Legal compliance in incentive programs is a critical aspect that businesses often overlook. Failing to adhere to regulations can lead to severe consequences, including fines and reputational damage.

At Reward the World, we understand the importance of creating incentive programs that not only motivate participants but also meet all legal requirements. This guide will walk you through the essential steps to ensure your incentive program stays on the right side of the law.

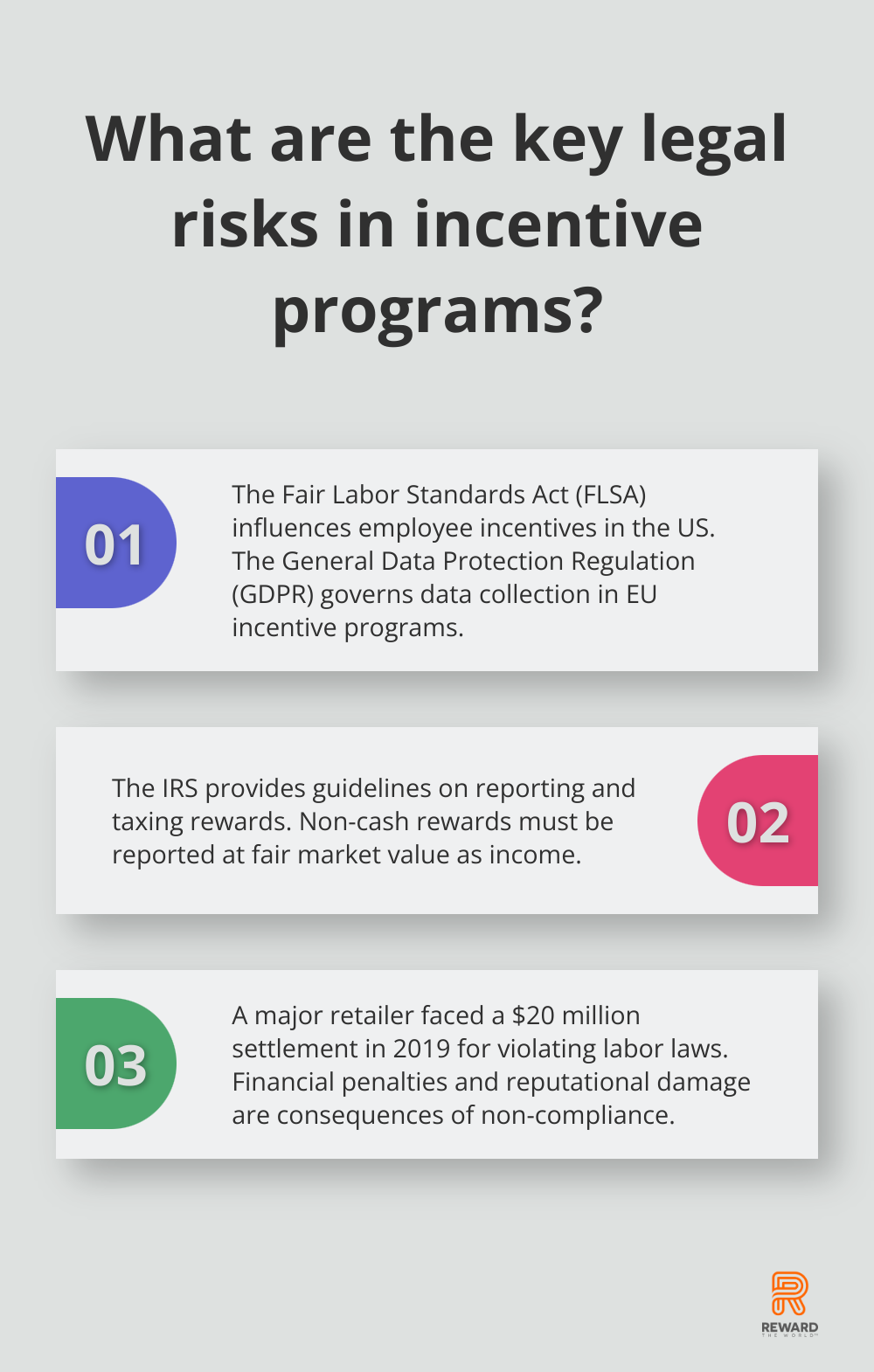

Legal Risks of Incentive Programs

Understanding Compliance in Incentive Programs

Incentive program compliance requires businesses to align their reward initiatives with applicable laws and regulations. This process protects both the company and participants from legal pitfalls. The complexity of this landscape demands careful navigation to avoid potential consequences.

Navigating the Regulatory Maze

The legal framework surrounding incentive programs varies by jurisdiction. In the United States, the Fair Labor Standards Act (FLSA) significantly influences how companies structure and pay out employee incentives. The FLSA establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers. The Employee Retirement Income Security Act (ERISA) also applies to certain types of rewards programs.

For businesses operating in the European Union, the General Data Protection Regulation (GDPR) takes center stage. This regulation governs the collection and use of personal data in incentive programs. Violations can result in hefty fines.

Tax Implications: A Hidden Minefield

Tax law often becomes an overlooked aspect of incentive program compliance. The Internal Revenue Service (IRS) in the U.S. provides specific guidelines on how companies should report and tax different types of rewards. For example, businesses must report non-cash rewards at their fair market value as income.

Misclassification of rewards can lead to serious tax issues. Tax policies can have significant implications on the behaviors of individuals and businesses, particularly regarding the federal income tax.

The High Cost of Non-Compliance

Running afoul of these regulations can result in severe consequences. Financial penalties can run into millions of dollars, and the reputational damage can prove difficult to quantify but easy to feel.

