Reward programs are a powerful tool for businesses, but they come with complex tax implications. At Reward the World, we’ve seen many companies struggle with the intricacies of incentive taxation.

This blog post will guide you through the essential aspects of reward program taxes, helping you navigate reporting requirements, thresholds, and best practices for compliance.

How Reward Programs Impact Your Taxes

The IRS Perspective: When Rewards Become Income

The IRS considers many rewards as taxable income. Businesses must issue Form W-2 for employees and Form 1099-NEC for independent contractors if the total value of incentives exceeds $600 in a year. This threshold applies to cash rewards, gift cards, and even points or miles with a clear cash value.

Cash vs. Non-Cash: Different Rewards, Different Rules

Cash rewards are straightforward – they’re taxable. Non-cash rewards, however, present more complexity. A Deloitte study found that financial rewards and simplicity and ease of use remain the most important loyalty program attributes, with 86% of respondents rating them as “important” or very important. Yet, these non-cash rewards (like free hotel stays or airline miles) still have a fair market value that might be taxable.

Navigating the Legal Landscape

Tax laws surrounding reward programs are complex and evolve constantly. The Fair Credit Reporting Act requires clear disclosure of terms, including tax implications. State laws vary widely – what’s tax-free in one state might incur taxes in another.

Record-Keeping: Your Tax Shield

Meticulous record-keeping protects your business. The IRS mandates that businesses maintain clear records of all distributed rewards. This includes the recipient’s information, the reward’s value, and the distribution date. Failure to comply can result in substantial penalties.

International Tax Considerations

For businesses operating globally, tax implications multiply. Different countries enforce different rules about reward program taxation. Consultation with international tax experts becomes essential to ensure compliance across borders.

Understanding these tax implications forms the foundation of any successful reward program. It’s not just about avoiding penalties – it’s about creating a program that benefits both your business and your customers. The next section will explore the specific tax obligations businesses face when running these programs, helping you navigate this complex landscape with confidence.

What Are Your Tax Obligations for Reward Programs?

Running a reward program involves specific tax responsibilities. Let’s break down these obligations to help you navigate this complex landscape.

Reporting Requirements: Essential Filings

The IRS mandates businesses to report payments received for goods or services through Form 1099-K. This form is required for certain payment transactions, including those from third-party settlement organizations. A 2022 survey by the National Small Business Association revealed that 68% of small businesses find tax compliance burdensome, with reward program reporting as a significant factor.

Taxable Reward Thresholds: Knowing When to Report

The reporting threshold can vary depending on the type of payment and the specific IRS form required. It’s vital to check your local regulations. A study by the Tax Foundation discovered that state-level reporting requirements can increase compliance costs by up to 15% for small businesses.

Cash vs. Non-Cash Rewards: Distinct Rules

Cash rewards always fall under taxable income. Non-cash rewards present more complexity. The IRS considers the fair market value of these rewards as taxable income. For example, a $100 gift card equals $100 of taxable income. However, if you offer a product worth $100 retail, you might report a lower value based on your cost.

The Incentive Research Foundation’s 2025 Industry Outlook Study provides an optimistic forecast for non-cash rewards programs in 2025. However, this perception isn’t always accurate. Non-cash rewards still carry tax obligations, and mishandling them can result in costly audits.

Automated Solutions: Simplifying Compliance

To address these complexities, many businesses turn to specialized platforms. These systems (like Reward the World) automatically track reward values and generate necessary tax forms, significantly reducing the risk of non-compliance.

Expert Advice: Navigating the Tax Maze

Tax obligations for reward programs extend beyond rule-following – they build trust with your participants and protect your business from potential penalties. Staying informed, keeping meticulous records, and seeking expert advice when needed will help you create a successful and compliant reward program.

As we move forward, let’s explore best practices for maintaining tax compliance in your reward programs, ensuring you maximize benefits while minimizing risks.

How to Ensure Tax Compliance in Reward Programs

Implement Robust Record-Keeping Systems

Accurate and detailed record-keeping forms the backbone of tax compliance. The AICPA provides extensive guidance to help practitioners structure a record-retention policy that complies with the Internal Revenue Code and the AICPA.

