Global incentive programs are a powerful tool for businesses, but they come with a complex web of regulations and compliance requirements. At Reward the World, we’ve seen firsthand how challenging it can be to navigate these intricate rules across different countries and regions.

This blog post will explore the key areas of incentive compliance, common pitfalls, and effective strategies for maintaining a compliant global incentive program. We’ll also look at future trends that will shape the compliance landscape in the coming years.

Why Is Global Incentive Compliance So Complex?

The Regulatory Patchwork

Global incentive programs face a maze of regulatory challenges. Different countries enforce diverse rules, creating a complex landscape for businesses. In the EU, the General Data Protection Regulation (GDPR) sets strict standards for data handling. Meanwhile, the California Consumer Privacy Act (CCPA) governs data practices in California. These laws often conflict, presenting a compliance puzzle for global businesses.

The complexity extends beyond data protection. Anti-bribery laws like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act have global reach. These laws affect how companies offer incentives to foreign officials or partners. Tax regulations add another layer of intricacy. For example, the IRS in the United States requires reporting of certain incentives as taxable income. Other countries may have different thresholds or exemptions.

Cross-Border Compliance Challenges

Companies must navigate not only federal laws but also state and local regulations. Brazil heavily regulates sweepstakes at the federal level. In contrast, each state in the United States has its own rules for contests and promotions. This regulatory patchwork means a program compliant in one jurisdiction may break laws in another.

Common Pitfalls to Avoid

One frequent mistake is the assumption that a one-size-fits-all approach works globally. Another error involves overlooking the importance of local expertise. Companies have faced hefty fines for failing to adapt their programs to local laws. For instance, a global tech company received a €50 million fine in France for GDPR violations in its loyalty program.

Misconceptions about digital borders also abound. The online nature of a program doesn’t exempt it from local laws. The European Court of Justice’s decision to invalidate the EU-US Privacy Shield in 2016 highlighted the complexities of cross-border data transfers. This ruling affected many incentive programs that relied on cloud-based solutions.

Strategies for Navigating Complexity

To tackle these complexities, companies need a robust compliance strategy. This strategy should include regular legal audits (preferably quarterly) and partnerships with local experts. Using technology solutions that adapt to different regulatory environments is also crucial.

Reward the World has built its platform with these challenges in mind. It offers a compliant solution that adapts to local regulations while providing a seamless global experience. This approach allows businesses to focus on their incentive programs without worrying about regulatory pitfalls.

As we move forward, it’s essential to understand the key compliance areas that global incentive programs must address. Let’s explore these areas in detail to ensure your program stays on the right side of the law.

Key Compliance Areas for Global Incentive Programs

Global incentive programs must navigate a complex web of regulations. Three critical areas demand attention: data protection, anti-bribery measures, and tax compliance.

Data Protection and Privacy Laws

The landscape of data protection changes constantly. The EU’s GDPR established a new standard, with Data Protection Authorities (DPAs) having the authority to address complaints and conduct investigations.

To maintain compliance:

- Conduct data audits every quarter

- Implement data minimization practices

- Obtain explicit consent for data collection and use

- Provide clear opt-out mechanisms

The California Consumer Privacy Act (CCPA) impacts any business with California customers (regardless of location). It grants consumers the right to know what personal information companies collect and how they use it.

Anti-Bribery and Corruption Regulations

Anti-bribery laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and UK Bribery Act are widely regarded as the two foremost heavyweights in global anti-bribery and corruption regulations.

To reduce risks:

- Create a clear anti-bribery policy

- Perform thorough due diligence on partners and recipients

- Set value limits on incentives (e.g., max $100 per gift)

- Maintain detailed records of all provided incentives

Tax Implications and Reporting Requirements

Tax regulations for incentives differ widely across jurisdictions. In the U.S., the IRS mandates that all Form 1099 filers must have an EIN. If you have not previously filed a Form 1099 or other return, you must obtain an EIN and include it.

