Traditional reward programs face mounting trust issues as customers question point valuations and redemption processes. Data breaches and opaque systems have eroded confidence in loyalty platforms.

Blockchain loyalty solutions promise to address these fundamental problems through transparent, immutable records. We at Reward the World see distributed ledger technology as a potential game-changer for rebuilding customer trust in reward systems.

How Distributed Ledgers Build Trust in Reward Programs

Transparent Transaction Records Create Complete Visibility

Distributed ledgers record every reward transaction in an open, verifiable format that customers access instantly. Each point earned, transferred, or redeemed creates a permanent digital fingerprint that no one can alter or delete. Singapore Airlines demonstrates this approach by allowing customers to track their miles across partner retailers in real-time, with every transaction visible on their blockchain network. This transparency eliminates the guesswork that plagues traditional programs where over one-third of points go unredeemed due to unclear terms and hidden restrictions.

Smart Contracts Eliminate Human Error and Bias

Automated smart contracts execute reward rules without human intervention, which removes the possibility of arbitrary point devaluations or program changes. These contracts reduce administrative time by up to 60% while they guarantee that earned rewards remain secure and accessible. Hilton’s pilot program with tokenized loyalty points showed a 25% increase in active participants because customers trusted the automated system more than traditional point management. The immutable nature of these contracts means companies cannot retroactively change terms or mysteriously lose customer data during system updates.

Cryptographic Security Prevents Fraud

Each transaction receives a unique cryptographic signature that makes counterfeits impossible and reduces fraud risk. The distributed nature means no single point of failure exists where hackers can compromise millions of accounts simultaneously. Real-time verification across multiple network nodes catches suspicious activity immediately, while the permanent audit trail makes investigations swift and conclusive. This security level addresses loyalty programs that lose billions annually to fraud, creating an environment where every reward transaction receives mathematical verification and permanent records.

These trust mechanisms solve fundamental problems, but traditional reward programs still face deeper structural issues that distributed ledgers must address.

Current Problems with Traditional Reward Programs

Point Values Change Without Warning

Traditional loyalty programs manipulate point values behind closed doors, which leaves customers with worthless rewards they cannot predict or control. Airlines regularly devalue miles by 20-50% overnight without advance notice, while hotel chains adjust redemption rates based on demand algorithms that favor the company over customers. Capital One Shopping research shows only 49% of loyalty program members stay active because they lose trust when point values fluctuate unpredictably. Companies deliberately obscure their calculation methods to maintain pricing flexibility, but this opacity drives away the most valuable customers who track their rewards closely. The average consumer holds memberships in 19 different programs yet cannot effectively use most of them due to constantly shifting terms and hidden restrictions.

Programs Operate in Complete Isolation

Each loyalty program functions as a separate ecosystem with zero connection to others, which forces customers to manage dozens of incompatible point currencies simultaneously. While 71% of Americans aged 55-64 participate in at least one loyalty program, only 43% of Americans aged 18-24 are loyalty program members. Airlines refuse to accept hotel points, retailers block restaurant rewards, and credit card programs maintain artificial barriers that prevent cross-brand redemptions. This fragmentation creates hundreds of billions in unredeemed points worldwide (according to industry estimates), which represents massive value that customers earn but cannot access.

Security Breaches Expose Customer Data

Traditional loyalty programs store customer data in centralized databases that hackers target repeatedly, which puts millions of personal records at risk. Major retailers and airlines suffer data breaches that expose names, addresses, purchase histories, and reward balances to cybercriminals. These centralized systems create single points of failure where one successful attack compromises entire customer bases. Companies often delay breach notifications for weeks or months, which leaves customers vulnerable to identity theft and financial fraud. The average cost of a hospitality data breach has climbed to $4.03 million in 2025, while customers lose confidence in programs that cannot protect their personal information or reward balances.

These fundamental flaws in traditional programs create the perfect environment for distributed ledger solutions to transform how companies build and maintain customer trust.