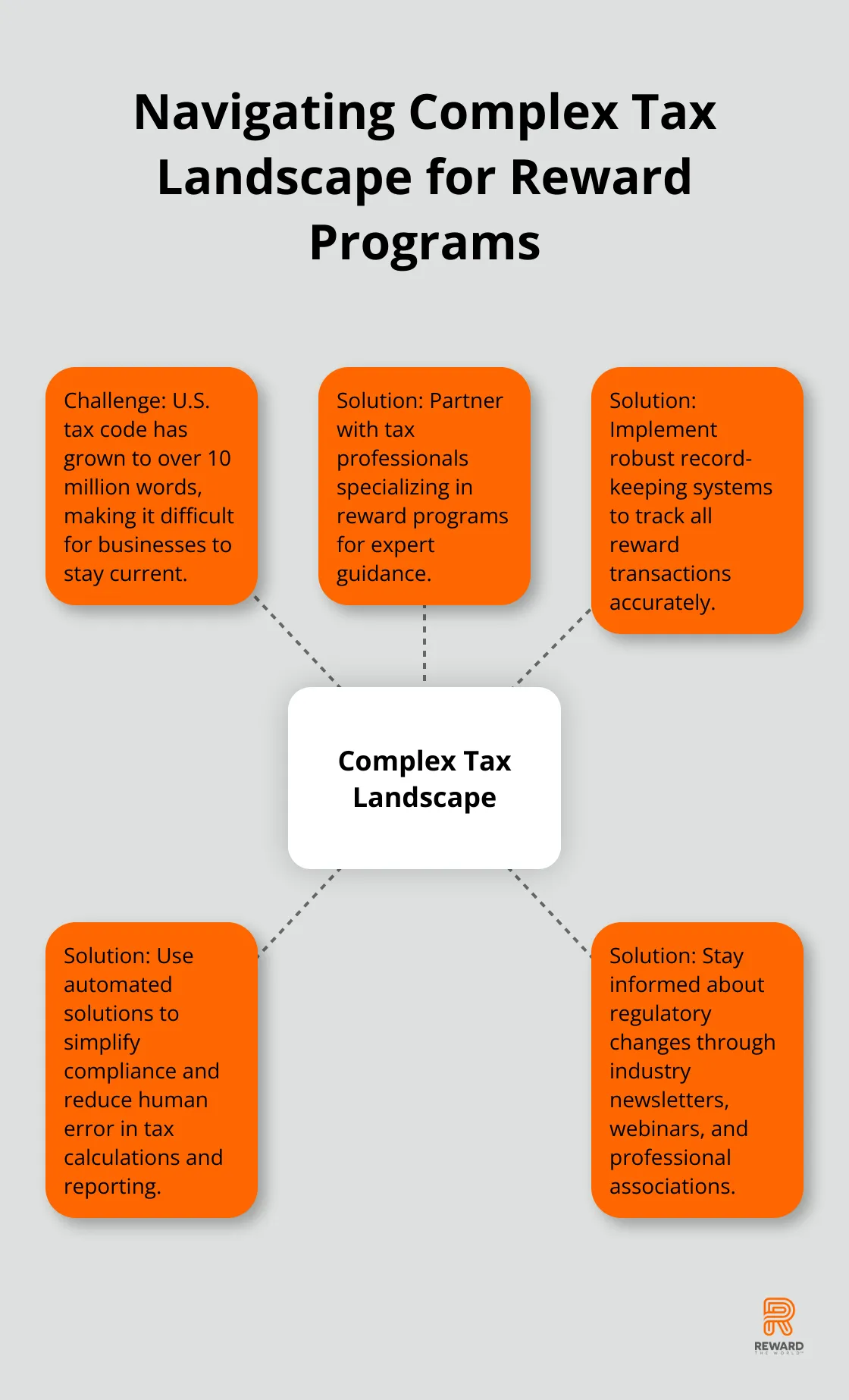

Invest in a reliable digital system to track every reward transaction. Include the recipient’s information, reward value, distribution date, and type of reward. Many platforms offer built-in tracking features that simplify this process and reduce the risk of human error.

Educate Your Team and Participants

Clear communication about tax implications is essential. The 2024 NFIB Tax Survey assessed small business owners’ biggest tax challenges, implications of potential changes to the tax code, and how tax policy impacts their businesses.

Create a comprehensive guide that explains the tax implications of your reward program. Cover reporting thresholds, the difference between cash and non-cash rewards, and participants’ responsibilities. Schedule regular training sessions for your team to ensure everyone understands these complexities.

Leverage Professional Expertise

Tax laws are complex and constantly change. The Tax Foundation reports that the U.S. tax code has grown to over 10 million words, making it challenging for businesses to stay current without expert help.

Partner with tax professionals who specialize in reward programs. They provide invaluable insights, help you navigate complex scenarios, and ensure you comply with the latest regulations. While this might seem like an added expense, it’s often more cost-effective than dealing with potential penalties or audits.

Use Automated Solutions

To address the complexities of tax compliance, many businesses turn to specialized platforms. These systems automatically track reward values and generate necessary tax forms, significantly reducing the risk of non-compliance.

Try to find a platform that offers features like real-time reporting, automatic threshold alerts, and integration with your existing financial systems. This automation not only saves time but also minimizes human error in tax calculations and reporting.

Stay Informed About Regulatory Changes

Tax laws and regulations surrounding reward programs evolve frequently. Subscribe to industry newsletters, attend relevant webinars, and join professional associations to stay updated on the latest changes.

Consider assigning a team member to monitor these changes and update your compliance strategies accordingly. This proactive approach helps you avoid unexpected tax issues and adapt your reward program as needed.

Final Thoughts

Navigating the complex landscape of incentive taxation requires vigilance, expertise, and a commitment to compliance. Businesses must report rewards exceeding certain thresholds, distinguish between cash and non-cash rewards, and maintain meticulous records of all transactions. Regular training, professional consultations, and automated solutions help businesses stay ahead of tax law changes and avoid costly penalties.

A well-managed, tax-compliant program boosts customer loyalty, employee engagement, and sales conversions. It builds trust with participants, enhances program transparency, and contributes to the overall success of incentive strategies. Effective reward program management involves creating a system that benefits your business, your participants, and meets all legal requirements.

For businesses looking to streamline their reward program management while ensuring tax compliance, Reward the World offers a comprehensive solution. With global reach, instant reward delivery, and robust analytics, it simplifies the complexities of incentive taxation while maximizing the benefits of your reward programs. Prioritizing tax compliance in your reward strategies sets the stage for sustainable growth and success.