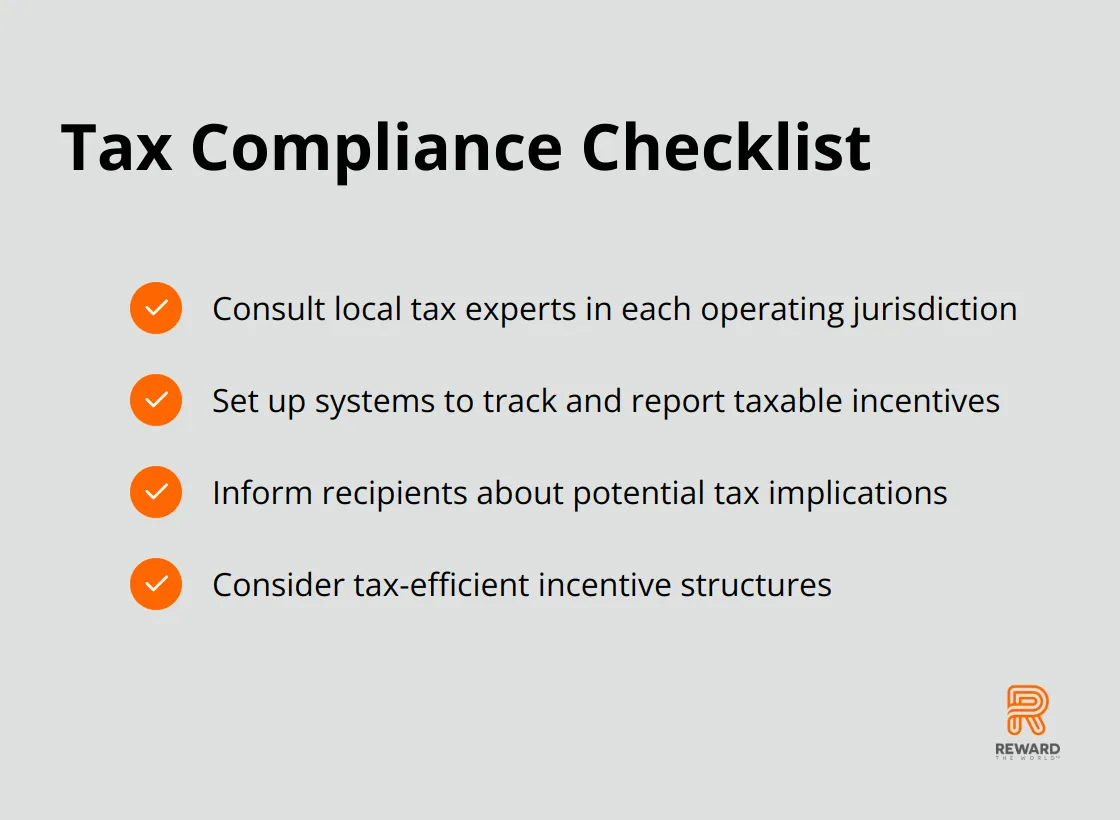

Essential actions:

A global incentive platform like Reward the World can help companies navigate these complexities. With its ability to adapt to local regulations while providing a seamless global experience, businesses can focus on their incentive programs without worrying about regulatory pitfalls.

As we move forward, it becomes clear that staying compliant requires more than just understanding the rules. Companies need effective strategies to ensure their global incentive programs remain on the right side of the law. Let’s explore these strategies in the next section.

How to Build a Bulletproof Compliance Strategy

Global incentive programs demand a robust compliance strategy. At Reward the World, we’ve observed the importance of staying ahead of regulatory changes. Here’s how to build a compliance strategy that withstands scrutiny and protects your business.

