review and update your loyalty program based on data insights. Try A/B testing different reward structures or communication strategies to optimize your program’s effectiveness. This iterative approach ensures your loyalty program remains relevant and engaging.

Final Thoughts

Customer loyalty datasets provide invaluable insights for businesses to enhance relationships and drive growth. Companies collect comprehensive data through multiple channels to understand customer behavior, preferences, and satisfaction levels. Key metrics such as Net Promoter Score, Customer Lifetime Value, and Churn Rate offer a multifaceted view of loyalty, enabling informed decision-making.

The true value of loyalty data lies in its application through trend identification, smart segmentation, and personalized experiences. Predictive analytics allows companies to anticipate customer needs and address potential issues proactively. Continuous monitoring and improvement ensure loyalty programs remain effective and engaging over time.

Reward the World offers powerful analytics tools and instant reward delivery options to help businesses transform their customer loyalty data. We support companies in creating lasting relationships with customers, which translates into long-term success. The key to success is an ongoing process of learning, adapting, and improving based on data-driven insights.