Loyalty programs are under attack. In 2025, fraudsters are using increasingly sophisticated methods to exploit these systems, costing businesses billions and eroding consumer trust.

At Reward the World, we’re committed to staying ahead of these threats. This post explores cutting-edge fraud prevention techniques that are revolutionizing loyalty program security.

The Alarming Rise of Loyalty Fraud in 2025

Unprecedented Growth and Vulnerability

The loyalty management market is projected to grow from $15.19 billion in 2024 to $41.21 billion by 2032, exhibiting a CAGR of 15.3%. This rapid expansion has turned loyalty programs into prime targets for fraudsters. In 2025, these programs face unprecedented threats, jeopardizing businesses and consumers alike.

Shocking Statistics

The numbers reveal a disturbing trend. Ecommerce fraud trends in 2025 show that 43% of online merchants reported being victims of a phishing attack, with friendly or chargeback attacks being the second most common type of fraud. More alarmingly, global losses from loyalty fraud are nearing $3 billion annually. These figures underscore the urgent need for robust security measures.

Prevalent Fraud Tactics

Account Takeover (ATO)

ATO remains the primary method of loyalty fraud. Criminals use credential stuffing, phishing, and brute-force attacks to access customer accounts illegally. Once inside, they drain points, make unauthorized purchases, or sell account information on the dark web.

Promo Abuse

Fraudsters create multiple fake accounts (often using stolen identities) to exploit promotional offers. This tactic not only causes financial losses but also distorts marketing data and undermines loyalty initiatives.

Far-Reaching Consequences

The impact of loyalty fraud extends beyond immediate financial losses. Data breaches expose customers’ personal and financial information, leading to hefty compliance fines. For instance, Marriott International faced a $52 million settlement in 2024 due to a massive data breach affecting over 344 million customers (FTC).

Fraudulent redemptions and fraud investigation costs significantly impact a company’s profitability. Moreover, the reputational damage from security breaches can erode customer trust and loyalty, potentially crippling a brand’s long-term success.

The Silent Threat

One of the most insidious aspects of loyalty fraud is its often-undetected nature. Unlike payment card fraud, loyalty fraud can remain hidden for weeks or months. Customers typically check their point balances less frequently than their financial accounts. By the time fraud is discovered, significant damage may have already occurred.

To combat this silent threat, companies should implement real-time notifications for account changes and suspicious activity. This proactive approach can significantly reduce the window of opportunity for fraudsters and empower customers to take swift action if their accounts are compromised.

As loyalty programs continue to evolve and expand, so do the techniques used by fraudsters. The next section will explore the cutting-edge technologies and strategies that businesses are employing to stay one step ahead in the ongoing battle against loyalty fraud.

How AI and Blockchain Transform Fraud Prevention

At Reward the World, we explore cutting-edge technologies to outpace fraudsters. AI, blockchain, and advanced authentication methods lead the charge in transforming loyalty program security in 2025.

AI-Powered Anomaly Detection

Artificial Intelligence (AI) and Machine Learning (ML) have become essential tools in fraud prevention. These technologies identify patterns and anomalies that human analysts might overlook. AI systems analyze millions of transactions in real-time, flagging suspicious activities with high accuracy.