Implementation Challenges and Solutions

Integration Costs Exceed Expected Budgets

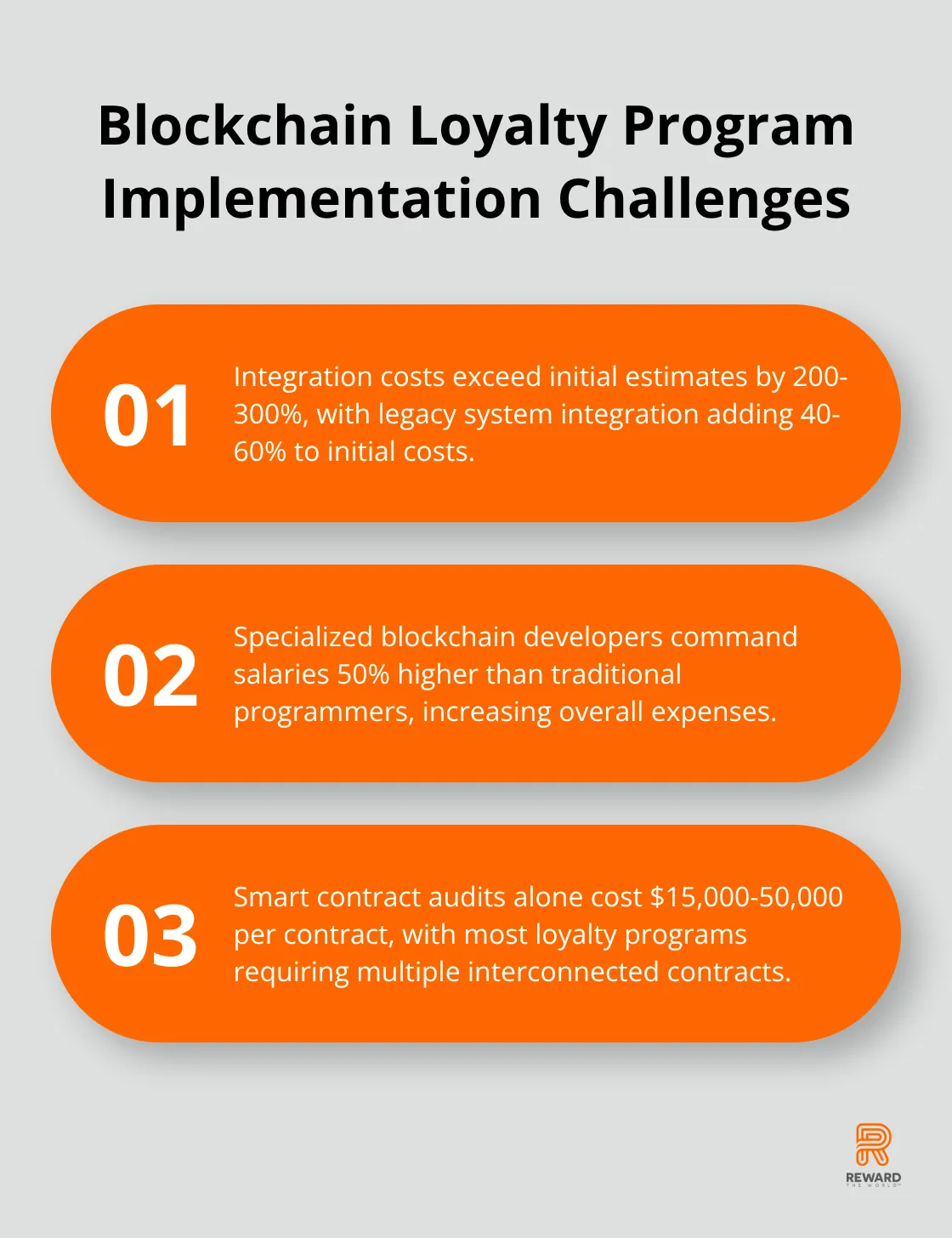

Most companies underestimate blockchain implementation expenses, which face significant scaling challenges according to industry research. Legacy system integration adds another 40-60% to initial costs because existing databases cannot communicate directly with distributed ledgers. Companies need specialized blockchain developers who command salaries 50% higher than traditional programmers, while maintenance requires dedicated technical teams. Royal Bank of Canada spent over $3 million on their blockchain loyalty pilot before they achieved basic functionality. Smart contract audits alone cost $15,000-50,000 per contract, and most loyalty programs require multiple interconnected contracts. The total cost of ownership often reaches 3-4 times initial estimates when companies factor in staff training, security audits, and regulatory compliance measures.

Transaction Speed Creates Customer Frustration

Current blockchain networks face scalability challenges while major loyalty programs handle thousands of simultaneous redemptions during peak periods. Ethereum network congestion can delay reward transactions for hours, which destroys the instant gratification that customers expect from modern loyalty programs. Transaction fees spike during high-volume periods, sometimes costing $20-50 per reward redemption when networks become congested. Visa processes 65,000 transactions per second, but even advanced blockchain solutions like Hyperledger Fabric max out at 3,500 transactions per second under optimal conditions. Companies must choose between speed and decentralization, often sacrificing the transparency benefits that make blockchain attractive in the first place.

Regulatory Uncertainty Threatens Program Viability

Financial regulators treat tokenized loyalty points as potential securities, which subjects programs to complex compliance requirements that vary by jurisdiction. Recent legislation like the CLARITY Act provides frameworks for tokens used as user incentives and loyalty points, which leaves companies vulnerable to enforcement actions. European GDPR regulations conflict with blockchain immutability because customers have the right to delete personal data, but blockchain records cannot be modified or removed. Tax implications remain unclear as some jurisdictions classify earned loyalty tokens as taxable income at the moment of receipt (creating unexpected tax burdens for customers). Companies that operate across multiple countries face conflicting regulations that make unified blockchain loyalty programs nearly impossible to implement legally.

Technical Complexity Overwhelms Development Teams

Blockchain development requires expertise in cryptography, distributed systems, and smart contract programming that most loyalty program teams lack. Companies struggle to find developers who understand both blockchain technology and loyalty program business logic, which creates knowledge gaps that delay implementation. Integration with existing customer engagement solutions, payment processors, and third-party APIs requires custom solutions that traditional web developers cannot build. Security vulnerabilities in smart contracts can expose entire reward pools to theft, while debugging blockchain applications takes significantly longer than traditional software fixes. Most companies discover they need to rebuild their entire loyalty infrastructure rather than simply adding blockchain features to existing systems.

Final Thoughts

Distributed ledger technology delivers measurable trust improvements through transparent transaction records, automated smart contracts, and cryptographic security that traditional reward programs cannot match. Singapore Airlines and Hilton demonstrate real-world success with 25% increases in active participation when customers can verify every transaction independently. The elimination of central authority dependencies removes arbitrary point devaluations that plague conventional systems.

Implementation challenges remain significant for blockchain loyalty programs. Integration costs exceed budgets by 200-300%, while transaction speed limitations frustrate customers who expect instant rewards. Regulatory uncertainty creates compliance risks that vary by jurisdiction (with technical complexity that overwhelms most development teams who lack blockchain expertise).

We at Reward the World recognize that businesses need proven solutions today while blockchain technology matures. Our global incentives platform serves millions of users across multiple languages with instant reward delivery and compliance capabilities. This offers immediate trust-building capabilities while companies evaluate blockchain loyalty investments for future implementation.