A stark reminder of the importance of compliance came in 2019 when a major retailer faced a $20 million settlement for improperly structured sales incentives that violated labor laws.

Proactive Compliance Strategies

To mitigate these risks, businesses should adopt a proactive approach to compliance. This approach includes:

- Regular audits of incentive programs

- Staying updated on changing regulations

- Investing in specialized software to manage the complexities of reward distribution and reporting

Companies like Reward the World have built compliance into the core of their platforms. Such systems help businesses navigate the complexities of global regulations, allowing them to focus on rewarding participants without worrying about legal pitfalls.

As we move forward, it’s important to consider the essential elements that make up a legally compliant incentive program. These components form the foundation of a robust and risk-mitigated reward strategy.

Building a Legally Sound Incentive Program

Transparency: The Foundation of Compliance

A legally compliant incentive program starts with transparency. Transparent communication and diligent documentation are foundational for compliance in incentive programs. Every aspect of your incentive program should be explained in plain language. This includes eligibility criteria, reward structures, and the process for earning and redeeming rewards. Ambiguity can lead to misunderstandings and potential legal challenges.

For example, in a sales incentive program, define what constitutes a qualifying sale. Specify if it’s based on revenue, units sold, or profit margin. Clearly state the timeframe for the program and any minimum thresholds that participants must meet.

Fairness: Creating a Level Playing Field

Fairness in incentive programs extends beyond giving everyone an equal opportunity. It involves creating a level playing field that doesn’t discriminate against any group. This is particularly important in employee incentive programs where federal and state laws apply.

Legal considerations for employee bonuses include compliance with federal and state laws, anti-discrimination regulations, and contractual obligations.

Documentation: Your Legal Shield

Meticulous record-keeping serves as your best defense against potential legal challenges. Document every aspect of your incentive program, from its inception to its conclusion. This includes:

- Program rules (and any changes made during the program’s lifetime)

- Participant data and their progress

- Reward distributions

- Any complaints or issues raised by participants (and how they were resolved)

In the event of an audit or legal dispute, this documentation can prove invaluable. Organize these records in a way that’s easily accessible and understandable.

Data Protection: A Non-Negotiable Requirement

In today’s digital age, data protection is paramount. The General Data Protection Regulation (GDPR) in the EU and various state laws in the US (like the California Consumer Privacy Act) have set high standards for data privacy.

Your incentive program should implement robust measures to protect participant data. This includes:

- Collecting only necessary data

- Securing data with encryption and access controls

- Providing participants with clear information about data usage

- Offering options for participants to access, correct, or delete their data

Unlock the details of GDPR, CCPA, and CPRA compliance to help your business meet data protection standards efficiently.

Legal compliance requires ongoing attention and adaptation as laws and regulations evolve. Regular reviews and updates to your program are essential to maintain a legally sound incentive strategy. The next section will explore best practices for implementing and maintaining legal compliance in your incentive programs.

How to Maintain Legal Compliance in Incentive Programs

Conduct Regular Audits

Regular audits form your first line of defense against compliance issues. A study by PwC found that companies with robust compliance audit programs were 65% less likely to face regulatory fines. We recommend comprehensive audits of your incentive programs at least annually, with more frequent spot-checks throughout the year.

During these audits, focus on:

- Review of program rules and terms for clarity and fairness

- Examination of reward distribution processes for accuracy

- Assessment of data handling practices for privacy compliance

- Verification of tax reporting procedures

Invest in Compliance Training

Your staff is your most valuable asset in maintaining compliance. Invest in Compliance Training that covers employee benefits, from time off to healthcare to flexible work arrangements to workers’ comp insurance.

Develop a robust training program that covers:

- Latest regulatory updates affecting incentive programs

- Proper data handling and privacy protection procedures

- Fair and non-discriminatory practices in program administration

- Accurate record-keeping and reporting methods

Consider the use of interactive training modules and real-world scenarios to enhance engagement and retention of compliance knowledge.

Leverage Legal Expertise

The legal landscape surrounding incentive programs is complex and ever-changing. Partnerships with legal experts who specialize in this field can provide invaluable guidance. A survey by the Association of Corporate Counsel found that 78% of companies that regularly consult with legal experts on compliance matters reported feeling more confident in their ability to navigate regulatory challenges.

We suggest:

- Establishment of a relationship with a law firm specializing in employment and consumer protection laws

- Scheduling of quarterly reviews with legal counsel to discuss program updates and potential risks

- Involvement of legal experts in the design phase of new incentive programs to ensure compliance from the start

Utilize Compliant Reward Platforms

The right technology platform can significantly streamline your compliance efforts. Reward the World stands out as a leading solution in this space. Our platform offers features like:

- Automated tax reporting for various reward types

- GDPR-compliant data handling and storage

- Real-time tracking and documentation of reward distributions

- Customizable rule sets to align with specific regulatory requirements

These best practices create a robust compliance framework for your incentive programs. Compliance requires an ongoing commitment to ethical and legal business practices (not a one-time effort).

Final Thoughts

Legal compliance in incentive programs protects businesses from regulatory risks and builds trust with participants. Companies must stay vigilant as laws change to ensure their rewards strategies remain effective and legally sound. A compliant program fosters trust, enhances brand reputation, and creates a solid foundation for long-term success in competitive markets.

Implementing a compliant incentive program requires ongoing commitment and attention to detail. Platforms like Reward the World can simplify this process with features designed to address legal requirements across multiple jurisdictions. These solutions help businesses create and manage incentive programs that motivate participants while adhering to regulatory standards.

Legal compliance should form the cornerstone of every incentive strategy. It ensures programs withstand scrutiny and deliver value to both businesses and participants. Companies that prioritize compliance demonstrate their commitment to ethical practices, which can serve as a powerful market differentiator.