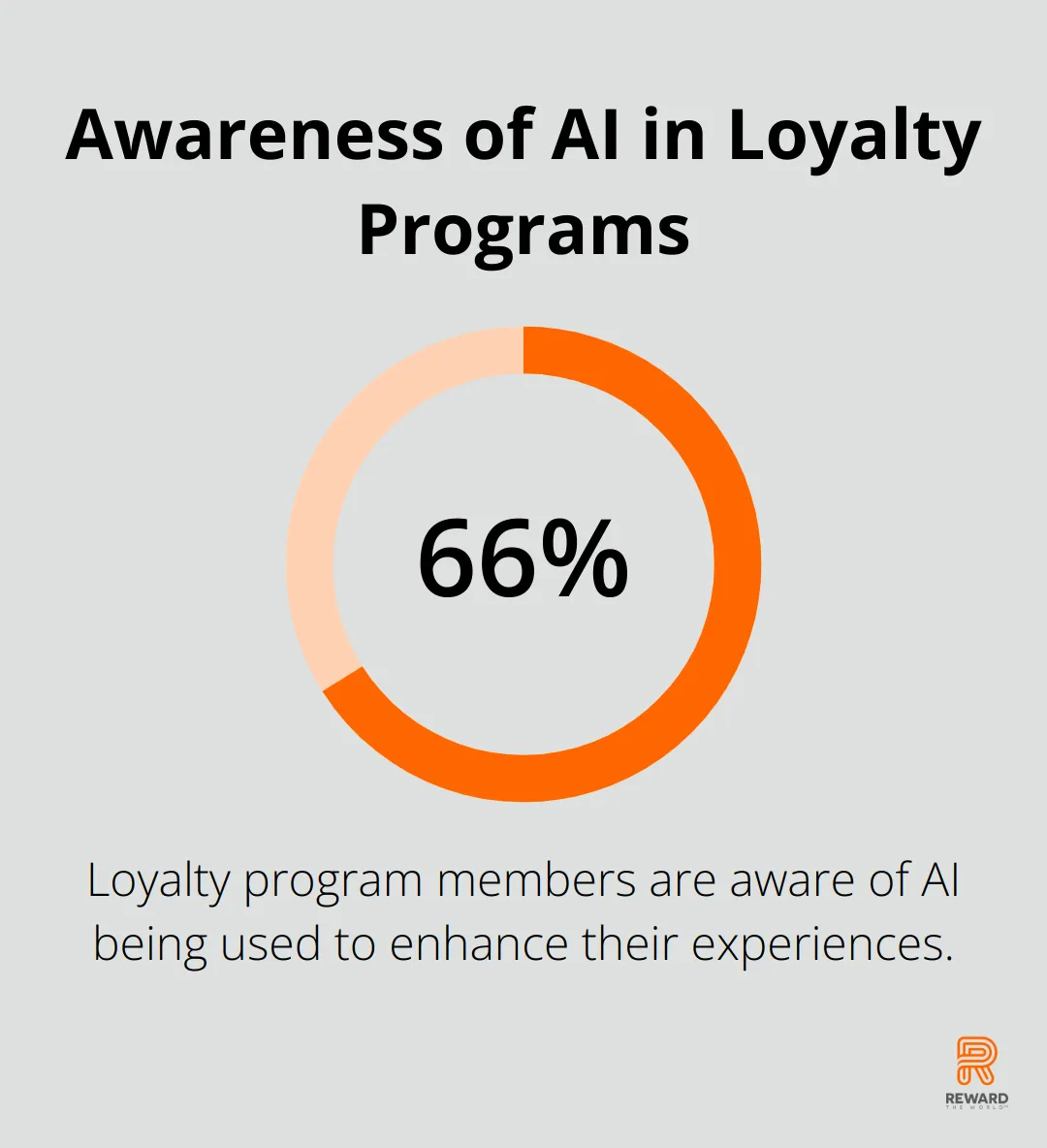

A recent study found that 66% of loyalty program members are aware of artificial intelligence (AI) being utilized to enhance their program experiences. This awareness indicates the growing importance of AI in loyalty programs.

One practical application detects unusual redemption patterns or account access from suspicious locations, allowing for immediate investigation.

Blockchain’s Unbreakable Chain

Blockchain technology revolutionizes loyalty program security due to its transparency and immutability. It creates an unalterable audit trail that fraudsters find extremely difficult to manipulate.

Players like Loyyal, a universal loyalty platform leveraging blockchain technology, are working to increase efficiency and improve engagement for commerce and beyond.

Businesses should start with a pilot program when implementing blockchain. They should focus on a specific aspect of their loyalty program, such as point issuance or redemption, and expand based on results.

Biometric Authentication: Beyond Passwords

Passwords become obsolete. Biometric authentication methods – including fingerprint scans, facial recognition, and voice analysis – now lead account security efforts.