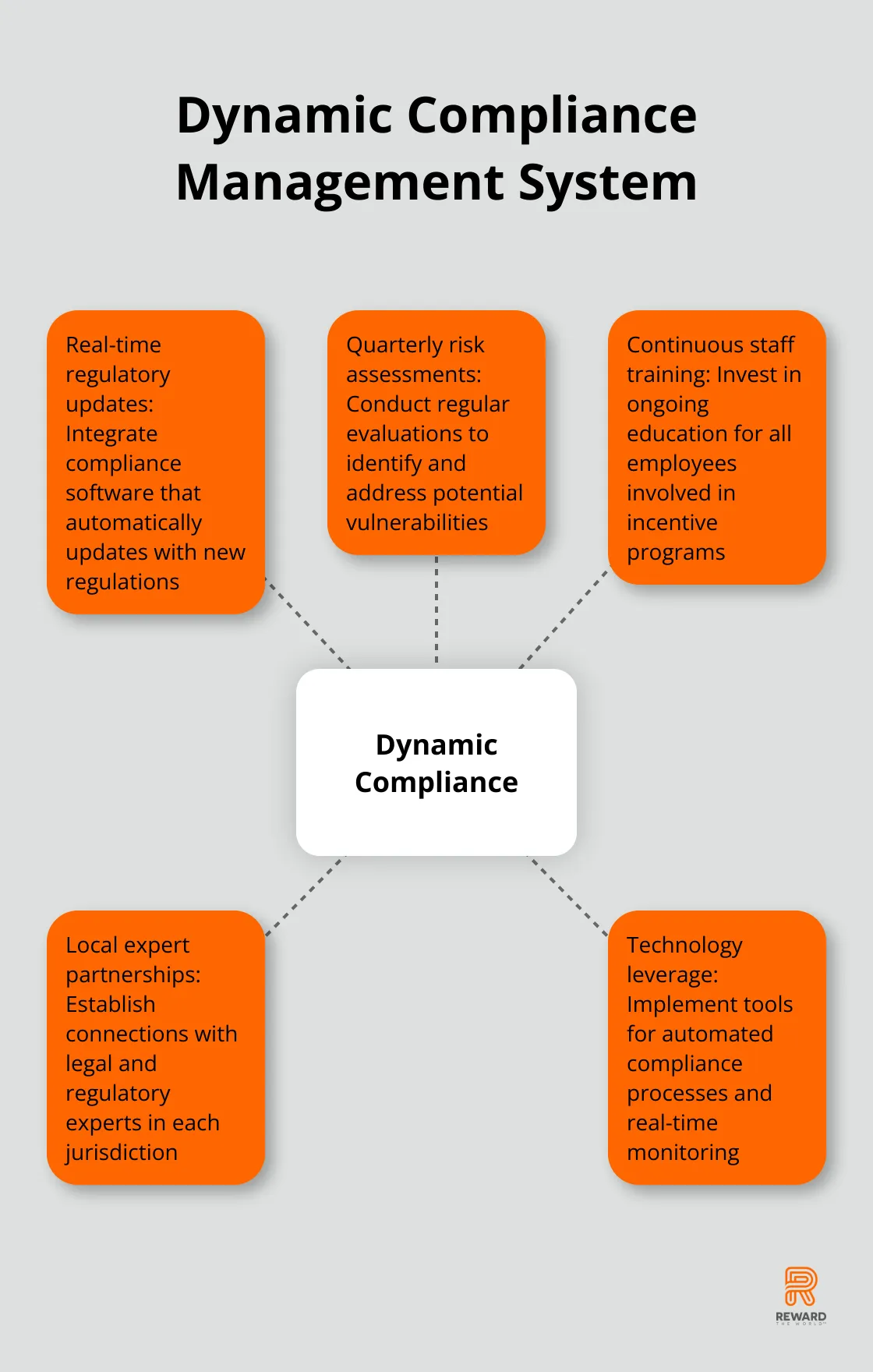

Implement a Dynamic Compliance Management System

A static approach to compliance invites disaster. You should implement a dynamic compliance management system that adapts to regulatory changes in real-time. This system must integrate with your existing business processes and be accessible to all relevant stakeholders.

Use compliance software that automatically updates when new regulations are introduced. These tools can flag potential issues before they become problems. Unlock valuable insights with up-to-date compliance statistics to stay informed about industry trends and benchmarks.

Conduct Regular Risk Assessments

Don’t wait for an audit to uncover compliance gaps. You should conduct quarterly risk assessments to identify potential vulnerabilities in your incentive programs. This proactive approach allows you to address issues before they escalate.

Create a risk matrix that categorizes compliance risks based on likelihood and impact. Prioritize high-risk areas and allocate resources accordingly. Employee health risk assessments can help employers better understand the health risks faced by their workforce and identify where to focus their wellness efforts.

Invest in Continuous Training

Compliance is everyone’s responsibility. You should invest in ongoing training for all staff involved in your incentive programs. This includes not just your compliance team, but also sales, marketing, and customer service representatives.

Develop a comprehensive training program that covers all relevant regulations. Use real-world scenarios and case studies to make the training engaging and practical.

Partner with Local Experts

Global incentive programs often require local expertise. You should establish partnerships with legal and regulatory experts in each jurisdiction where you operate. These partnerships provide valuable insights into local laws and customs (which can significantly impact compliance).

Try to build a network of trusted advisors who can offer guidance on complex regulatory issues. This network should include legal counsel, tax specialists, and data protection experts. Building partnerships in advance can help you get ahead of regulatory compliance requirements in new locations by learning the most common compliance variances.

Leverage Technology for Compliance

Technology plays a key role in maintaining compliance across borders. You should invest in tools that automate compliance processes and provide real-time monitoring capabilities. These tools can help you track regulatory changes, manage documentation, and generate compliance reports.

Consider implementing blockchain technology for enhanced transparency and auditability.

Final Thoughts

Companies that prioritize incentive compliance gain a competitive edge. They avoid costly penalties, build trust with stakeholders, and improve operational efficiency. We expect future trends in global incentive compliance to include stricter data privacy laws and increased focus on ethical AI in compliance monitoring.

Businesses must adapt their approach to incentive compliance as regulations evolve. Technology plays a vital role in maintaining compliance across borders. Companies should invest in tools that automate compliance processes and provide real-time monitoring capabilities.

We at Reward the World offer a dynamic global incentives platform to help companies overcome compliance challenges. Our solution provides instant reward delivery, GDPR compliance, and robust analytics. We strive to help businesses elevate customer engagement while adhering to regulations (across multiple jurisdictions).