Biometric verification has proven effective for merchants, despite challenges hindering widespread adoption. The future of identity verification technology continues to evolve.

We recommend a multi-factor authentication system that combines biometrics with other verification methods. This layered approach significantly reduces unauthorized access risk while maintaining a smooth user experience.

Behavioral Analytics: The New Frontier

Behavioral analytics takes fraud detection to new heights by analyzing how users interact with loyalty programs. This includes everything from mouse movements and typing patterns to app or website navigation.

To implement behavioral analytics effectively, establish a baseline of normal user behavior. Then use machine learning algorithms to continuously refine and update these baselines, ensuring your system stays ahead of evolving fraud tactics.

These advanced technologies offer powerful weapons in the ongoing battle against loyalty fraud. However, technology alone doesn’t suffice. The next chapter will explore best practices for implementing a comprehensive fraud prevention strategy, including robust policies and employee training.

How Can You Fortify Your Loyalty Program?

At Reward the World, we understand the importance of robust fraud prevention measures for loyalty programs. This chapter explores practical strategies businesses can adopt to protect their programs and customers.

Conduct Regular Security Audits

Security audits form your first line of defense. We recommend comprehensive audits at least quarterly. These assessments should cover all aspects of your loyalty program, from user authentication to data storage and transaction processing.

Salesforce reports that 84% of consumers stay loyal to brands with strong data protection policies. The depreciation of third-party cookies makes first-party data protection even more crucial.

To maximize the effectiveness of your audits:

- Use both internal and external auditors for a well-rounded perspective.

- Employ penetration testing to identify vulnerabilities before fraudsters do.

- Review and update your security protocols based on audit findings.

Empower Your Team

Your employees play a vital role in preventing fraud. A well-trained team can spot suspicious activities and respond quickly to potential threats.

Implement a comprehensive training program that covers:

- Recognition of common fraud tactics

- Proper handling of customer data

- Incident response procedures

Make training an ongoing process. Cyber threats evolve rapidly, so your team’s knowledge should too. Consider monthly security briefings and annual certification programs.

Strengthen Authentication Measures

Multi-factor authentication (MFA) is no longer optional-it’s essential. For high-value transactions, we recommend implementing at least three-factor authentication.

Recent statistics show that in medium-sized firms (26-100 employees), MFA usage is 34%. Smaller businesses (up to 25 employees) have a lower MFA adoption rate at 27%.

Consider these advanced authentication methods:

- Biometric verification (fingerprint, facial recognition)

- One-time passwords sent via SMS or email

- Hardware tokens for high-value accounts

Try to balance security with user experience. Overly complex authentication can frustrate users and lead to program abandonment.

Foster Industry Collaboration

Fraud prevention requires a collective effort. Collaboration with industry partners and law enforcement can significantly enhance your defense capabilities.

Join industry forums and information-sharing networks. These platforms allow you to stay updated on emerging threats and best practices.

Partnering with specialists in loyalty fraud protection allows marketers to focus on enhancing the program while ensuring security.

Establish a relationship with local law enforcement. Quick communication can prove vital in responding to large-scale fraud attempts or data breaches.

Final Thoughts

The landscape of loyalty program security evolves rapidly in 2025. Businesses now possess powerful tools to combat fraud, including AI-powered anomaly detection, blockchain technology, biometric authentication, and behavioral analytics. These advancements provide a robust defense against increasingly sophisticated fraudsters.

Regular security audits, employee training, and strong authentication measures form the core of an effective fraud prevention strategy. Industry collaboration and partnerships with law enforcement further enhance the collective ability to stay ahead of emerging threats. The future of loyalty program security requires continuous innovation and adaptation to new challenges.

We at Reward the World understand the importance of fraud prevention in loyalty programs. Our global incentives platform offers businesses a turnkey solution that prioritizes security and compliance while fostering customer loyalty. With instant reward delivery and robust analytics, we help businesses elevate their customer engagement and protect against fraud.